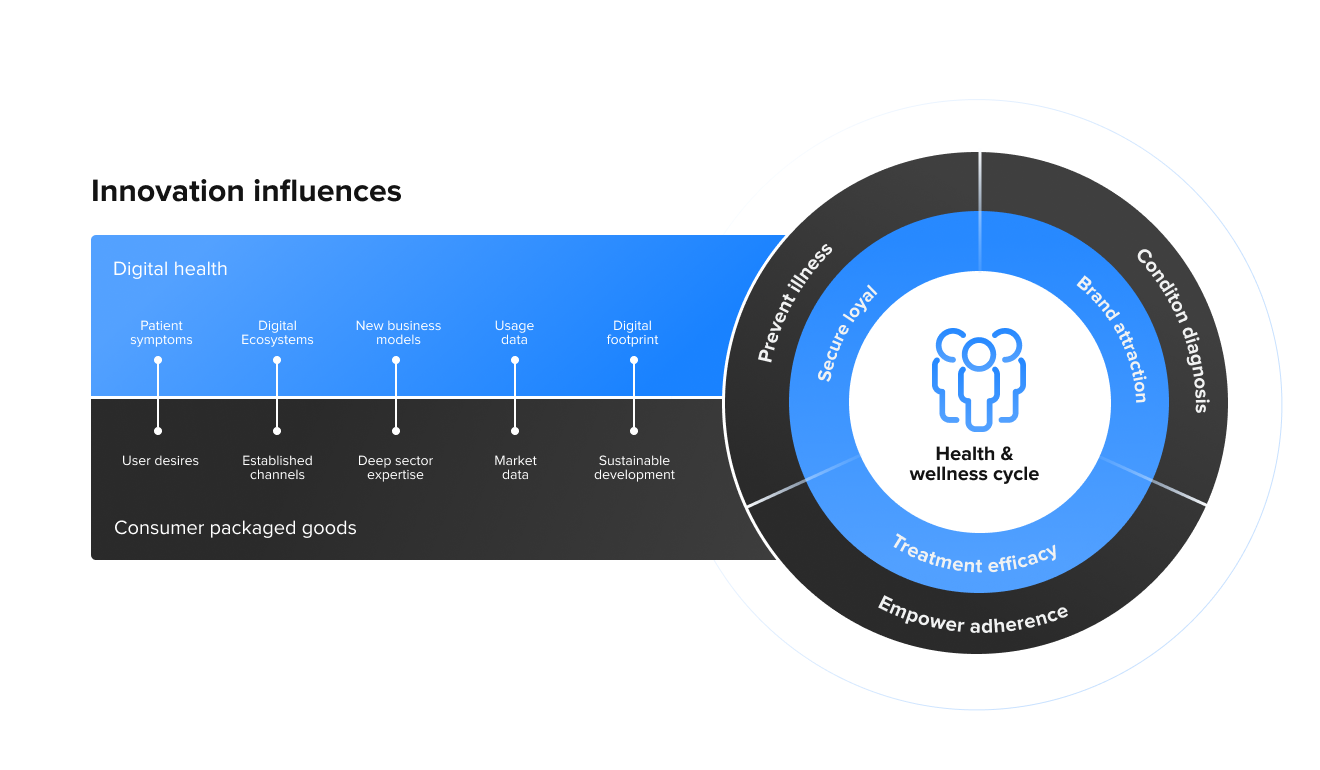

In categories such as consumer healthcare, nutraceuticals, personal care and beauty, a potent mix of consumer packaged goods (CPG) brand “push” expertise, combined with a “pull” for digital solutions from empowered health consumers, is opening new doors for brands throughout the entire prevent-diagnose-treat cycle.

The rhythm of digital maturity and market appetite is clearly in sync right now. The challenge is to find harmony within the push and pull.

“We are really excited about serving consumers at this particular moment in time. Today, consumers want to take health into their own hands and either manage conditions they currently have, or prevent them in the future”

Thibaut Mongon

Johnson & Johnson's Executive Vice President and Worldwide Chairman of Consumer Health

The broader health context is driving change

This rise in awareness of how lifestyle choices affect our health, plus the increasing desire to self-medicate by many, is music to the ears of global health sectors. This is true, especially considering the drivers of change at play:

- A larger proportion of the rapidly increasing population will be geriatric: by 2030 the number of people 60 years and older will grow by 56 percent

- The rising prevalence of chronic disease (e.g. COPD, arthritis, diabetes) and people living with multiple long-term conditions, such as back pain, which has been the leading condition for global disability since 1990

- The shortfall in the global health workforce is estimated at 18 million workers by 2030

- A lack of patient compliance is wasting precious resources: 50% of all medicines are not taken as prescribed on average, costing an estimated £300 million in the UK alone

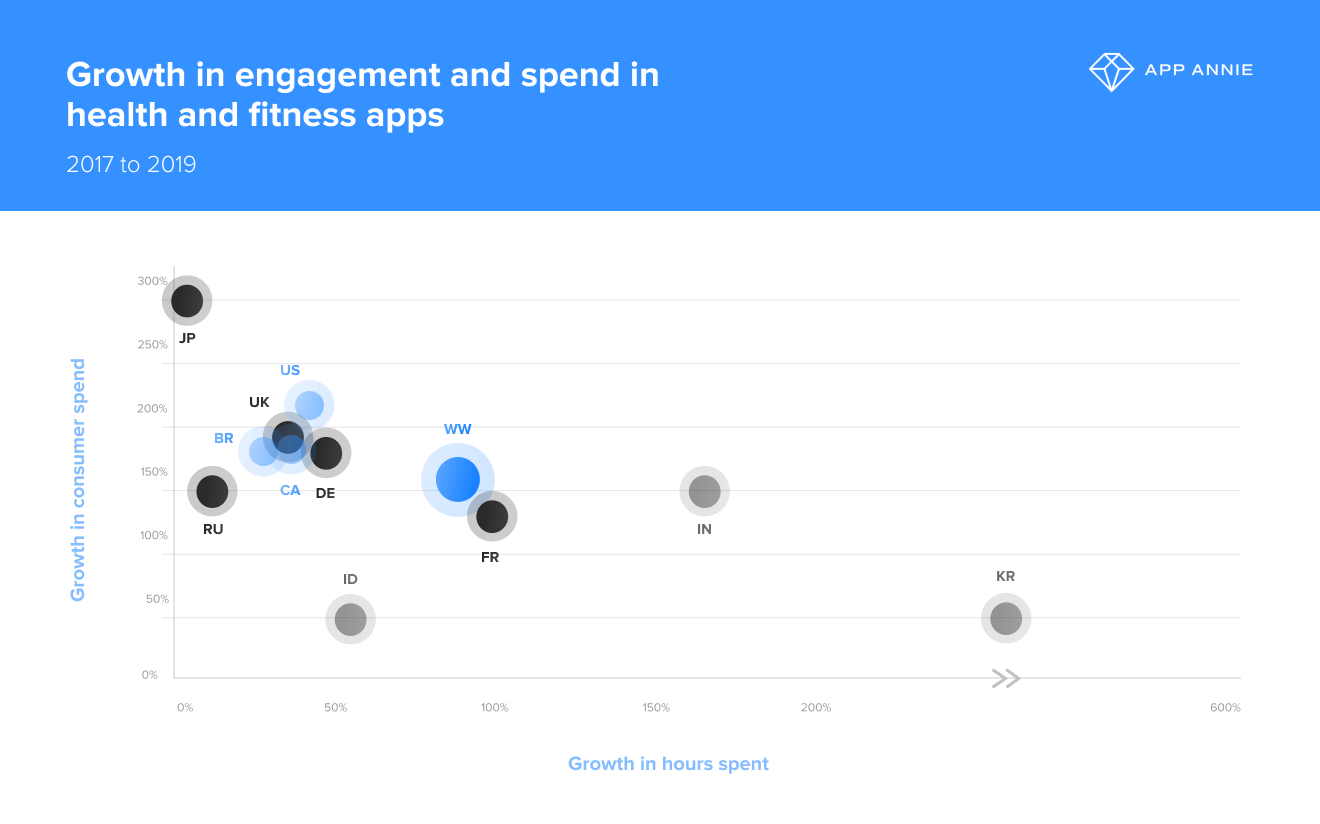

App Annie State of Mobile Report 2020: Consumers spent 130% more money on health and fitness apps in 2019 vs. 2017 (not including web-based apps)

A bold response from digital health

In reaction, business and consumer behavior change is encouraging for digital health:

- Healthtech awareness on the rise: 41% of healthcare executives ranked AI the number one technology in terms of impact on their business

- Investment in digital health skyrockets: there are 37 VC-backed digital health unicorns worth a combined $92.1B

- Digital care programs are strongly recommended for certain conditions: American College of Physicians studies recommended a 12-week, app-based treatment for low back pain as being ‘less harmful’ and more broadly accessible than invasive treatment

- People are increasingly willing to trust digital solutions: 7 in 10 UK/US consumers are happy to have their health data made accessible through their smartphones

- Consumer spending on digital health & fitness apps increases again: Globally, consumers spent $1.5B on health and fitness apps in 2019

Tensions

The Journal of mHealth declared “Health Consumerism is not a disruption, it’s a revolution! … we are never going back to an age where a patient comes into a doctor’s office without a solid opinion or at least a basic understanding of their affliction.”

Sounds perfect, doesn't it? Almost too good to be true… put all bets on digital, right!? The cautionary tale is never to ‘push’ a new technology without a user need, nor allow users to ‘pull’ innovation that’s not perfect for your business, or indeed their well-being.

From discussions with Star’s digital health experts and several large CPG companies, there are obvious tensions to resolve that will force smart choices, early on:

Business

- Creating appetite: Belief in digital value vs. tracking ROI and patient outcomes

- Growth strategy: Layer onto existing products vs. stretch to new revenue space

- Data requirements: Additional data streams vs. making existing silos useful

- Capability gap: Up-skill internal resource vs. augment with external experts

Brand

- Regulation: Safety and compliance vs. empowering individuals to self-medicate

- Relationship: Focus on current users vs. attract new audiences

- Use case: Focus on existing benefit/treatment vs. stretch credibility to more needs

- Touchpoints: Connect to physical product/device vs. stand-alone digital therapy

Users

- Do I trust this? — Desire for empowerment vs. trust in technology and data security

- Is this for me? — I see a personal need vs. belief in the brand expertise & guidance

- Is it worth a premium? — Nice to have vs. must-have benefits

Resolving tensions: mixing expertise and influences

We believe that mixing the capabilities of digital health experts with those of CPG can deliver products people adopt, with a regimen they adhere to, from brands that they trust, in a commercially motivating way… ultimately improving patient outcomes.

Health & wellness cycle

Condition diagnosis + brand attraction

Why? Drive adoption and trial through personalization

Brand owners are experts at attraction: using storytelling and shopper psychology to tie brand values into a compelling offer that resonates with our lifestyle. This could help digital health products cut through the noise and ensure they are able to get to the diagnosis stage: matching their solutions to your symptoms and lifestyle.

- RB Nurofen FeverSmart connected thermometer patch that reassuringly monitors the temperature of your child and advises on the best course of action

- L’Oreal Perso and Breezometer partnership: AI-enabled device uses real-time environmental data to dispense a personalized skincare formulation at home

- Shiseido Hada-Pasha “skin unravel” app: Learn how your skin changes daily and find the best skincare for you. It had 22,286 downloads last month (at the time of this article)

Empowering adherence + treatment efficacy

Why? Improve the efficacy of the overall product experience

As digital products push rich interactions throughout our day (e.g. education, reminders, reassurance) they can empower adherence and ensure that the product is administered in the most effective way. Offering features and benefits that the physical product can only dream of, together they are much greater than the sum of their parts.

- ZzzQuil Sleep app helps you start sleeping better and waking brighter, from P&Gs #1 selling medication for sleeping difficulties

- Aquafresh Brush Time: encouraging kids to brush their teeth (correctly)...genius!

- Huel Calculator: unofficial app (endorsed by Huel) that calculates how much product to use based on your profile… if you don’t create it, the audience will!

Prevent illness + secure loyalty

Why? Deepen and extend relationships to remain front-of-mind

Not all products have a use case that spans the entire prevent-diagnose-treat cycle. The ultimate aim of empowered health consumers is to prevent illness through better wellness practices. Leveraging a brand's ability to create virtuous engagement cycles is key to retaining loyal customers in between purchase occasions.

- FLO HEALTH period & ovulation tracker: the most downloaded health & fitness app in the App Store Worldwide in 2019

- Enfamil Family Beginnings: RB’s baby formula ‘first 1000 days’ support app

- DnaNudge: DNA-based recommendations for personalized shopping; recently partnering with UK retailer, Waitrose

Innovation approach: mixing expertise & perspective

There are also interesting differences in how digital health teams and consumer brands approach their product innovation funnel. Imagine if these perspectives were combined:

Innovate on patient symptoms + user desires

Why? Tap into our human nature to create a competitive advantage

Digital ecosystems + established channels

Why?: Future proof go-to-market flexibility

Digital products integrate into dynamic ecosystems. Solutions can be updated and expanded relatively easily, compared to the physical battlefield in which CPG brands have become “shelf-stand-out” warriors. Optimizing established retail channels while connecting into an ecosystem of credibility-enhancing partnerships is key for survival.

New business models + portfolio segmentation

Why? Be tactical on where you invest energy

CPG portfolios are expertly segmented across a spectrum of user profiles, occasions or cultures… we all fall for the “good-better-best” strategy! Harnessing the necessity for new business models of digital health (from subscription to value-based performance) brands could create a very sophisticated, yet familiar, model that spreads investment across the ever-changing needs of the audience.

Cutting-edge approach + deep sector expertise

Why? Ensure new approaches remain fit for purpose

Integrating new approaches into an established business is often a roadblock to success. Incrementally layering a digital experience on top of an established physical product could enable the ‘integration’ culture of connected products to complement the deep expertise of the consumer health sector… without hopefully causing too many ripples!

Product usage data + audience market data

Why? Use real-time data to fuel your product development process

CPG’s sit on a wealth of market and shopper data (not always easily accessible for all business functions) that is primarily used to inform product development and target marketing outreach. Digital health products thrive on a feed of real-time usage data to personalize and dynamically adapt features. Combining these two data streams could improve the richness of the brand experience in a way that’s hard to resist for empowered consumers. For example, Clorox used Kinsa’s smart thermometer data to target advertising.

Sustainable development + digital footprint

Why? Smash your sustainable development commitments

This is a call to action based on a belief that digital technologies can contribute significantly to sustainable development: moving value from ‘heavy’ physical products to ‘lightweight’ digital footprints, guiding sustainable consumer behavior, creating support communities, connecting circular economies and removing counterfeit drugs using blockchain, for example. If we’re talking about the health of people, then ensuring the health of society and the planet has to be a fundamental requirement, right?

Turning theory into action

With my background in brand-led innovation, I feel lucky to work alongside the certified digital health technologists at Star. The team has delivered medical grade software products in remote health, DTx, connected devices, system optimization and fitness platforms. The first step in delivering products to market is to turn theory into action, crucially following a risk-driven approach while being patient-centric and commercially savvy. You can only start moving with the correct mix of expertise.

For more on why the broader CPG sector should embrace digital innovation, please read my other article: How CPG brands can move to the relentless beat of digital disruption.