A lot has been written about Gen Z relationships, or their lack of relationships with sex, drugs and rock and roll, but what about that other corrupting vice . . . money?

Understanding this youthful generation’s views on finances is integral for any brand that provides FinTech software or apps. Before delving into the details, let’s begin by clarifying who exactly is Gen Z.

Defining Generation Z

While there is some argument on dates, this generation generally includes those born between 1995 and 2015.

Where do they bank? It probably comes as no surprise that the generation that grew up with the internet are mobile-first bankers. A whopping 70% of Gen Z checks their bank balance on their phones every day. However, something you might find surprising is that they are also the largest users of branches, with a particular fondness for locations offering free drinks or snacks.

Furthermore, Gen Z has a strong affinity for saving. Over two-thirds believe saving early and often is key to monetary success. Impressively, over a third already have £1,000 in savings.

How do they buy? The data shows this group is increasingly cost-conscious, with price being the number one consideration when shopping.

In a recent couponing survey, almost all Gen Z respondents said that they search for coupons before making a purchase. Services like Honey are automating this process with an online browser plugin for user convenience.

This generation is also much more likely to use a digital wallet and popular Peer-2-Peer payment services, such as Venmo and Zelle. Other Fintech software and apps providers must also step up to meet Gen Z needs if they want to be successful in the long run.

What does this mean for traditional providers?

For traditional financial service providers, these characteristics are problematic. It’s not just because of weaker mobile apps and closing branches, either.

There is a larger problem related to traditional offerings. Typically, conventional banking products have low savings rates and high overdraft charges that are unlikely to be attractive to the younger segment.

This begs the question: How do you create FinTech apps and software that appeals to Generation Z?

4 essentials of a product for Gen Z?

Simplicity

Learning the finance basics isn’t easy for most people. From budgeting to savings, there are a lot of concepts to grasp, not to mention the abbreviations and variety of product options, including ETFs, ESGs, and ISAs.

The services that work the best are those that cut through this complexity to deliver the consumer their desired outcomes. A great example from a few years back was the Level Money app (unfortunately no longer available).

This app asked the user three simple questions to onboard them. That followed with a clear representation of what this individual could spend today, this week, and this month to hit their savings goals.

Personalization of FinTech software

Big Data and Artificial Intelligence create a range of opportunities for attracting new customers. They seamlessly create hyper-personalized insights for GenZ customers to achieve their goals. The agility of new market entrants is radically outpacing the progress of large banks, with 94% of large banking firms failing to deliver on personalization.

Interesting companies to watch in this space include Empower.me, which offers personalised savings insights and 1-2-1 chats with a coach. Also noteworthy is the French rewards startup Paylead.

Financial Education

A recent UK study found that 9 out of 10 people felt undereducated in financial matters. While financial literacy has long been the responsibility of parents, several FinTech companies are helping educate users to help fill the knowledge gap. In addition to the altruistic benefits, providing education builds trust with customers and encourages them to use your service over a competitor.

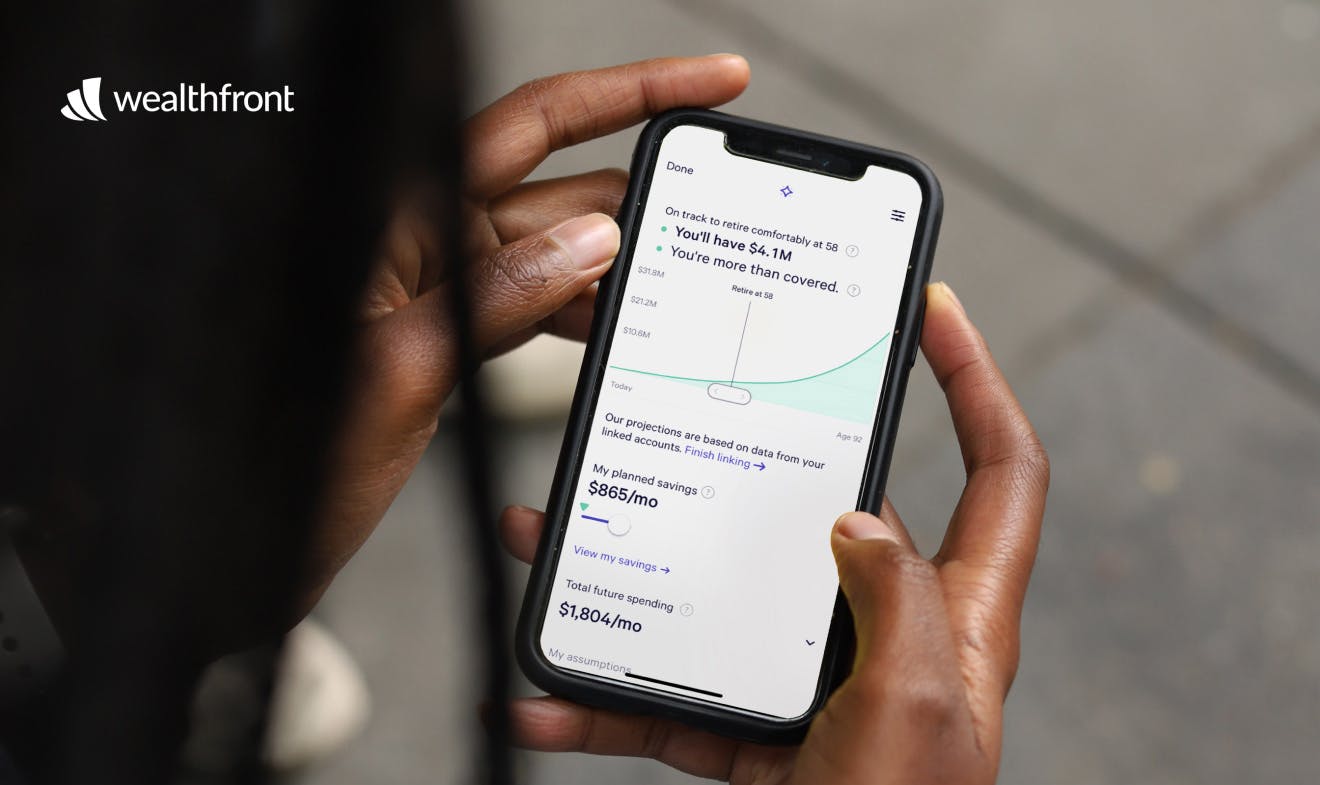

Leaders in this space include the pension aggregator, PensionsBee, and neobanks, such as Monzo and Starling. Robo-advisors, including Betterment and Wealthfront, also effectively help customers understand their products and investing as a whole.

FinTech software must connect with relevant lifestyle brands

Another approach getting a lot of attention lately is the partnerships between financial services brands and consumer lifestyle brands. In 2019, for example, the global investment firm Goldman Sachs teamed up with Apple to launch the Apple Credit card.

At the time of writing, it was the most successful credit card launch ever. You can find more big stories of 2019 here.

As another example, Mox, a new challenger bank from Standard Chartered, partners with PCCW, HKT, and Trip.com to offer a range of telecom, entertainment and travel experiences.

These partnerships can offer users fun options, but their benefits go far beyond that. The collaborations can also reduce administrative work, as services like Emma demonstrate well by helping users avoid unwanted subscriptions.

Concluding words

Looking ahead, one thing is certain. Financial services will continue to evolve.

As new generations with different priorities emerge, the race will be on for FinTech software and app providers to create products and services that meet users’ changing needs. Understanding how to do so effectively for Generation Z and other segments of the population is crucial for the success of any business.