Time-sensitive data analytics in banking and finance

Your customers demand speed, efficiency and mobility. Are you ready to keep up? Ensure critical data is at your fingertips when decisions can't wait.

Capitalize on real-time market movements, not yesterday's insights

Your customers transact, interact and live their financial lives on the go. Each tap, click, call and meeting generates a wealth of data that you can use to build your competitive edge. We are here to help you seize the opportunities while they still matter.

Payment data

Customer interaction data

Card transactions

Operational performance data

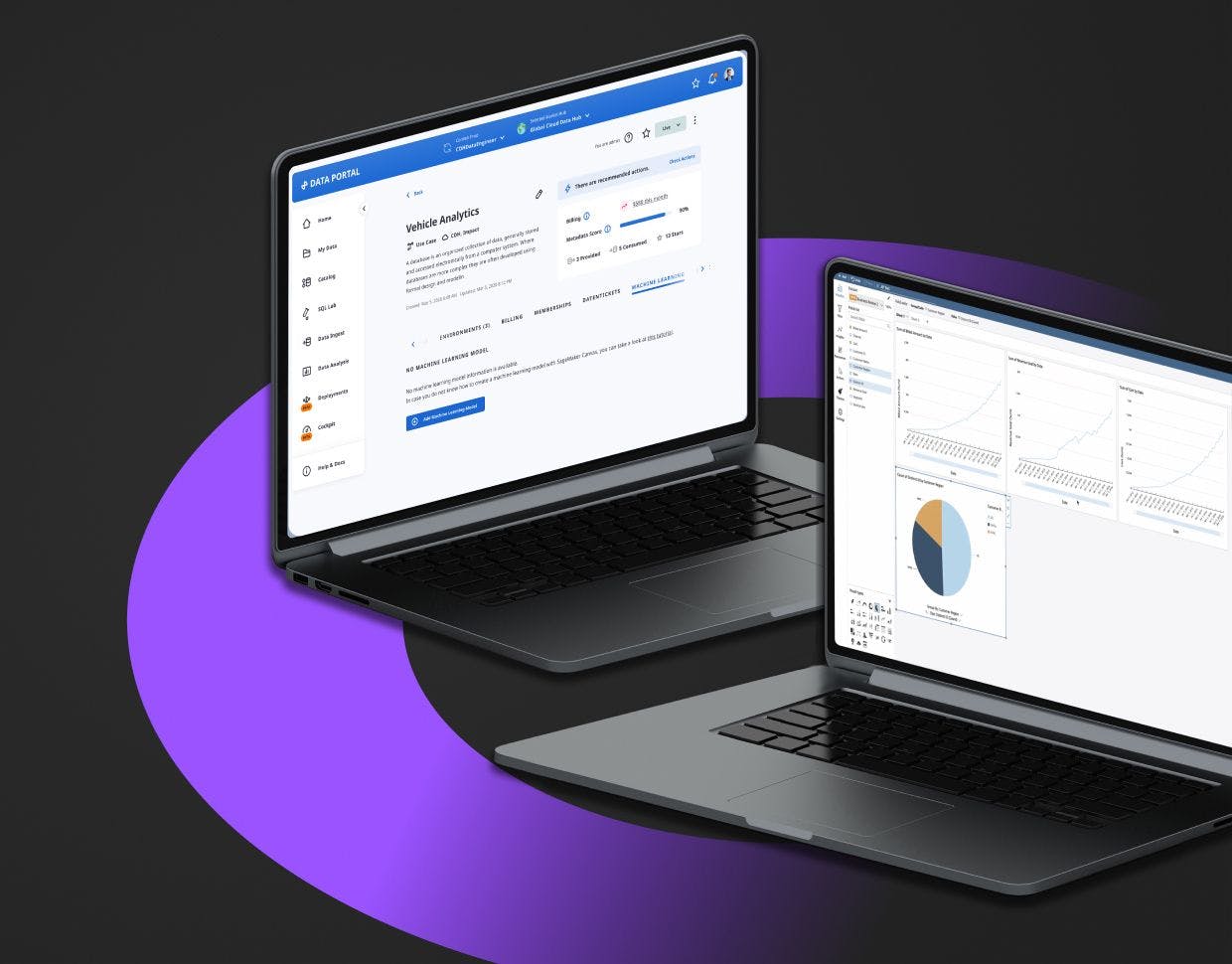

Put your data goldmine in action by building data platforms and integrated ecosystems

Rely on us to enhance your data governance to industry-leading standards, implement robust and scalable data capture, storage and processing solutions, develop custom dashboards for immediate access to key insights, and utilize AI to unlock complex data sets, paving the way for forward-thinking strategies and informed decision-making.

Dynamic data utilization

Harness the power of live transactional data for on-the-spot decision-making.

High-velocity data processing

Process and report on large volumes of transactional data with unprecedented speed.

Unlock real-time insights

Access immediate understanding of transactional flows to seize opportunities.

Missed opportunity detection

Transform data into a tool to act on fleeting market opportunities as they arise.

Aggregate your data from all kinds of upstream sources to craft innovative banking experiences

Convert high-frequency, multi-dimensional customer data streams into prompt, actionable insights to deliver seamless experiences, boost customer loyalty, and stay competitive.

The future of banking is data-driven, personalized, and mobile-first. Are you ready to lead?

Partner with us to embed AI in your operations, craft strategies for redefined user experiences, and deliver compelling, compliant AI-powered solutions. With our Endgame Thinking, we ensure that every R&D investment advances your market leadership.

AI-powered customer experience & KYC

AI-powered customer experience & KYC

• Streamline the KYC process, making customer onboarding quick and frictionless.

• Analyze customer data, providing tailored banking experiences and financial advice.

• Tailor individual product combinations for a specific customer situation, i.e. have "dynamic pricing" per customer and service.

• Provide instant customer assistance across all digital channels.AI-enhanced personalization

AI-enhanced personalization

• Dynamically tailor banking products to evolving market conditions and customer behaviors.

• Match banking products with customer profiles, ensuring relevance and enhancing uptake.

• Create sophisticated financial models for product development and risk assessment.

• Predict the success rate of new banking products and services.

We're experienced financial technologists

Our clients say...

Contact our experts