For nearly two decades, my team and I have partnered with some of the world’s leading marketing agencies as they’ve expanded their capabilities in emerging technologies – from mobile reshaping consumer behavior to eCommerce redefining customer experience – to better serve their clients. Today, we’re witnessing an even more profound transformation, as platform technology and AI challenge the very foundations of the agency business model, indeed, of all service industries.

Agencies, especially networks and groups, are already shifting their core value proposition from pure creative storytelling to an integrated offering combining creative + technology + data solutions. Rather than pitching bold ideas in isolation, agencies now position themselves as partners delivering data-driven creativity that results in measurable business outcomes.

The ongoing value proposition expansion also includes platform-based offerings and deeper client integration. Agencies are increasingly embedding software or teams on-site with clients, providing access to proprietary tools and offering marketing automation capabilities alongside traditional creative and media services.

When a service sector that traditionally delivers value through its human resources now creates value using technology, that's when the business model needs to evolve.

How AI and tech are transforming agency value creation

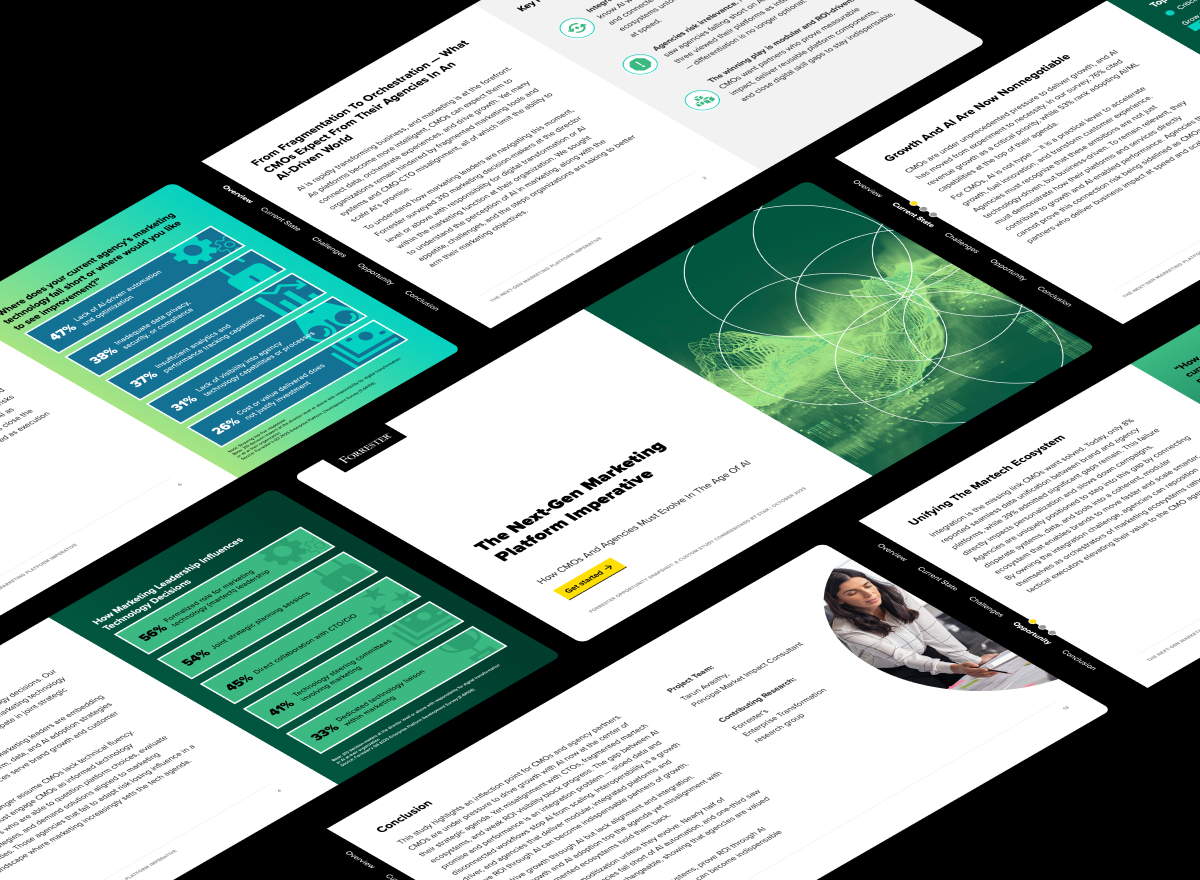

In our 2025 independent Forrester consulting study, 79% of CMOs and marketing leaders surveyed say agency technology plays a high or critical role in partner selection and retention. Yet, only 55% feel sufficiently educated on the most important new tools to make these calls and about a third see agency platforms as interchangeable. CMOs cite gaps like lack of AI automation, weak privacy/compliance and poor performance analytics as areas where they expect agencies to improve in 2026 and beyond.

This signals a new reality for agencies: data and technology now sit alongside creativity as core drivers of client value. Agencies are building or accessing first-party data, investing in technology infrastructure and hiring talent such as data scientists and technologists. Proprietary algorithms and datasets have become new forms of intellectual property that agencies protect as closely as their creative concepts.

Inside agencies, AI and automation are reshaping how work gets done. Content production, media buying and even strategic planning are increasingly supported by intelligent tools and AI, making workflows more technology-first. Campaigns are evolving into continuous, always-on cycles of analytics and optimization. The modern agency model blends human creativity with machine execution, demanding seamless integration among people, data and technology.

These changes also alter the economics of agency operations. As automation reduces the marginal cost of serving each additional client, the cost structure shifts from variable billable hours to higher fixed investments in technology, potentially improving margins if pricing remains stable. However, as identified earlier, clients increasingly expect these efficiency gains to translate into lower fees. This creates a growing misalignment between how agencies capture value from technology and how clients expect that value to be shared.

Explore how AI and platform technologies are changing agency–client relationships in our webinar with a guest Forrester analyst.

Agency tech ownership: weighing the cost of buy vs build

The tension between building and buying technology emerges from a more fundamental strategic question: how should agencies allocate resources between deepening existing capabilities and expanding into new ones? This distinction provides a coherent framework for understanding when agencies should own technology (build) versus when they should leverage external platforms (buy).

Building technology in-house means developing your own software, AI models or data platforms tailored to your agency’s needs. The pros of building are primarily about control and differentiation. You own the intellectual property outright – giving you independence from vendors and possibly a unique capability no competitor has. An in-house solution can be custom-fit to your processes and client requirements, potentially making it more effective for your specific use cases.

From a strategic standpoint, the resource-based view favors building if the technology can be a core differentiator. However, the cons are equally significant: building requires substantial upfront investment which is costly for agencies not historically structured as software firms. Also, technology evolves fast, and an agency might sink millions into a tool that becomes outdated if done solely in-house. It also demands ongoing maintenance and upgrades, creating a new organizational competency and cost that agencies must sustain.

Buying technology involves using existing technology from third parties – whether licensing software, using cloud AI services, or partnering with martech/adtech companies. The pros here center on speed and proven capability.

By buying, an agency can deploy a solution quickly, often immediately getting world-class functionality (since the vendor specializes in that tech). It avoids reinventing the wheel – for example, rather than building a cloud infrastructure, agencies use Google Cloud or AWS; rather than developing a generative AI from scratch, agencies license OpenAI or Google’s models.

This often has a lower initial cost with many tools that are subscription-based, spreading expense over time, which allows the agency to focus on its core creative/strategic work. Buying also means getting regular updates and support from the vendor – the tech stays cutting-edge without the agency bearing all R&D costs.

However, reliance on external capabilities will always lead to less differentiation – if everyone can buy the same tool, it’s hard to claim competitive advantage from it. Dependence on vendors can be a vulnerability: pricing or terms might change, or the tool might not evolve in a direction that suits the agency. There’s also integration complexity – ensuring the bought tools fit into the agency’s workflow and systems, though this is usually easier than building everything.

Crucially, relying on external platforms can mean surrendering some control over data or capabilities. For instance, if you use a third-party data management platform, you’re constrained by its data schema and privacy rules; if you heavily use a marketing automation SaaS, your service quality is tied to their uptime.

Why integration can help agencies stand out in the AI era

The future of agency tech strategy is rarely “build” or “buy” alone. It is integration.

In marketing services, integration means acting as the orchestrator of tools and data to create client value. Rather than owning every component, agencies master how to blend the best tools and apply them to real workflows. APIs and cloud platforms make this practical at speed and scale.

Our independent Forrester Consulting study found that 34% of enterprise CMOs expect agencies to integrate across MarTech platforms, which shifts the role from isolated service provider to end-to-end orchestrator.

For example, an agency might use a leading AI image generator via API, but build an internal interface that is tuned to the agency’s creative workflow and trained on its unique brand style datasets – giving a semi-proprietary advantage without building an AI model from scratch. For clients, this translates into faster delivery, more consistent brand expression and access to cutting-edge tools tailored for their specific needs.

Integration benefits agency employees as well. It removes friction and manual overhead by embedding tools directly into their workflow, so instead of toggling between platforms or reworking generic outputs, teams work inside a system designed for how they think and deliver.

In practice, an integration strategy blends best-in-class external platforms for generic capabilities, such as cloud hosting, AI algorithms or CRM systems, with targeted custom layers or connectors that adapt these platforms to an agency’s unique processes. The result is a cohesive toolchain that automates and executes work end-to-end, with human expertise guiding and quality-checking the final output.

How services firms can regain differentiation: Scale vs Scope

When technology and data become ubiquitous, an agency can either strive for scale advantages with efficient, high-volume, cost-competitive services, or for scope advantages with specialized, highly differentiated expertise, or some combination of focus. The worst place to be is where you're trying to be everything for everyone.

We are already seeing marketing services becoming commoditized with the advent of martech solutions, and now AI. When services become seen as commodities, price competition intensifies and profit margins shrink. For large holding companies, there’s also internal competition and overlap among their agencies offering similar services, which they’ve tried to address by consolidating brands. AI threatens to commoditize certain creative and analytical tasks that used to command premium fees. In such a landscape, an agency needs a clear value strategy to avoid being one of the many undifferentiated players.

Scale strategy – resource expansion: This means leveraging technology and process excellence to offer services at a lower cost per output, aiming to serve a large number of clients or high-volume transactional work. Investment in automation and standardized platforms lowers both unit costs by spreading overhead over more clients and increases bargaining power with vendors due to volume.

In sustaining such a strategy, proprietary platforms and IP play a key role: to avoid pure commoditization, even a scale player benefits from owning some unique tech (e.g., an exclusive database or a patented AI tool) that others can’t easily copy, giving it a slight edge beyond just cost.

Scope strategy – resource deepening: On the other side, a scope-focused strategy means an agency concentrates on a narrower set of offerings or a specific market segment where it can truly excel and charge a premium.

Agencies going this route leverage depth over breadth, they aim to be the best rather than the biggest. Their differentiation might come from exceptional creative quality, proprietary research or intellectual capital, a unique methodology or even a charismatic brand personality. They likely work with fewer clients, focusing on those who value their special capabilities.

For a scope player, technology still plays a critical role, but in a different way. Instead of using tech primarily to cut costs, they use tech to enhance or amplify their uniqueness. For example, a data-driven creative agency could own a proprietary dataset that underpins their offering.

The key is, whether at a network level or agency level, make deliberate choices: decide what you will excel at, and let that guide your tech and talent investments.

Entering the age of technology-driven marketing service

The most urgent question for agency leaders isn’t whether to invest in technology, it’s what purpose that investment serves. Is the goal to drive operational efficiency in client delivery or to create a strategic differentiator that defines the agency’s unique position in the market? The answer shapes everything downstream, from hiring plans to platform architecture to how an agency communicates its services.

To quote the godfather of strategy Michael Porter: “Strategy is about making choices. It is about deliberately choosing to be different.” I believe agencies ought to apply this principle rigorously. That means building coherent activity systems where technology choices reinforce a clear, differentiated value proposition.

This requires deliberate clarity on three areas that should guide its technology decisions and investment:

- What services do we deliver and not deliver.

- How can we deliver them in a way others can’t or won’t.

- Which clients do we serve, and which to walk away from.

Not all CMOs are created equal. Though they may all hold the budget, their mandates differ drastically. A CMO at a high-frequency touchpoint brand, such as retail and travel, tends to operate at speed and iterate on performance data. A CMO in a low-frequency category like luxury will likely prioritize brand stewardship instead.

This difference should shape the agency’s tech roadmap. A one-size-fits-all platform won’t serve both. Therefore, the endgame of your tech investment must reflect your strategic position. If tech is purely a delivery engine, invest for speed and cost. If it’s a differentiator, build proprietary tools, processes and data that others can’t replicate, and ensure every part of your service model supports that differentiation.

In the next evolution of agency models, we could see a fundamental shift towards platform modularity and Platform-as-a-Service (PaaS) offerings where they deliver value with technology, but humans are still the differentiator. A blueprint for this shift is Palantir’s FDSE model, where software is embedded via specialists who deploy and operationalize it based on each client's unique demands.

Agencies can adopt a similar model: modular platforms with tailored components, for example content automation, identity, retail media, measurement and more, each designed to address a specific marketing need. And the real differentiator continues to be the agency’s in-house specialists who activate these tools to solve problems clients cannot tackle alone.

CMOs increasingly hire generalists internally but look externally for applied expertise and tooling. To stay relevant, service industries must stop treating technology as infrastructure and start using it as an outcome engine. The future belongs to those who use technology as an enabler to deliver sharper results, faster decisions and real growth for clients, not how much tech you own in-house.