The automotive and mobility (A&M) sector is facing a confluence of disruptive forces. Established enterprises are grappling with existential questions about their business models, changing consumer mobility habits and highly competitive models from new EV companies.

We recently launched 10Forward, a future-gazing framework and trend report. It explores the potential evolution of the A&M sector over the next decade based on various levels of technological innovation and prosperity. While some of the trends and mobility habits envisioned in the four 10FWD scenarios may seem extreme, they are there to push industry leaders to think from the future back to picture their business 8 to 10 years from now and what they need to do to stay relevant.

The power of three: Electrification, SDVs and new revenue models

Over the next three years, we believe that electrification, software-defined vehicles (SDVs) and new revenue models will form a trifecta of success for OEMs. While these trends may seem like distinct areas (e.g., electrification impacting product development, SDVs affecting software engineering, and new revenue models pertaining to sales and marketing), they are all deeply interconnected in a business’s transformation.

- Consumer experience and trust: All three trends influence how consumers perceive and interact with a brand. Electrification redefines the driving experience with cleaner technology; SDVs enhance personalization of in-car interactions and connectivity beyond the vehicle; innovative financing models can improve customer satisfaction and foster brand loyalty.

- Business infrastructure: Each trend demands substantial investment in business infrastructure. Electrification requires enhancements in battery technology and charging networks; SDVs necessitate advanced software development capabilities; new revenue models may require overhauling traditional sales and backend systems.

- Alternative revenue streams: The traditional revenue model of car companies, built on vehicle sales and spare parts (SMR) is under siege. Electrification offers new revenue streams through battery services and charging infrastructure, but also threatens SMR profits as fewer parts are needed. SDVs create opportunities for ongoing income through subscriptions and data-driven services but the rise of leasing and potential technology advancements further erode the reliance on SMR. To adapt, OEMs need to diversify their revenue streams. Subscription services for features like ADAS or in-car entertainment, data-driven services like predictive maintenance and innovative financing solutions for EVs and new ownership models can all provide a financial safety net in this rapidly changing landscape. By embracing this paradigm shift, OEMs can secure their financial future and remain competitive in the evolving A&M sector.

Electrification: Shaping the future of EV adoption

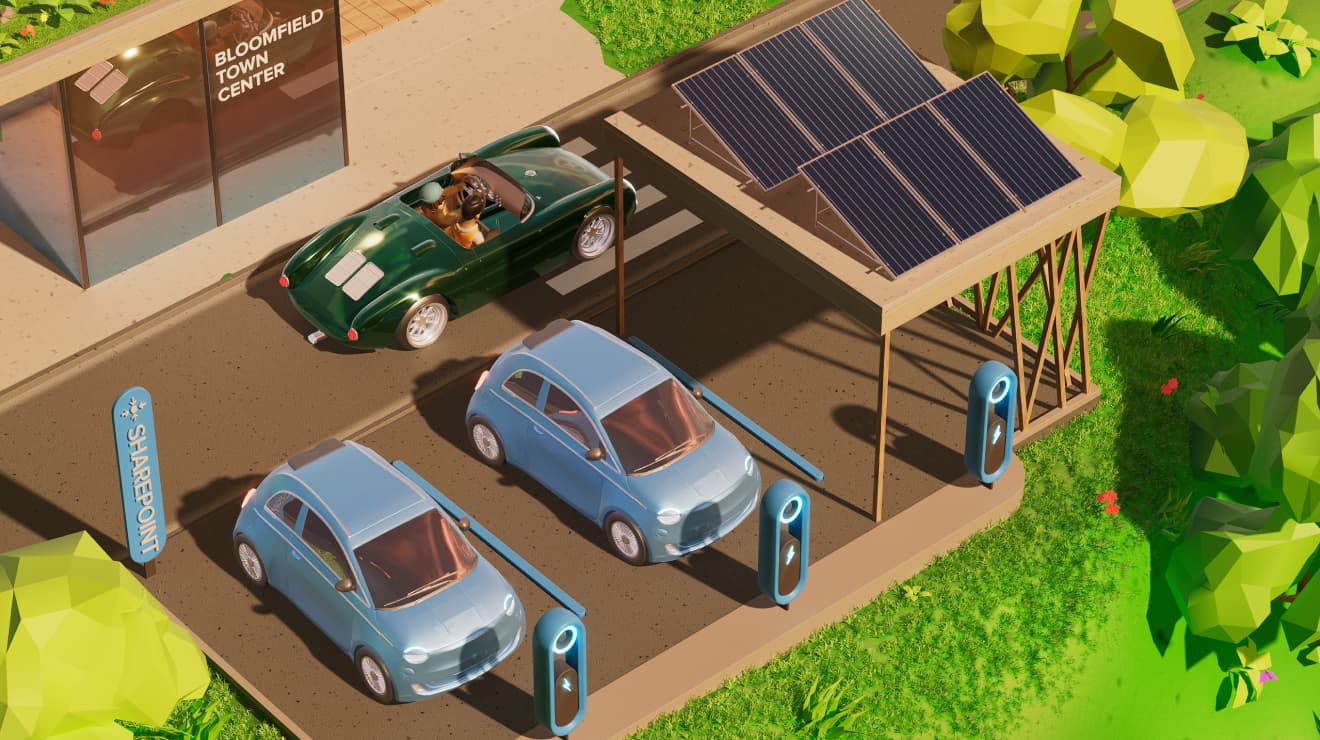

Part of the process of shaping new behavior is building trust with end-users and electrification is fundamentally about trust. The widespread adoption of EVs depends on several trust-influencing factors: the reliability of EV batteries, charging speed, the widespread availability of charging stations and the vehicle’s range. These are critical components that assure drivers of their ability to reach their destinations safely and efficiently. Star can help OEMs make their EV offerings a reliable and appealing choice for consumers. We envision a future where electric vehicles seamlessly integrate into existing and future infrastructures, supported by innovations that enhance battery performance and charging solutions.

- Short-term consideration: OEMs should invest in partnerships with battery developers and charging network providers to enhance the electric range and reduce charging times of their EV offerings. Initiatives could include pilot programs for battery-swapping technologies or collaborations with local governments to increase the availability of public charging stations.

- A 10FWD view: In 2034, we could have intelligent roads that power EV adoption as seen in the Ecolysium scenario. Exploration or partnership with parking providers to build battery pads embedded in parking spaces could transfer energy to a receiver coil in the car. Imagine not having to reserve charging stations in advance and having your car charged while you’re at the movies or shopping.

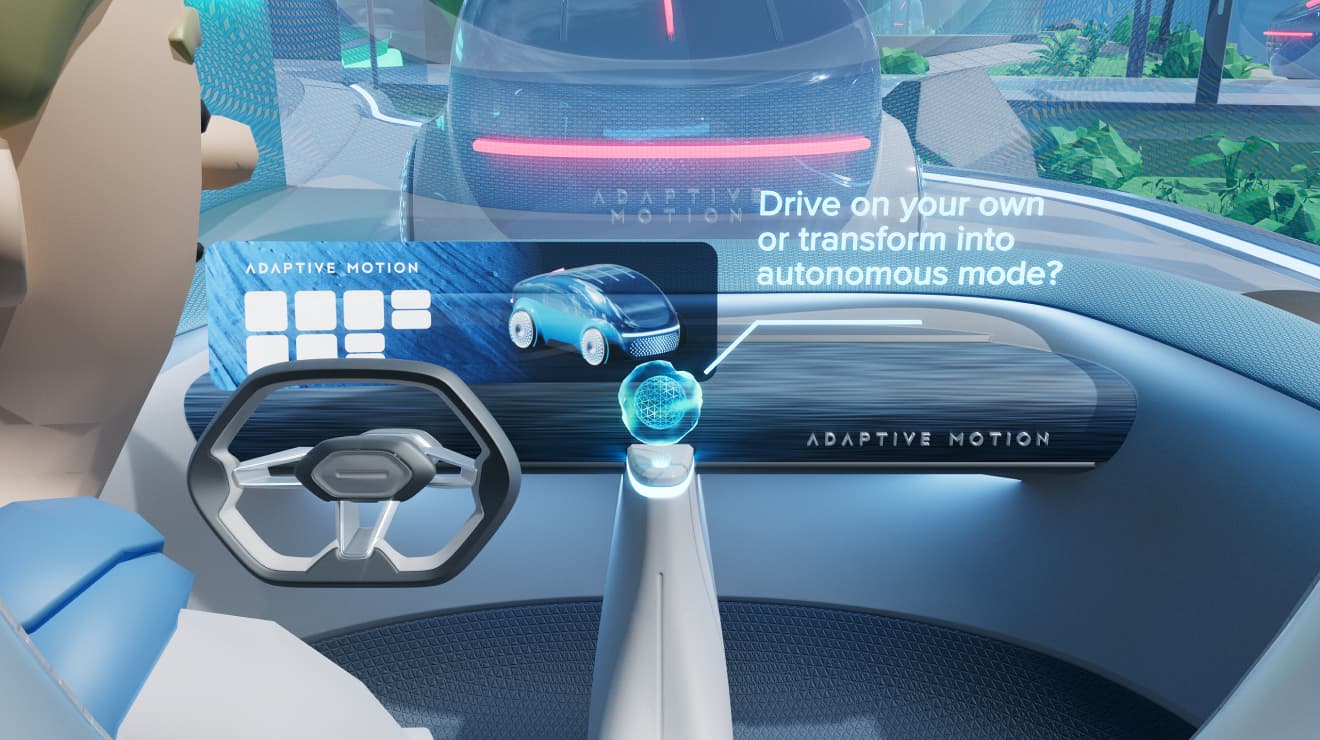

SDVs & new revenue model: transforming vehicles as part of people’s digital ecosystem

The way people view cars will fundamentally change over the next decade, and we will see a seismic shift in how different brands position their EVs over the next three years. If anyone has seen how a Chinese consumer electronics brand is positioning its latest EV as a connected car from their phones – that is a very different value proposition compared to traditional OEMs who use engine power, vehicle design and brand association to drive sales and differentiation. More established EV brands like Tesla are also enhancing the consumer experience by treating cars as integral components of the user's digital ecosystem.

That means vehicles are not just a mode of transportation but an Internet of Things (IoT) device that seamlessly integrates with the existing and ever-expanding digital ecosystem the end-user has based on their personal needs. The shift towards SDVs fundamentally changes the traditional business model and will open up new revenue streams beyond traditional vehicle sales. Subscription models for premium digital services, tiered software updates and integrated third-party offerings can all provide ongoing revenue. An example might be offering a monthly subscription for enhanced AI-driven personalization features, predictive maintenance updates, or premium entertainment packages tailored specifically to user preferences and habits.

- Short-term consideration: OEMs should prioritize investments in developing their own operating systems while continuing to strengthen partnership with the popular ecosystems provided by Apple, Google, and others to ensure seamless integration based on customer’s preferences and behaviors. Operating systems development is in its nascent stage for OEMs. Whether it is through proprietary OS or third-party OS, OEMs must keep the endgame in mind – which is creating a connected and frictionless user experience. This also means they need to strengthen partnerships across the digital value chain. This includes collaborations with mobile tech companies, app developers, and even service providers like food delivery apps or e-commerce platforms to create a cohesive digital experience inside the vehicle.

- A 10FWD view: In Star’s reimagined 2034, vehicles are not just connected but are active participants in the digital and physical infrastructure. Future developments might include cars that automatically sync with your daily schedule to pre-configure driving routes, adjust in-cabin ambiance based on time and weather or even transact for services directly from the vehicle's dashboard. Imagine your vehicle can communicate with your home AI with food delivered by your personalized drone attached to your car from your favorite restaurant.

Embarking on the digital journey with endgame in mind

It's crucial to recognize that building and maintaining trust with your customers is at the heart of this transformation journey. This trust must be considered in every innovation, digital solution, and cost implication introduced during the transformation journey. In our increasingly digitally integrated world, whether consumers view your vehicle as part of their digital ecosystem or merely as a mode of transportation – a view more common among younger consumers – the paramount importance of safety cannot be overstated. Ensuring that drivers and passengers arrive safely at their destination must remain the guiding star for all strategic decision-making.

Companies that can successfully develop and integrate all aspects of this trifecta of success while continuing to strengthen brand trust and reputation will be well-positioned for the future. This integrated approach will enable a successful transition into a digital business with a strong brand image, increased operational efficiency and the ability to remain relevant and competitive in a rapidly evolving landscape.