FinTech innovation is at the forefront of another global tipping point — this time, with mandatory ESG (Environmental, Social and Governance) practices and investments on the near horizon.

The adoption barriers for investors are clear, with sacrificing returns and a lack of robust data topping the charts. Yet new technologies offer companies and portfolio managers the best tools to break through ESG’s complexities on a macro scale, and those with robust data management services and specific sustainability expertise stand to gain the most.

So, how can this be leveraged for your business? This guide takes a strategic look at ESG basics, from its recent boom to global frameworks, vital for today’s cross-sector market. Most notably, we highlight the growing need for big companies, financial institutions and banks to implement FinTech-forward solutions for not only becoming ESG compliant but also increasing value with current and prospective investors.

Why ESG frameworks have gone mainstream

So, what are the key drivers behind ESG’s rise in finance? More than anything, the abrupt onset of the COVID-19 pandemic made it starkly clear that traditional global economic structures are not crisis-resilient. Investors quickly acknowledged that social and environmental matters have a vast and direct impact on economic stability, and ESG factors subsequently emerged as a strong indicator of resilience in the overall market. With this, the global appetite for ESG investments shot up, and businesses are having to quickly adapt to the demands of varying ESG framework templates around the world — with Europe leading the charge.

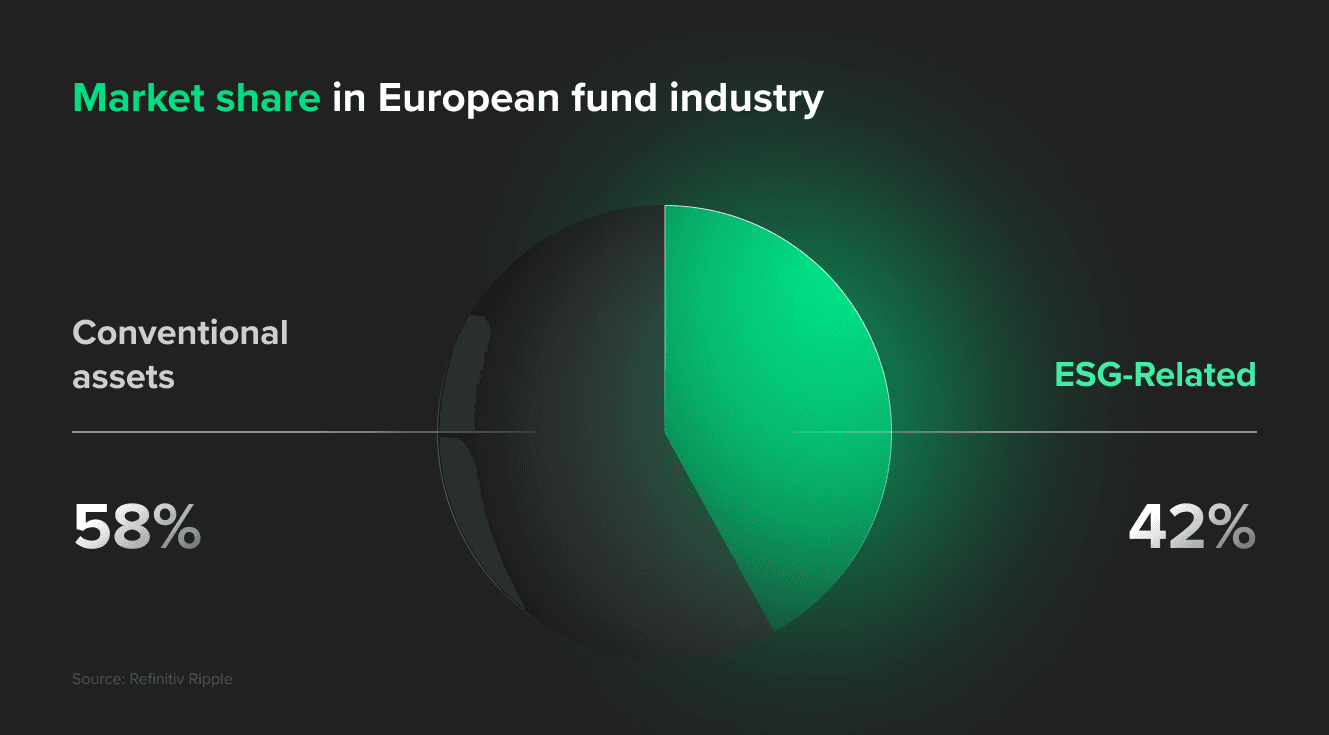

ESG-related products still take up an impressively strong market share in Europe, even with ongoing disruptions in supply chains, Russia’s invasion of Ukraine, plus rising inflation and interest rates. Additionally, the proportion of global ESG investors in 2022 has reached 89%, up from 84% in 2021. In other words, ESG has become a crucial, and likely permanent, variable for firms when making any investment decisions.

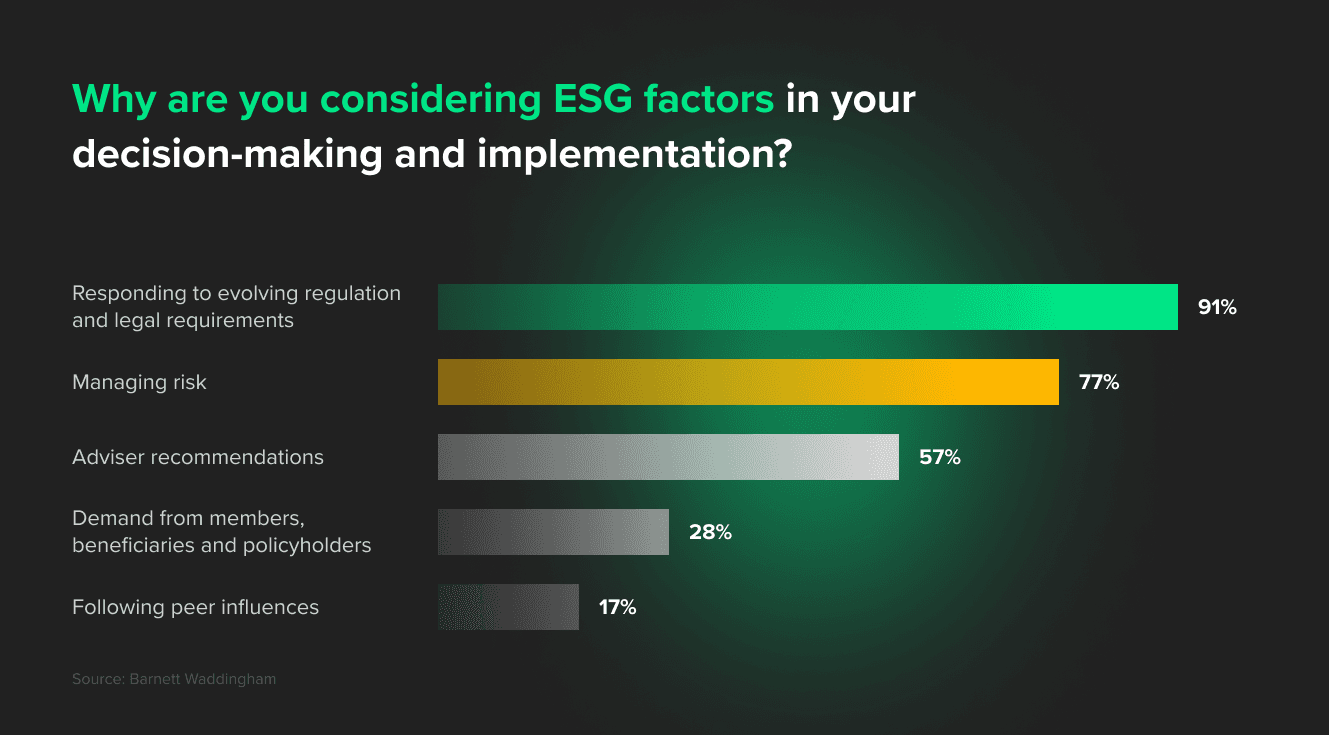

With this shift, ESG frameworks and regulations became central to the country’s long-term value creation, and investors’ views were quick to reflect this. In a recent survey of 82 pension trustees and 9 other asset owners in the UK, the leading reasons for considering ESG factors in their investments were revealing — with risk management and responding to evolving regulations topping the list.

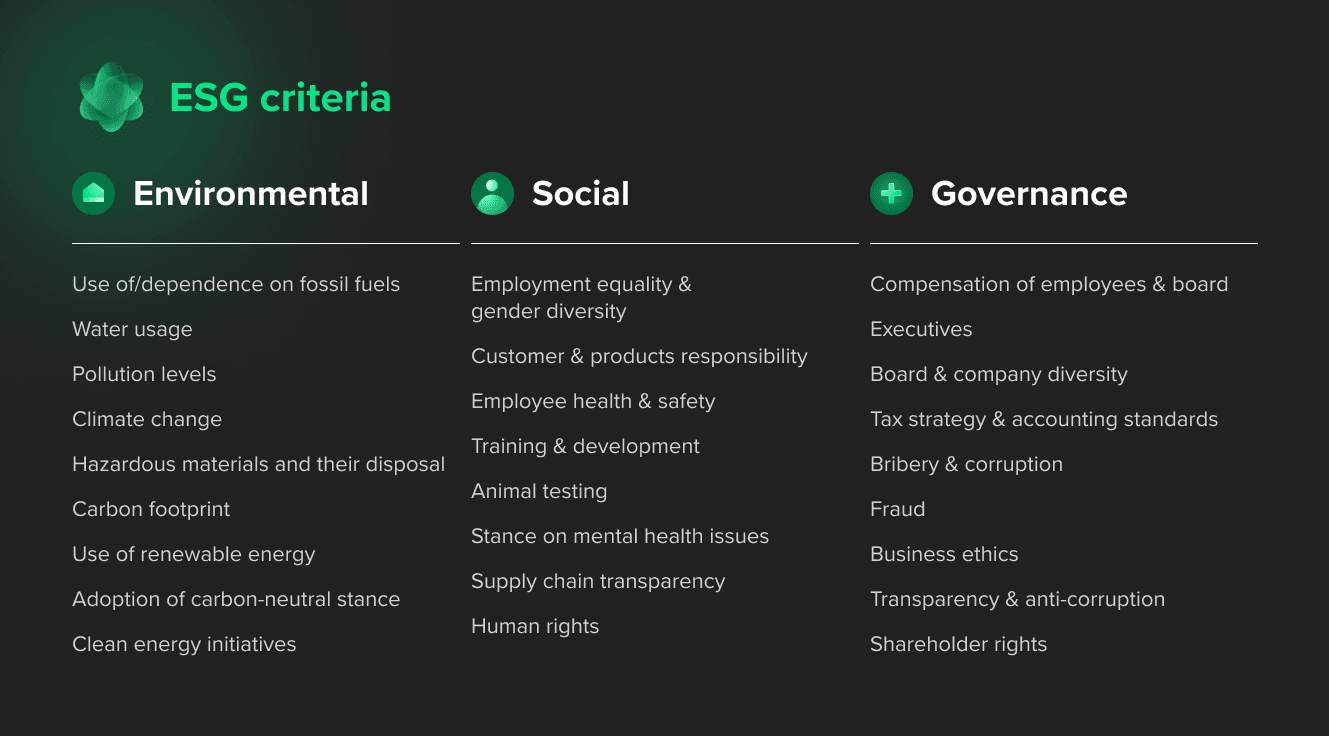

These UK investors represent a microcosm of changing attitudes across the globe. Yet, no matter the reasons, the important thing to remember about the evolution of ESG is that each factor can no longer be considered in vertical silos — with E, S or G occupying isolated spaces. Instead, Environmental, Social and Governance criteria should be looked at from a multidimensional perspective that measures the opportunities and risks across all three categories.

ESG readiness: companies need to be agile in the absence of a global standardized framework

The full impact that many early sustainability initiatives could reach has been impeded by incompatible policies and differing frameworks that result in a somewhat cryptic process. At the moment, there are many established frameworks for companies to choose from including the Global Reporting Initiative (GRI), the EU Taxonomy, the Sustainability Accounting Standards Board (SASB) and the Task Force on Climate-related Financial Disclosures (TCFD). Despite the demands of these different compliance metrics, better regulation is soon on the way — and your business needs to be preemptively ready to take on any changes from regulators.

Let’s look at the current ESG landscape as an example. To stay relevant globally, some companies define their sustainability metrics using multiple frameworks since each framework focuses on different aspects of ESG guidelines and metrics. At the same time, firms also need to consider industry-specific standards similar to the GRI, which is working on developing standards for 40 sectors. Between the various regional frameworks and industry-specific demands, there’s plenty of room at any company for sustainability criteria to get convoluted.

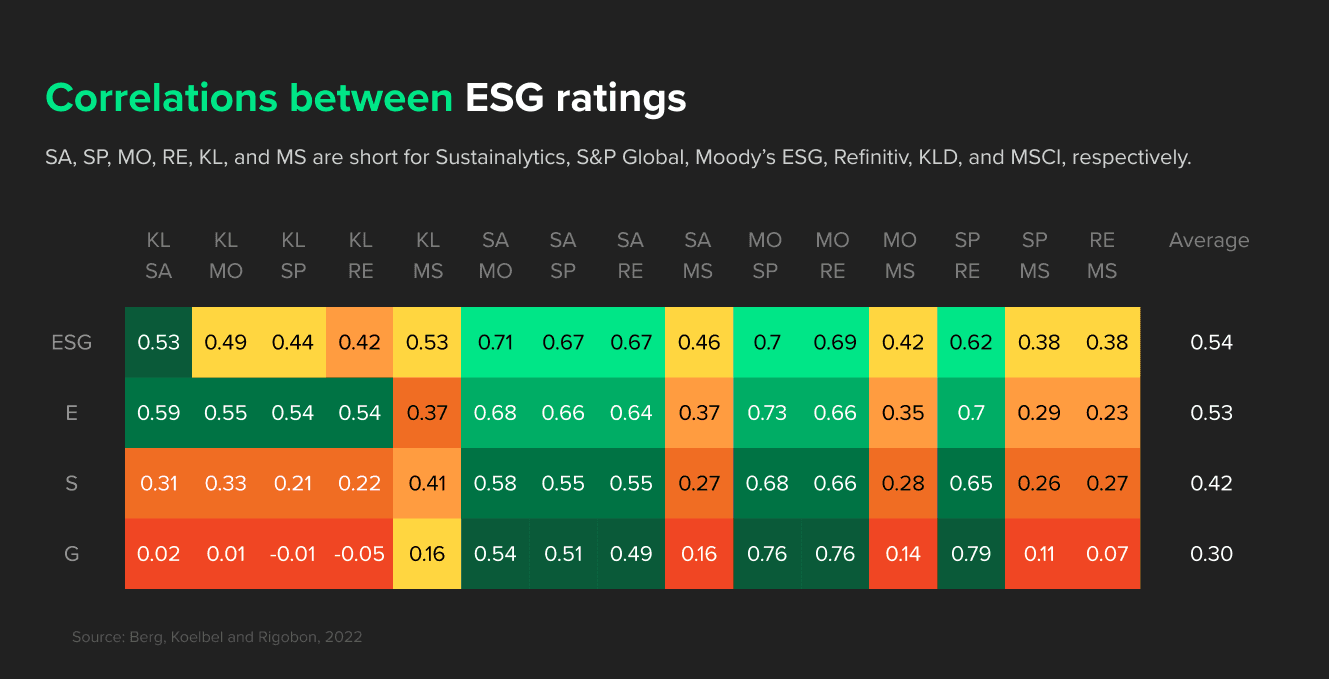

The lack of standardization has also pushed financial data providers and aggregators to adopt different methodologies for calculating ESG ratings over the years. This growing divergence was confirmed in a study conducted by SSRN which investigated six major ESG rating agencies and their methodologies. With the highest overall correlation at 71%, the need for better data and consistency is all too clear when it comes to ESG compliance and investment decisions.

In the near future, we’re expecting (in 1 to 2 years) the introduction of more robust and strict ESG policy templates in order to achieve better alignment with materiality factors but also to eliminate the risk around “greenwashing” — misleading environmental or sustainability claims.

Such work is already underway for some countries. Last year, for example, the UK government announced it will be launching new domestic criteria in their Sustainability Investment Roadmap. In this, policymakers claim their ESG strategy is “taxonomy-aligned” and brings together existing sustainability-related disclosure requirements under a single framework.

While it’s all good news in the world of sustainability, this country-by-country policy work continues to bring additional challenges. To avoid any surprises, companies should focus on the following:

- Make sure that data architecture is modular and flexible

- Work towards a bulletproof data governance framework

- Look into updating any manual data gathering processes

- Revamp in-house analytical and reporting tools

- Have all possible structured and unstructured datasets ready in case the definitions of data elements change within the frameworks

The main takeaway here: businesses need to plan in advance and work twice as hard to stay ahead of the changes within their ESG reporting, analysis and more — or adopt technology that can accomplish this for you.

Streamlining the intricacies of ESG data gathering, management and analysis

Collecting, compiling and disseminating any type of data can be tricky and tedious work. For anyone who’s worked with big data sets, we all know that the outcome will only be as good as the data that’s collected — and ESG data should not be treated any differently. Unfortunately, companies don’t always have the data available, nor is it complete, because they are pulling from a combination of different external providers plus internal departments such as supply chain management and human resources. This multifaceted approach understandably puts a strain on most traditional data management systems.

Believe it or not, for most companies, Excel spreadsheets are still doing the heavy lifting when it comes to tracking ESG assessment data, creating calculations and reporting. No one would argue that Excel is a powerful tool, but maintaining large spreadsheets can be time-consuming, unreliable and ultimately create inefficiencies.

To produce quality reports, it’s critical that they’re easily digestible, actionable and meet the needs of requirements of all stakeholders involved. Businesses of all types need to build a system which intelligently absorbs ESG’s disparities and overcomes the technical challenges of data compiling.

More consistency, less data gaps

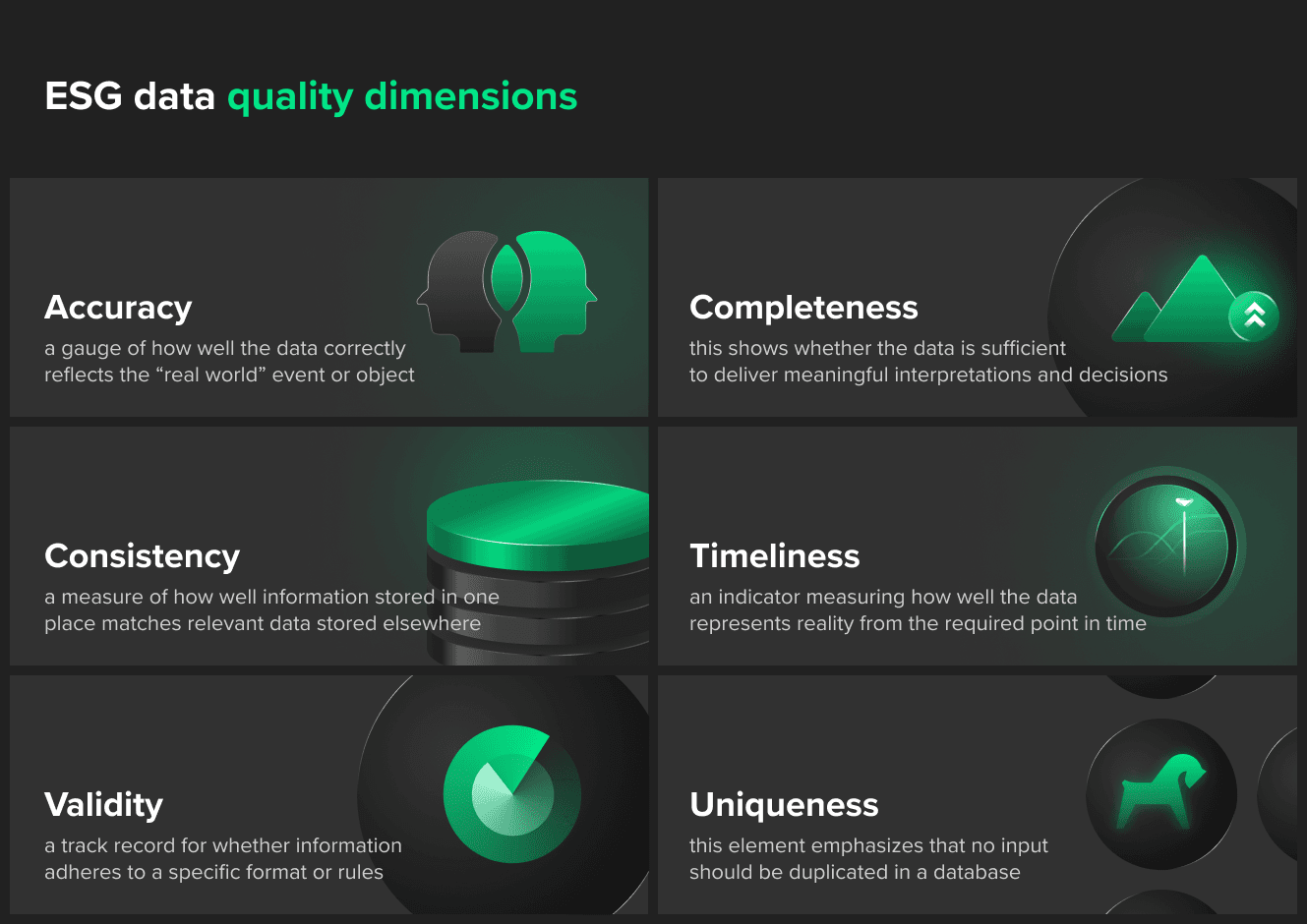

Data is, without a doubt, the most important aspect of ESG reporting and analysis. In order to achieve the best data quality within ESG, today’s financial services companies should consider the following:

- With all the different methods used for measuring ESG compliance, ensure that your data is fully integrated and that the data landscape can handle gathering information across different departments.

- Enable users to query information seamlessly and confirm that reporting tools are in place.

- Make sure to easily integrate with third parties like ESG rating providers so you can benchmark yourself against your peers.

These steps, of course, may result in a serious amount of investment, especially for SMEs. In order to stay relevant and attract more investors, while keeping costs low, companies may look for readily available solutions that offer cloud-based ESG reporting, risk management and analysis services.

FinTech enables better ESG scoring and investing

Here is the part where financial technology comes in. We’ve covered extensively how the ease and affordability of FinTech have delivered businesses worldwide once-unimaginable financial services and a newfound consumer-first approach, and the same applies to those dedicated to ESG. FinTech makes these new tools readily available to anyone across the financial services ecosystem — from banking and payments to trading and risk analysis — plus they can be tailored to solve ESG’s most pressing challenges.

This problem-solving potential can tackle the inconsistencies within global ESG frameworks and due diligence. Today’s financial technology has an ever-growing capacity for big data processing, broad analysis of both structured and unstructured information and sector-specific applications for turning data from qualitative to quantitative. Due to the digital nature of the industry, FinTechs focused on sustainability have a rare ability to gain rapid growth, achieve ESG obligations, attract investors to back their environmentally- and socially-minded goals and produce healthy returns — all at the same time.

Tech-enabled ESG solutions

Furthermore, with the global proportion of ESG investors in 2022 reaching its highest ever, ESG strategy and reporting are here to stay. Now’s the time for companies to step up and push for innovative technology solutions that assess their ESG risks; the more reliable their ESG data is, the stronger their position will be in the market when it comes to sustainable investing.

The good news is companies are not alone in this process. From data management to data collection using drones and satellites, there are various FinTech companies offering software solutions.

Let’s now take a deeper dive into the pioneering technologies leading the ESG space:

Distributed Ledger Technology (DLT)

Are companies’ supply chains sustainable — or sustainable enough? While it’s not always the easiest question to answer, businesses of all types are often asked to address this issue. There is increasing pressure for both startups and enterprises to provide transparency on their supply chain, regardless of how muddled the supply management arena can get.

Blockchain technology — a form of Distributed Ledger Technology — has huge potential to redefine supply chain management. These decentralized databases can record each transaction in a supply chain and store the details in multiple places simultaneously. In return, they deliver companies transparency, traceability and more reliable and cost-effective supply management.

There are already businesses that have integrated blockchain into their supply chain management. The diamond giant DeBeers, for instance, has already adopted blockchain for reliably tracking the journey of stones from mining to customer. There are other significant use cases where DLT can be valuable in improving internal sustainability. Companies can use blockchain-enabled reporting platforms for data collection and produce credible ESG reporting. Tech businesses like Diginex are already offering this service to various companies, and they recently expanded their offerings to the African market.

AI & machine learning

As the ESG space continues to evolve, the tech space is simultaneously getting more sophisticated in the use of artificial intelligence (AI) techniques including machine learning and deep learning. These advances further enable us to achieve better data quality and analyze it more efficiently. The power of AI facilitates the creation of meaningful data by screening millions of articles, texts, documents, speeches and beyond. By using sentiment analysis algorithms, these solutions can even determine a company's ESG goals and practices from CEO’s speeches or interviews — something Sevva's SaaS platform is already starting to champion.

Are you interested to combine technologies? Well, AI combined with blockchain technology can accomplish even more within supply chain management. While blockchain can help with tracking and traceability using smart contracts, machine learning facilitates with supply planning, inventory and warehouse management. Furthermore, AI utilizes NLP (Natural Language Processing) which works to improve efficiency in analyzing foreign language data by creating data sets and streamlining compliance and auditing activities–making their reach ever-more global.

Alternative data solutions by using drones and satellite images

From here to outer space, things are really getting exciting. Leading financial data companies have long been talking about alternative data in order to measure economies in a timelier manner — which makes the company called Spaceknow all the more interesting. Using Earth Observation imagery, they provide services that measure night light intensity and provide alternative macroeconomic data for economies globally. They’ve even expanded their coverage to include the energy and environmental sectors with tools that track ecological changes at any location over time.

As the availability of Earth Observation imagery is increasing, we can get meaningful results by connecting geospatial intelligence to ESG factors. One such example is a Swiss tech company called Picterra; with the help of machine learning, satellite and drone imagery, this cloud-based platform is working to track innumerable ESG metrics — starting from potential infrastructure leaks and pollution to farmworker and supply-chain conditions.

Co-creating the future of ESG compliance

As the pressure from investors, consumers and governments continues to grow, one question remains: is your company prepared for the onset of mandatory ESG reporting? From Singapore to the EU and US, this new reality is swiftly taking shape.

That’s why, in the burgeoning world of ESG consultancy, FinTech innovation provides a much-needed holistic and cost-effective approach. Both legacy companies looking for in-house products and startups acting as a third-party that work on ESG data solutions can start finding the answers they need now. The best solutions often derive from a combination of industry-leading technology and FinTech product developers that know how to apply these powerful tools with a user-centric and design thinking approach.

At Star, our team of digital finance experts collaborates with its partners on next-gen ESG strategy, bringing together leading data scientists and software architects. As a team, they innovate on efficient data and content management, reporting tools, dashboards and automation — all built into customized software tools and cloud platforms. Find out what steps you can take now to transform your idea into a tangible product.