What does it take for Chinese automotive brands to not just expand, but truly thrive, in Western markets? Knowing UX expectations.

China’s rapid automotive UX evolution

In recent years, Chinese car manufacturers have transformed from fast followers to global contenders — to potentially soon be leading the way. Initially, Chinese car brands studied established markets and analyzed successful UX patterns from the west and incorporated best practices to accelerate their progress.

Over time though, they’ve evolved these patterns, creating a unique, cutting-edge and technologically advanced approach that thrives in an environment with fewer regulatory constraints. This approach, coupled with rapid iteration and a trial-and-error mindset, has led to an explosion of innovation in the domestic market.

Today, China is home to some of the most advanced, tech-driven automotive experiences, with new brands and sub-brands launching at an unprecedented pace. The domestic market thrives on fast product cycles, bold experimentation and consumer acceptance of cutting-edge features.

However, expanding to global markets is a different challenge. It’s a costly and high-risk endeavor where misalignment with user expectations, regulatory hurdles and brand perception issues can lead to significant setbacks.

Four UX challenges for Chinese OEMs in the West

User experience (UX) encompasses the overall interaction between a user and a product. In this case, UX refers to the automotive Human-Machine Interface (HMI) which is required for interactions between drivers, passengers, and vehicle systems.

Unlike the Chinese market, where innovation is embraced at an extraordinary pace, Western consumers have different interaction preferences and are still more accustomed to simplified UX patterns. Global expansion demands a greater investment in UX research, product-market fit and brand positioning, making differentiation and adaptability critical success factors.

Chinese OEMs also face perception challenges, as skepticism still exists regarding their brand image in Western markets. Another complicating factor is the rapid pace of change in Chinese domestic markets, which doesn’t always translate well abroad. Features like karaoke in the dashboard, multiple displays and unconventional controls, overly complicated interfaces might be impressive locally but can be perceived as gimmicky or distracting by Western consumers. Without a nuanced understanding of local context, even well-engineered features may be seen as overengineered or irrelevant. What delights one market may confuse or alienate another — reinforcing the need for cultural UX calibration as a foundation, not an afterthought.

As Chinese automotive brands enter Europe and North America, they face four key UX and HMI challenges:

Interaction preferences

Balancing advanced technology with intuitive, driver-friendly experiences. While Chinese consumers are comfortable with AI-driven, voice-first interfaces, Western users expect minimalist UI, tactile controls and intuitive workflows

Cognitive load and information hierarchy

Many Chinese digital interfaces are densely packed with features, influenced by the all-in-one super-app ecosystem (e.g., WeChat). Western users are accustomed to simplified, structured UX that reduces cognitive overload

Perceived quality and craftsmanship

Despite the growing presence of Chinese cars in Europe, many consumers remain skeptical about their perceived quality. In China, innovation typically centers on advanced software, but Western consumers look for premium quality with seamless digital-physical integration, thoughtful UI animations and high-end material finishes, which they don’t associate with Chinese cars. This perception is reinforced by data: 62% of people view Chinese cars unfavorably, compared to 45% for Western brands

Brand identity and originality

Most Chinese car brands have excelled domestically with good UX and high performance but still face skepticism abroad. Success requires a unique design language and a globally resonant brand identity, rather than replicating Western aesthetics

The role of UX research, prototyping and AI

For Chinese OEMs to thrive internationally, investing in UX-driven market research, rapid prototyping and AI-powered adaptability is crucial.

- Research: understanding local users – Each market has unique ergonomic, cognitive and cultural expectations. Successful brands leverage deep user research to ensure their HMI, infotainment and digital services align with local driving habits

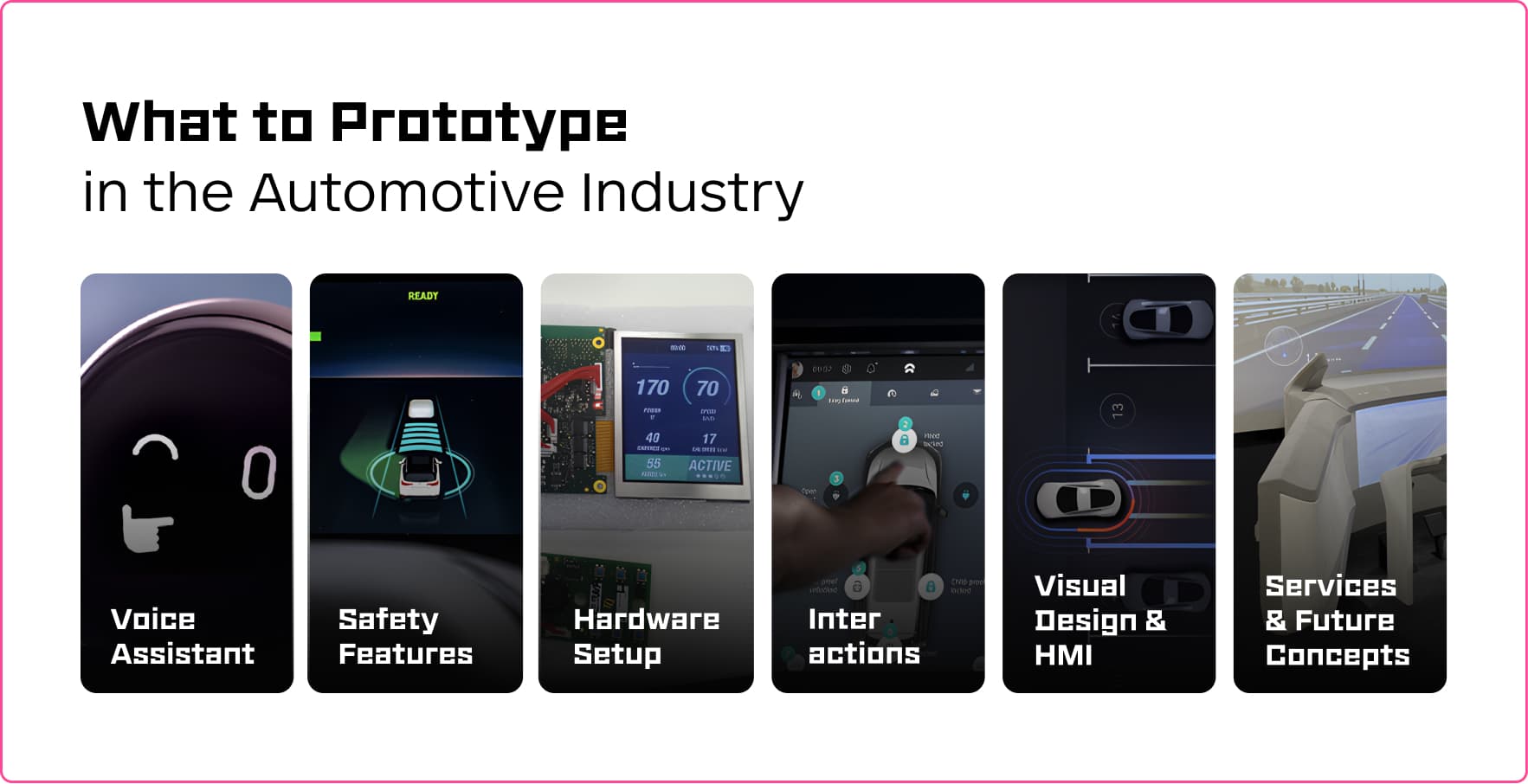

- Prototyping and validation – Western users expect seamless, frustration-free interactions. Testing concepts early and iteratively ensures smooth integration across physical and digital touchpoints before scaling to production

- AI-Powered adaptation – AI can bridge cultural gaps and Chinese automakers are increasingly partnering with Western tech firms — like NIO did with their in-car AI assistant — to enhance their smart driving capabilities and strengthen their competitiveness by dynamically adjusting UI complexity, voice interactions and driver assistance features based on user preferences

From fast followers to global leaders

Chinese automakers have proven their ability to disrupt the automotive industry, with many now expanding into global markets despite trade barriers and regulatory hurdles. The challenge now is to translate domestic success into globally resonant brands — ones that merge technical innovation with cultural understanding.

To learn how to do so, read our new automotive research piece: Global automotive industry outlook 2026: Insights and trends.