Micromobility refers to the personal usage of small, lightweight vehicles like electric scooters and bikeshare fleets. The micromobility trend really took off post-Covid when people were looking for alternatives to mass transport and it hasn't slowed down since. You only have to look around East London and the sea of Lime bikes (electric-assist bikeshares) to see how much it's thriving.

The global micromobility market is expected to exceed $200 billion in the coming years, reaching $340 billion by 2030. Government support is also contributing to the bright future of micromobility. Around the world, urban areas are investing in micromobility solutions and infrastructure. Milan announced an ambitious plan to replace car lanes with cycling lanes for bikes and electric scooters. And Rome, Lisbon, Barcelona and Paris are also among the growing list of European cities investing in new cycling lanes.

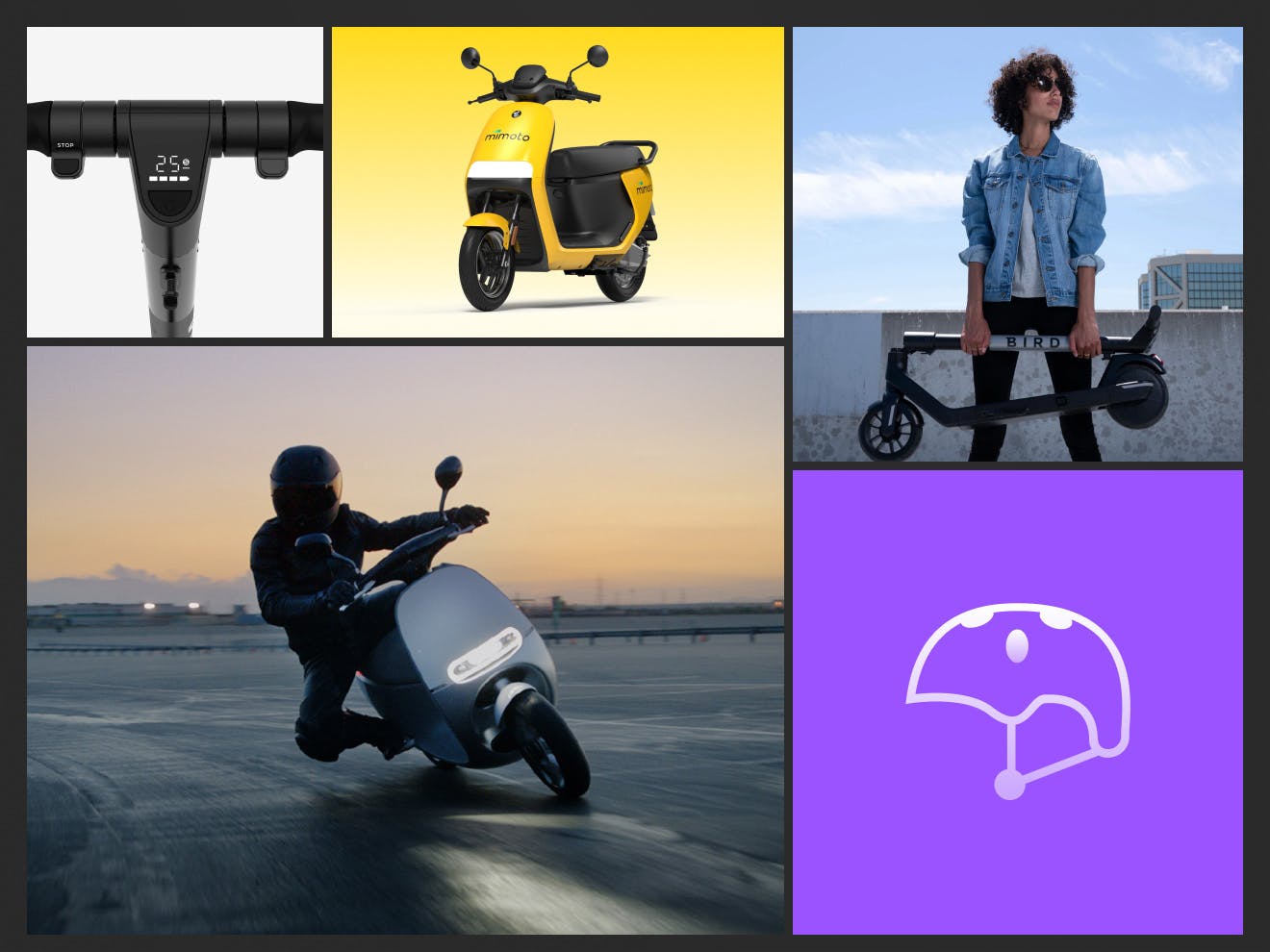

Micromobility trends for 2025

So, which micromobility industry leaders will win the global race for market share? Here's key micromobility trends and solution that will help separate you from the pack.

1. Address user pain points

Star’s analysis revealed certain services and vehicle features have become table stakes for the micromobility industry, such as providing estimated range times so users know how long they can go before they need a charge. This feature addresses “range anxiety” — the fear that you may not be able to get where you are going before your electric scooter, e-bike or moped runs out of power.

But the scooter operators that are standing out and defining the future of micromobility are using less common ideas to address user challenges and improve the rider experience. TIER Mobility, a leading scooter sharing and micromobility provider in Europe, is building a collaborative charging network across urban areas in Europe by inviting local businesses to host a PowerBox, an easy-to-use battery swapping station where users can exchange depleted batteries for charged ones.

Wind, a leading micromobility company in Europe, added an integrated wireless phone charger to the front panel of the scooter. The new feature qualms another common fear: what happens if your phone runs out of batteries?! It also protects Wind scooters. According to a customer survey, 36% of riders had been unable to lock their electric scooter upon reaching their destination because their phone had died.

2. Improve vehicle safety

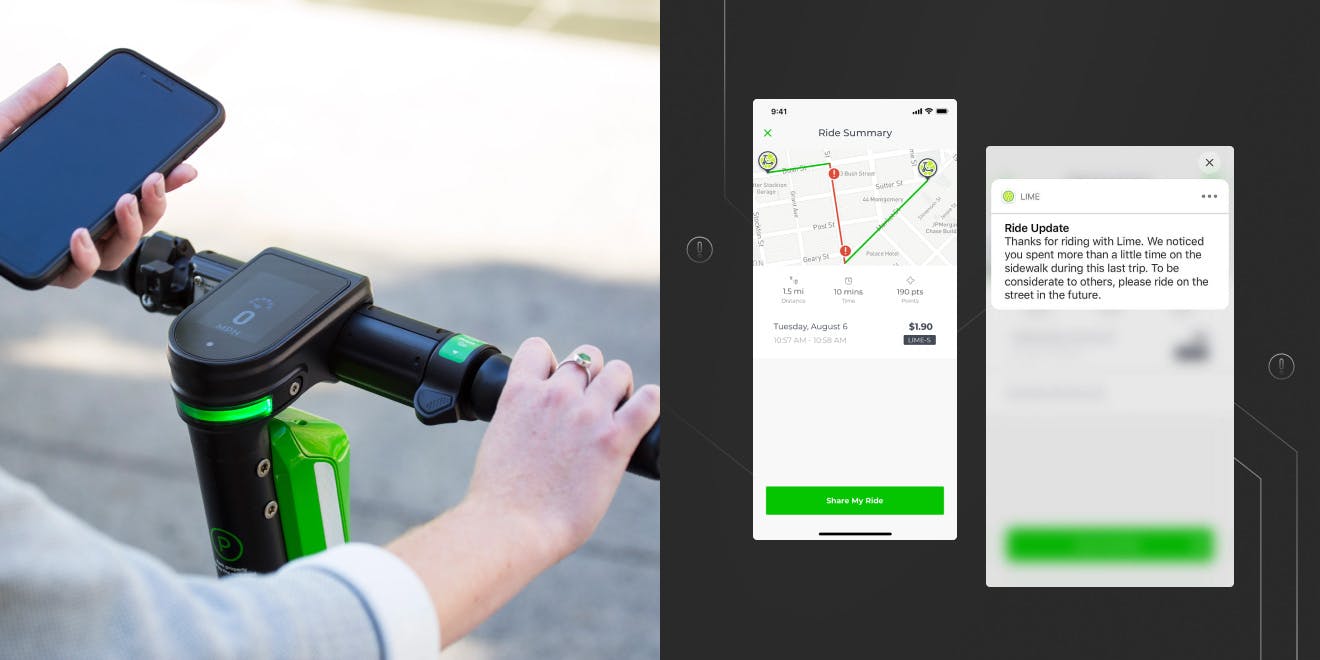

While global micromobility market growth is undeniable, city officials, local residents and micromobility riders have questions and concerns about safety. Micromobility companies are using cameras, sensors, AI, voice, intelligent dashboards, GPS and more to verify user identity and detect and prevent accidents. In San José, California, micromobility company Bolt is testing a new feature that uses built-in sensors and AI to detect if an electric scooter rider is on a sidewalk instead of the street.

What’s better than detecting unlawful or risky behavior? Preventing it before it starts. Star’s analysis revealed that a key micromobility trend is incentivizing users to take online safety courses. More than half a million users have “attended” Voi’s online traffic school, Ride Like Voila. The digital program rewards people for participating with credits for future rides. TIER also incentivizes users to participate in its digital learning program, Ride Safe School, by offering users a free ride when they finish.

To ensure the quality of these programs and, in turn, the safe and compliant future of micromobility, some companies are partnering with third-parties. Tier’s program was created with AA’s DriveTech, while Lime worked with Motorcycle Safety Foundation to create its online moped safety course.

These collaborations should contribute to shared mobility services that rival public transportation.

2. Build customer journey maps

To differentiate their sharing services and keep up with changing preferences, emerging technology and micromobility trends, companies must continually roll out new features. But they must never lose sight of the overall rider experience. Every addition or change should streamline or augment the user journey.

A trend we're seeing is that micromobility innovators should adopt a customer-centric approach to design and use design thinking principles to create a holistic customer journey. This requires companies to put themselves in the shoes of the rider, share data across teams and departments, challenge preconceived notions and test and experiment tirelessly.

Innovation areas of opportunity include:

- The vehicles themselves: how can you use technology and intuitive user interface design to make sure your scooter, bike or moped delivers a superior ride?

- Contactless payment solutions: Covid accelerated the shift to mobile payment options as companies looked to reduce the risks associated with handling cash. How can you meet customer expectations for these contactless payment options and ensure they are integrated across multimodal transport modes?

- Sustainable mobility benefits: how can you continually find ways to reduce your micromobility company’s environmental footprint and empower customers with data on how their transportation choices make a difference?

- Real-time data: how can you use real-time data to improve the rider experience, for example, by enhancing vehicle safety and facilitating predictive maintenance?

Stakeholders in the micromobility market should also invest in user research to understand not only further micromobility trends, but automotive customer satisfaction. They just may discover customer pain points their solutions can address. They may also uncover visual design inspiration and find ways to improve or differentiate customer interactions.

4. Take a design thinking approach

What do market leaders have in common, besides digital ecosystems? They use design thinking principles to map the customer journey. Design thinking is a user-centric approach to designing products, services and experiences.

Teams not only come together to define every customer touchpoint, they consider the needs of users every step of the way. They also set a goal for each interaction. how should customers feel after this touchpoint, and how will the organization measure success?

Design thinking in micromobility requires:

- Teamwork: departments must come together to map a complete customer journey

- Empathy: putting yourself in the user’s shoes enables deeper customer understanding, therefore leading to better, human-centered design

- Creativity: challenge assumptions and hypotheses. Approach old problems in new ways

- Resilience: a key component of Design Thinking is experimentation. You will test, iterate, measure, and repeat, until you discover the optimal way to solve customer challenges while living up to your Experience Vision

- Getting Phygital: phygital design bridges online and offline worlds using interactive experiences. For micromobility companies, that means considering things like how the physical experience of unlocking or parking a bike leverages digital technology and reflects the brand’s online presence

5. Invest in infrastructure

Forward-thinking cities are designing ways to support the adoption of lightweight, eco-friendly travel and incorporate it into the big-picture of mobility service design.

Necessary measures include installing battery charging stations, adding more bike lanes, and creating electric grids that support all electric vehicles, including lightweight ones. Providing simple, secure parking solutions for micromobility vehicles near public transport will also be essential for supporting multimodal transport patterns.

Micromobility trends can be hard to keep track of, let alone implement. But Star is your partner for all things micromobility success.