In January 2020, Tesla’s market value surpassed Ford’s and GM’s combined value, Google’s Android Auto hit 100m downloads in the Google Play Store and Sony entered the Automotive market with their Sony Vision-S concept car. It’s clear that the big tech players are taking an ever-increasing interest in this automotive and mobility market. Without a doubt, we’re standing in front of what can be seen as the new tech giant battleground.

It poses a challenge to the traditional players in the automotive & mobility solutions realm. How can they stay at the top of their game, and what will it take to push the envelope as tech giants enter mainstream automotive?

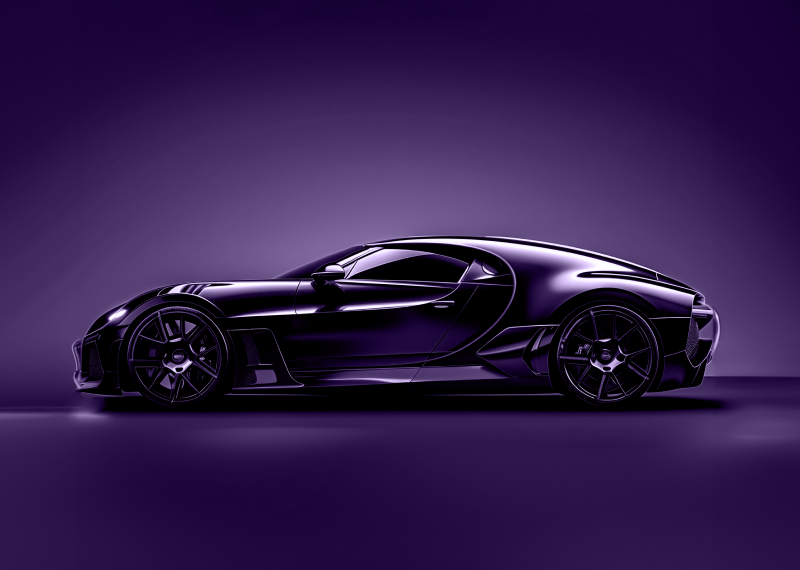

Historically, the automotive landscape has consisted of well-defined players, acting inside well-defined domains, with clear value propositions. We’re seeing a shift in the industry where electrification and the promise of full autonomy are rapidly disrupting the value chain. The previous core business of selling vehicles is being commoditized. Instead, value generation increasingly comes from products and services connected to the vehicle.

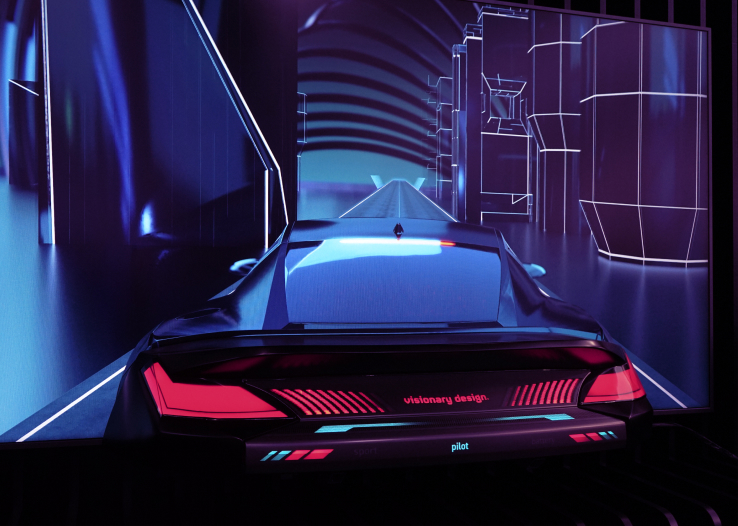

The GAFA group (Google, Apple, Facebook, Amazon) have all been active in this field and pouncing on the new business opportunity. 2020 has seen additional new tech entrants state their claim, as is the case with the new Vision-S from Sony and the launch of Microsoft’s Connected Vehicle Platform. Both of these can be seen either as a component in the value chain or as a jumping-off point for new automotive software platforms intended to run on top of different vehicle platforms.

The increasing interest by bigtech is no surprise as the amount of code within automotive software grows exponentially. Take for instance modern vehicle braking systems — it’s made up of a large set of sensors and over a million lines of code.

When uniqueness and value are increasingly coming from software, how do mainstream players respond?

Primarily, the big tech companies can no longer be seen as just another supplier. With their deep pockets and constantly prowling for new opportunities, they will not be content to remain a fragment in the value chain but will continue to take on more value and challenge your business.

A software-first mentality

A shift is on the horizon. Rather than viewing the vehicle as the value, auto manufacturers must change their perspective to view the automotive HMI as the value. That is, how the vehicle can enable or interact with drivers. See the vehicle as a channel or platform.

The journey begins with selling a vehicle and value is gained over time with new mobility services, content, and experiences as well as the traditional automotive domains or vehicle servicing, spare parts, and accessories. The more volume you have out there, the more value you’ll gain over time.

The vehicle will be more akin to what we’re used to with our mobile phones or internet access: a subscription model. The hardware is provided for free and you pay for it via a subscription. Software organization will be interesting to watch. Will these arm’s length digital organizations have the power to influence the core business and will they get the acceptance needed to trailblaze into the future?

We translate challenges and ideas into tangible automotive and mobility solutions.

Increase cycle times by separating the SW and HW trains

The automotive lifecycle involves redesigning a model every five to eight years, retooling an assembly plant, and marketing the vehicle as new-and-improved. It’s a strategy that’s long in the tooth and can perhaps be done better with the goal of optimizing the customer experience.

Rather than hearing manufacturers announce the number of new vehicles they are going to launch in a year, we’d prefer they develop and present a product roadmap of the new services and features that will be deployed over the air to all of their existing vehicles already out there. What we want to achieve is an evolutionary customer experience where you have access to a vehicle — whether bought, leased, or rented — and that vehicle will continue to evolve and improve over time. Who wouldn’t wish for an owner experience that evolves instead of a scenario like today where our vehicles get older by the day?

Build unique partnerships

Carmakers face massive cash investments if they wish to ideate and create solutions on their own. Yet, without innovation, the mainstream players will fade into the background with archaic products. Rather, partnerships with unique solutions keep them on the leading edge.

An area where we are seeing real innovation is in partnerships between automotive & mobility solutions, whether it’s Hyundai’s partnership with Uber on flying taxis, Ford’s acquisition of electric scooter start-up Spin, or Toyota’s autonomous vehicle concept in partnership with Amazon, Uber, and Pizza Hut. These partnerships are being used to access new forms of mobility and deliver new services through the vehicle, transitioning automotive manufacturers to become mobility service providers.

Dare to try new things

In a rapidly transforming industry like automotive & mobility, we have to try new things and take a non-traditional perspective. That’s exactly what new entries into the automotive space are doing right now. We need to boldly try new things and do so in an agile and fast-moving way. Let’s be proactive, not reactive, quickly moving from ideation to testing and evaluation prior then moving onto large-scale investment.

In today’s climate, the results aren’t always clear before we try, but innovation waits for no one. Bigtech certainly proves it. We cannot be afraid to set out on a path where we don’t know the result before we start. The times of innovating under the umbrella of “yes we can be innovative as long as we can be sure about the ROI before we start” are gone.

In summary, there is a lot going on out there and we can’t remember a more exciting time in automotive innovation. The well-funded tech giants continue to shake up industries with automotive and mobility firmly in their sights. Automotive manufacturers can and are responding, but the transformation will be a long and hard one and require new brave thinking.

At Star, we design and build the new software-driven products and experiences that automotive manufacturers are looking to embrace. To learn more, connect with us.