The vehicle-buying experience is changing fast, and OEMs and dealers have no choice but to keep up. Multiple factors are driving the transformation, from the explosion of ecommerce channels, to the rise of new automotive market players, to consumers’ new expectations, and increasing willingness to buy a car entirely online.

McKinsey predicts that in the coming years, new-car purchase journeys will shift from 0 percent digital to 10-25 percent digital, while used cars will increase from 6 percent to 25-50 percent digital. Most automotive companies are not aptly prepared to support digital car buyer journeys. They have work to do in-store, too. Although consumers believe the car-buying experience takes too long and requires too much paperwork, they still perceive the customer experience and relationship with salespeople as integral to decision-making, according to research from Deloitte.

So, what needs to be done to prepare dealer groups, OEMs, and other mobility players for vehicle buying 2.0? How can brands use vehicle buying experience design to create omnichannel car-buying experiences that not only drives sales, but foster loyalty and longevity?

Here are five questions every mobility brand must answer to achieve automotive digital retail transformation, and thrive in today’s market - and beyond.

1. How do you identify key touchpoints throughout the car buyer journey?

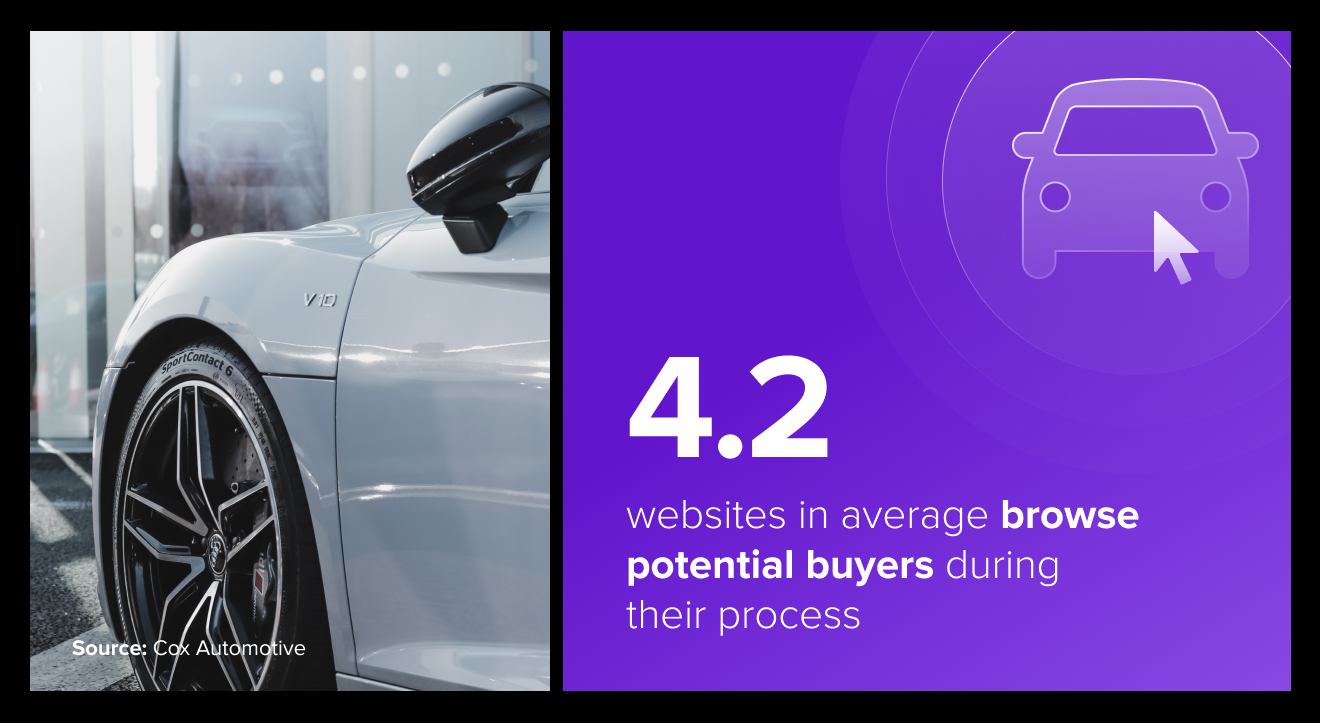

One of the biggest challenges shaping the future of automotive digital retail is mapping the automotive customer journey, from the Discovery stage, to Brand Evangelist. This path is rarely a straight line. Recent research from Cox Automotive found more than half of buyers use multiple devices when car shopping and visit an average of 4.2 websites during their process. During the Consideration phase, consumers are probably checking out the vehicle in-person, whether at a retail location or in a friend’s driveway, and may experiment with an online configurator to design the vehicle of their dreams.

OEMs and dealers must understand their unique sales funnel. At Star, we begin this task with exhaustive research, spending weeks reviewing client branding materials and customer personas and analyzing the market, including competitors’ online shopping experiences and in-store approach. We map the automotive customer journey, pinpointing meaningful touchpoints for both human and digital interaction, and considering how they come together to create a brand ecosystem and coherent user experience.

2. How do you integrate offline and online sales touchpoints?

With these touchpoints in mind, you can create an Experience Vision — an overarching plan for designing omnichannel experiences that connect users to your brand. But holistic experiences are not possible without data integration.

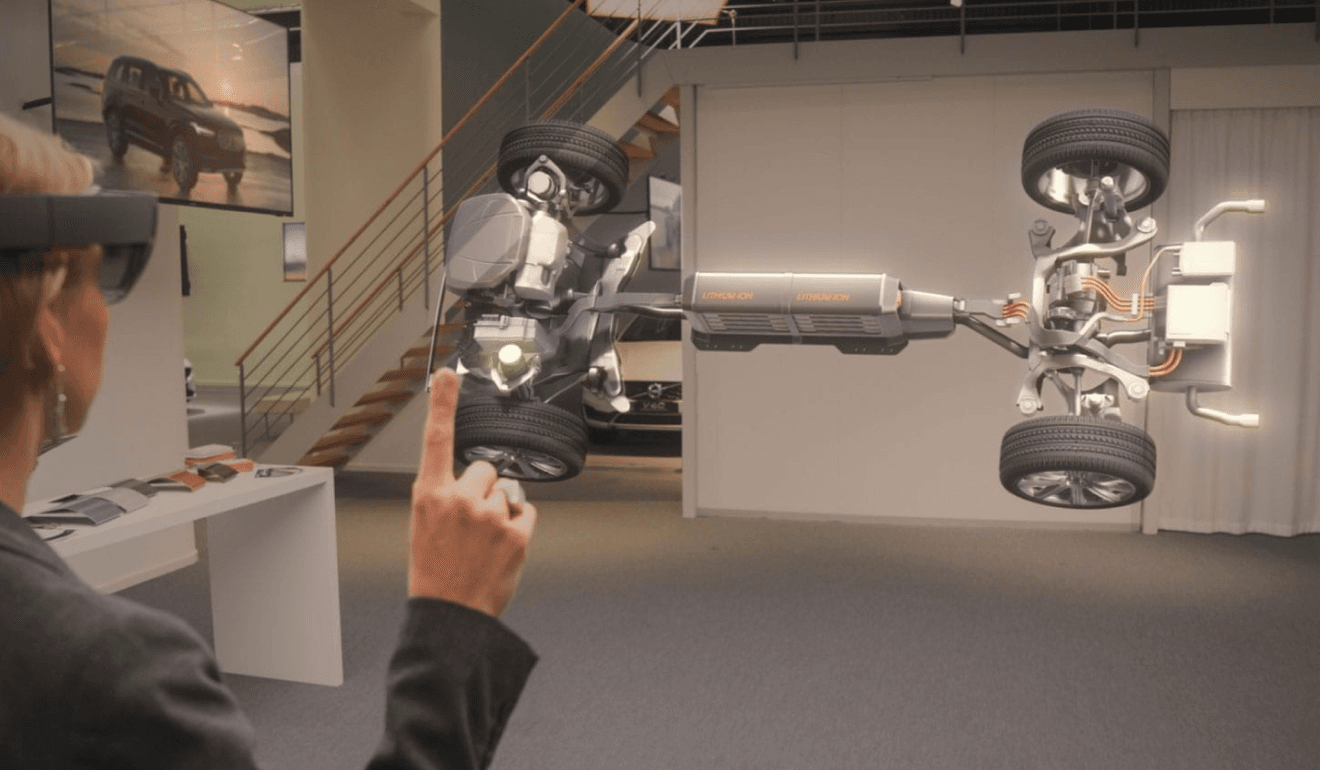

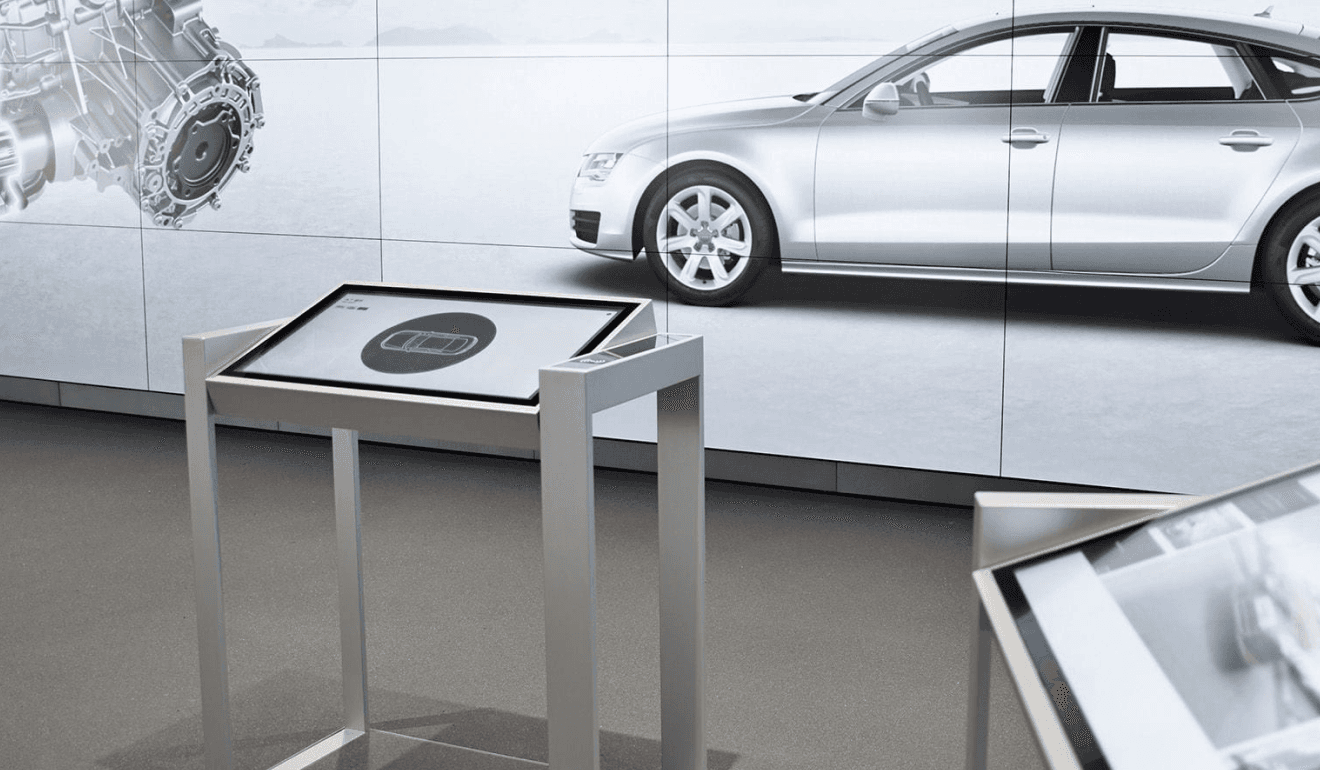

An analysis of the European automotive market by Deloitte found that most OEMs do not offer an end-to-end digital solution or integrate physical and online shopping experiences. Many struggle to create personalized automotive digital retail experiences, such as using VR/AR technology to enable consumers to explore the car they customized online. To enable a dealer experience like that, mobility companies must connect online and offline data to create a holistic understanding of each prospect. This can be done by creating customer IDs that connect users across all tools - a manufacturer website, dealer portal, car dealer apps, in-car technology, etc. Although this solution sounds simple, it requires new software and architecture, system integration, and specific design and technology skill sets.

3. How do you design and build omnichannel architecture?

We believe a successful Experience Vision considers input from Marketing and Product Design teams - two departments that are usually siloed. An Experience Vision considers not only immediate goals, but the future of a brand, and how an experience might be expected to grow and change. In the automotive space, an effective Experience Vision is most certainly omnichannel, built on an understanding of how customers move from one channel to the next, and designed to deliver an uninterrupted experience across them all.

Few automotive companies have the in-house skills to build architecture to support holistic omnichannel strategies. They should seek guidance on best practices, which include building an ecosystem with feature parity to create a flexible platform experience while mitigating siloed products; and using multilayer, modular client-server architecture with a presentation layer that communicates with the business layer to enable system scalability and sustainability.

4. How do you create holistic, on-brand consumer experiences?

Experience Design isn’t necessarily about selling something, but rather, about making a user feel a certain way. At Star, we consider strategy and user-centric design best practices to create experiences that advance brand ideals while meeting user demands and preferences. All interface designs should feel holistic and on-brand, whether a user is on an OEM website, car dealer apps, or at a dealership or “brand experience center.”

While supporting luxury automotive innovators in omnichannel strategies and experience design, Star has uncovered a few helpful tips, including:

- Invest in continuous customer feedback and introduce feedback loops across all channels and digital retail solutions to help uncover market demands.

- Think beyond IT, because you will need close collaboration between all departments involved in the car buyer journey.

- Always consider the shortest possible customer journey, as effortless continuity is a key enabler of omnichannel UX.

- Don’t ask for too much personal verification information upfront - do so gradually. More than three-fourths of consumers are willing to share information about themselves in exchange for contextualized and consistent interactions across brands - but how you ask matters.

- Guide users through first-time interactions on your platform and help them keep track of their previous actions, especially when they switch devices.

5. How do you build a collaborative dealer and OEM partnership to consolidate data and customer insights and build a 360-degree view of consumer purchasing needs?

According to Star’s Automotive Retail Trends report, operational challenges are some of the biggest hurdles to digital transformation. The OEM/dealer relationship is strained. Dealers realize change is imminent: In a 2018 survey by PwC in Germany, 79 percent of dealers said they believe their role will change dramatically in the next five to 10 years. But only one percent felt “very well prepared” for the change.

Automotive innovators like Tesla and Byton have already proven that selling via their own stores and showrooms can work, in part because it allows them to control their sales channels, customer relationships, and all the associated data. For OEMs and dealers to compete, they will need to solve the operational and cultural challenge of cooperation; effective vehicle buying experience design and new digital retail solutions are not possible otherwise.

Summary

User-centric vehicle buying experience design and seamless integration of online and offline data are critical to creating the best car-buying experience possible, and to OEMs and dealers’ ability to thrive in the future of automotive retail. But most are struggling to overcome key challenges, from understanding the complicated customer journey to fostering OEM/dealer cooperation.

From innovation ideas and market research to HMI design, dealer portal development, dealership chatbots, and connected vehicle software, Star Automotive Experts can provide a number of services to support next-generation Automotive Digital Retail. Contact us today to learn more.