Simplifying portfolio management for VCs

Industry

Financial services

Service Line

Software Engineering

Overview

New Model Venture Capital (New Model) manages a group of companies that oversees direct investments, debt placements and M&A transactions ranging from £50,000 to over £200 million.

With Via Fig as a lead investor and New Model as a fund manager, the team at New Model has over £160m in assets under management (AUM). For New Model, therefore, data accuracy and transaction transparency are critical to their success and relationship with their investors. They need visibility across all investor positions, portfolio compositions, investment vehicles and flows of funds, as well as immediate access to the supporting documentation for each of the hundreds of transactions completed annually.

Having tried several market-leading products that were either too simplistic or overly tied to specific use cases, New Model turned to Star to develop an in-house proprietary investment dashboard.

✓ Developed from scratch a platform for New Model to aggregate all their investment data in one secure location

✓ Enabled greater collaboration for team members without losing data integrity

✓ Increased transparency and improved risk management and process optimization

✓ Users can more easily understand portfolio insights due to various data export capabilities

✓ Streamlined approval process to enable easier and secure data engagement process

✓ Created notifications so senior managers can quickly see specific changes or when their approval is needed

The idea

Across angel investment networks, venture capital groups, early-stage private equity and the wider investment community, large volumes of capital are often deployed by small teams that operate as independent groups without significant material or remotely consistent back-office support and resources.

This leads to challenges when tracking investors’ portfolios and trying to ensure compliance across a wide range of legal, regulatory, tax, accounting and ethical standards. Senior investment managers, CEOs, Non-Executive Directors, lawyers and accountants spend a disproportionate amount of time composing and maintaining investment records. Consistency across firms, let alone third parties, can be a challenge when thousands of transactions are collated for performance analysis.

To streamline operations and ensure transparency across all investor positions, portfolio organizations and investment vehicles, New Model needed a portfolio management platform. After being unable to find an “off the shelf” tool with the right blend of flexibility, transparency and ease of use, they asked Star to craft a scalable digital solution tailor-made for them.

Project

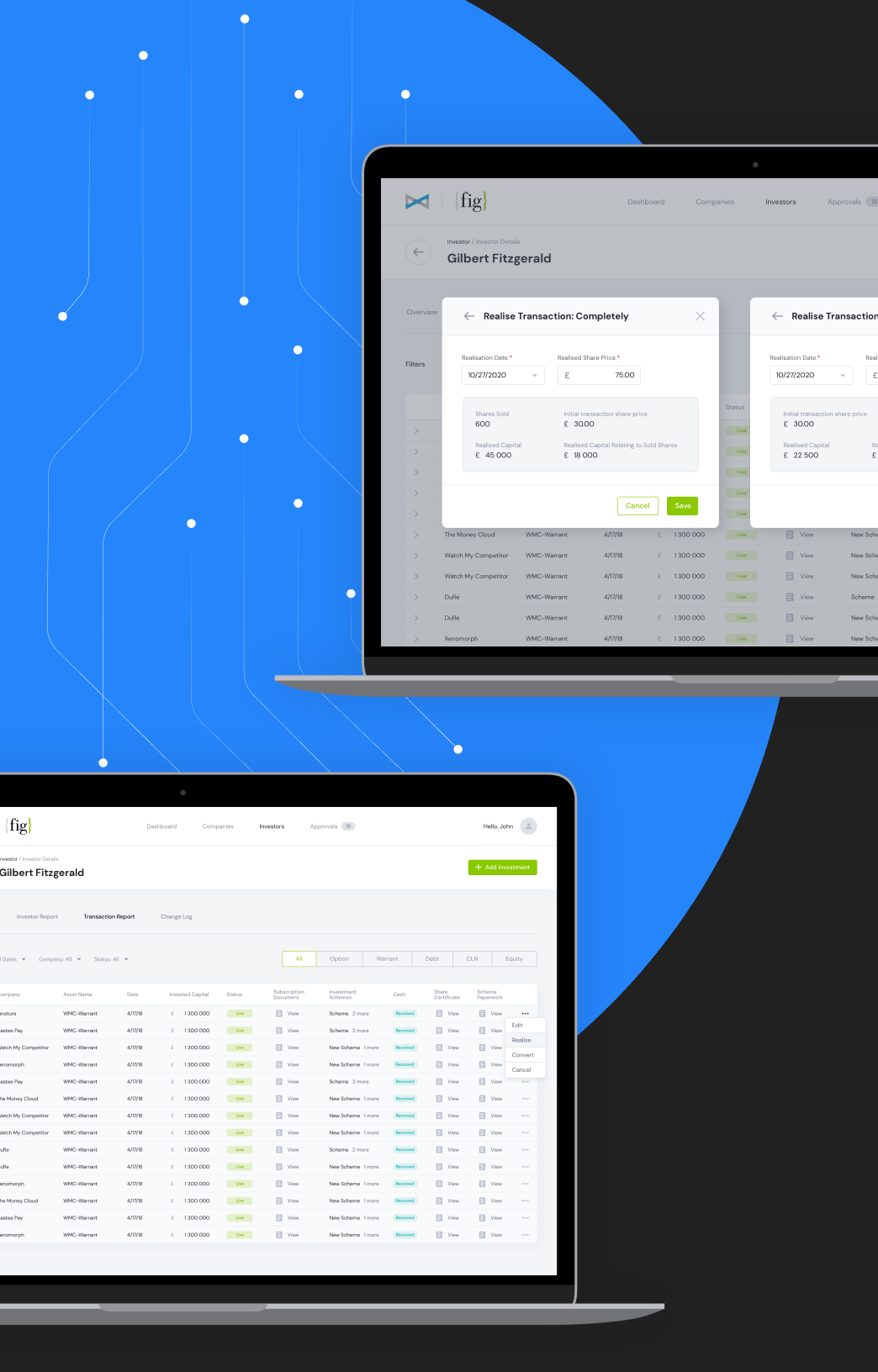

Star took the lead in devising the platform’s structure, creating the user interface, and the flows the data took through the various screens and dashboards. In addition, we worked closely with New Model’s fund managers throughout the journey, who brought essential sectoral knowledge and expertise.

After the definition phase, Star product leads and UX designers created a final feature list and an initial MVP to ensure alignment between our teams. Following initial engineering and implementation, Star worked in short iteration sprints. Every two weeks, changes to the product were presented to New Model to allow rapid and early-stage feedback on the features and user experience.

The result is a light, user-centric investor management platform designed to follow a specific feature set with enough flexibility to be iterated and developed further in the future. New Model is currently trialing the solution with its core clients and exploring routes to expand the platform over time.

Testimonial

“Star took the time to listen to how we worked. They understood our principal goals incredibly quickly and ultimately it meant what they developed didn’t fall short, where other’s software had. The team was fun, interesting and clearly very capable. Their responsiveness enabled us to quickly refine our requirements and really focus on what was essential for now and the potential for the future. The outcome is an initial platform which our team as well as our clients are equally proud of and impressed by. We are very excited about the next stages of development and working with the team at Star again.”

James King

Founder & Director at New Model Venture Capital

Project Scope

Service Lines:

- Project Management

- Product Management

- DevOps

- Digital Design

- Software Engineering

- Quality Assurance

Technology:

- DigitalOcean

- Firebase

- Reactjs

- Nodejs & Express Framework

Share

Share