Trust has never been needed so much in FinTech. Gaining it with consumers, regulators and partners may seem daunting. But it doesn’t have to be! At Star, we know there is a massive opportunity to harness FinTech to build trust and change people’s lives. This begins with a renewed focus on every FinTech product development process stage. From user experience to MVP creation, let’s take a closer look at the holistic, full-cycle development that delivers FinTech products people trust.

Trusted FinTech products: the linchpin for your growth

When most of us in the industry think of FinTech, technologies like open banking, digital ID and Big Data likely come to mind. These tools facilitate the world of new opportunities that come with any finance digital transformation. But getting people to try out the FinTech products fueled by these innovations requires trust.

Yolt, one of the EU’s leading providers of open banking solutions, recently announced market research results. They found that “23 % of [1000] respondents thought that open banking was the ability to take a customer’s data without consent.”

Let that sink in. Consider how fundamental open banking is to digital financial services right now – and that it’s a relatively simple technology to understand. Now zoom out for a moment. We are still amid the massive social, political and economic consequences from the aftermath of the pandemic while being on the brink of a pending global financial crisis. Combine this with the dizzying array of new technologies, especially in FinTech, hitting the scene, and it’s amazing that industry adoption rates are as high as they are.

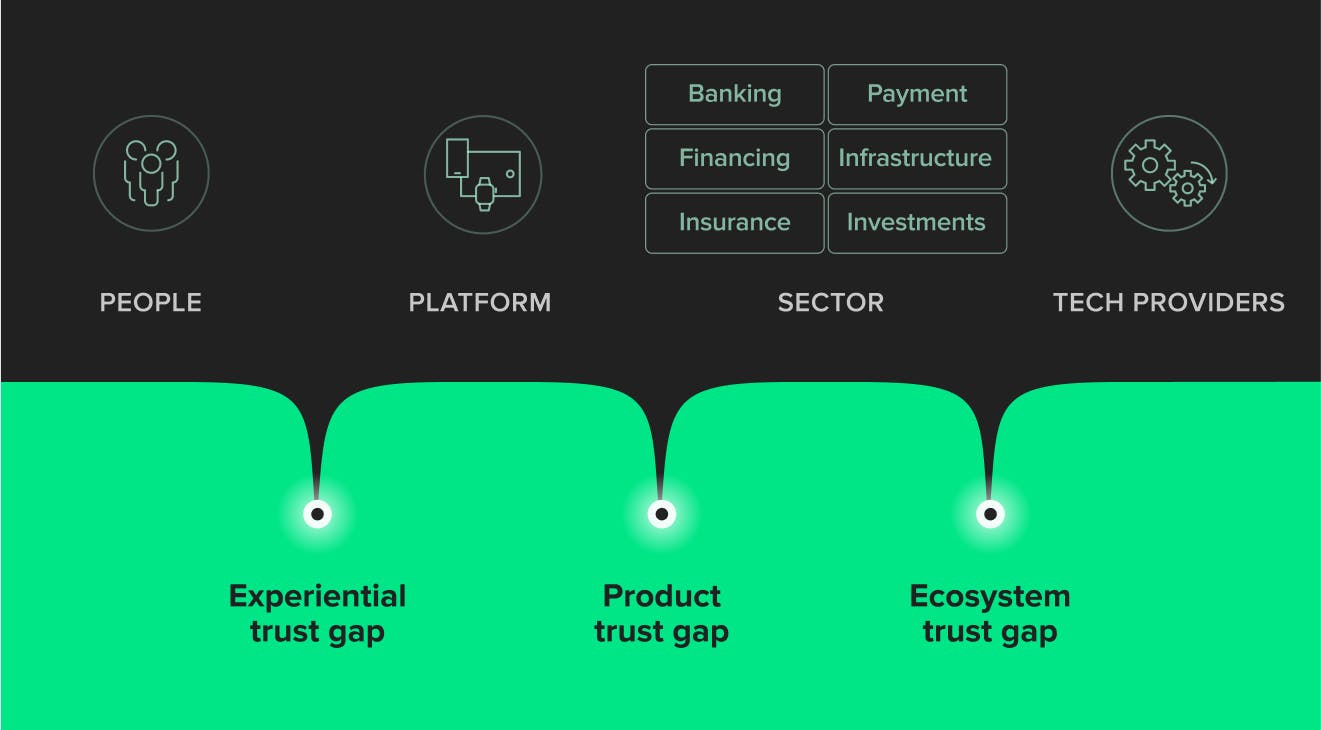

For this reason, it’s vital to approach FinTech products holistically. Trust gaps can occur at every level in the digital finance ecosystem between people and platforms, platforms and sectors, and sectors and tech providers.

As you design your FinTech solution, you need to ask yourself these fundamental questions:

- Experiential trust gap: are you creating user experiences that resonate with people on an emotional and rational level?

- Product trust gap: does your FinTech product and data choice feature services that are meaningful?

- Ecosystem trust gap: how do you signal trust and ensure your technology partners add credibility and functionality to your offering?

The bottom line is that to avoid trust gaps in FinTech products, you must truly empathize with your users and match technology to their needs.

Merging trust into the FinTech product development process

As we all know well, money is a sensitive topic for most people. People can, therefore, be extra conservative when they aren’t familiar a FinTech application or brand. To minimize this risk, trust should be a foundational building block for each stage of FinTech product development.

The main stages of FinTech product development

- Business analysis and MVP creation. Creating a successful and meaningful FinTech product that people want first requires deep market analytics. That means understanding users’ real needs and pain points, market challenges and the company’s operational capacity – and then creating a trust-centric product strategy based on that. Star’s four FinTech trust pillars are also a great guide for developing your MVP and strategy analysis, the stress test for usability and finally, for scaling.

- User experience. Building trust through design is foundational to a successful FinTech product. This involves things like clear product navigation, no hidden costs, and payments in one click – but we also recommend these 6 FinTech design principles to ensure user-centric growth.

- Key FinTech product features. We detail this in the next section, but this really means listening to end-users and their fast-changing demands to match technology to their needs. This also involves being transparent and providing inclusive tools – direct feedback lines, chatbots and customer support platforms.

- FinTech product security. Since financial services deal directly with money and intimate personal information, every Fintech brand faces the hurdle of getting customers to trust its app. That’s why integrating cutting-edge security protocols and authentication measures is paramount. A 2019 Report by Aite Group indicates that 97% of financial services lack proper code protection, while 90% of apps leave important data in other apps, showing huge vulnerabilities that can quickly damage trust. Another way to fast-track legitimacy and even security is to partner with firms already trusted by consumers.

Download the report

Get complete insights on trust gaps. Download the “Inspiring trust in digital finance experiences” report to learn more.

Key features of FinTech products that drive trust

Now let’s flesh out one of the integral steps for any financial technology company: key features development. These underlying drivers encourage people to use FinTech products and have become indispensable in building trust with users after COVID-19:

- Intuitive interface. For today’s FinTech service providers, step one should always be aimed at eliminating any form of complexity in accessing FinTech services. Most users expect a compelling and easy-to-use interface with fast sign-in from any app. Besides, an excellent UI can be the deciding factor in making your FinTech app stand out from the competition.

- Onboarding. It’s equally critical to define a strategic way for communicating how your app, and brand at large, can immediately improve your customer’s time, work and life. And great UX is the answer to this. Not only does it jumpstart trust and user retention but also helps dramatically decrease fraud.

- Payment gateways. Your app also shouldn’t complicate basic financial operations, including money transfers and digital payments. To increase customer loyalty, the app should allow users to choose from multiple payment gateways, pay by link and alternative payments such as Buy Now Pay Later. However, remember not to compromise security in favor of convenience.

- Personalized experience. People love it when an app is built around their needs. At the very least, you should allow users to filter the information they receive, such as push notifications. But, in terms of new opportunities, Big data and Artificial Intelligence tools provide the most transformative abilities for hyper-personalized apps. Not only does it drive user engagement and better involvement, but it’s a key way to attract Gen Z customers.

- User management. Some types of services benefit from multi-user support. For example, finance management apps are often used by several family members. Additionally, larger companies want their employees to share a single account for easier monitoring.

- Communication tools. Fintech companies can immediately improve their customer satisfaction rate with any number of communication tools. Whether by the traditional means of phone and email support or with online chats and robo-advisors, it’s important to find what matches the users’ and company’s needs best. AI-powered chatbots, in particular, are bringing promising options to elevate user experience while reducing costs. The 2017 Juniper Research Report suggests that chatbots will help companies save over $8 billion annually by 2022.

- Cybersecurity. We can’t stress this point enough because it covers everything from third-party integrations to payments. Users prefer transparency with in-app certificates and third-party integrations. We also recommend these three essential payment security strategies: password protection, two-factor authentication, and enhanced Know your Customer (KYC) technologies.

- Add-on plugins. You can include other third-party services in your app. For example, remittance software will become more convenient if it’ll work with food ordering and finance management apps.

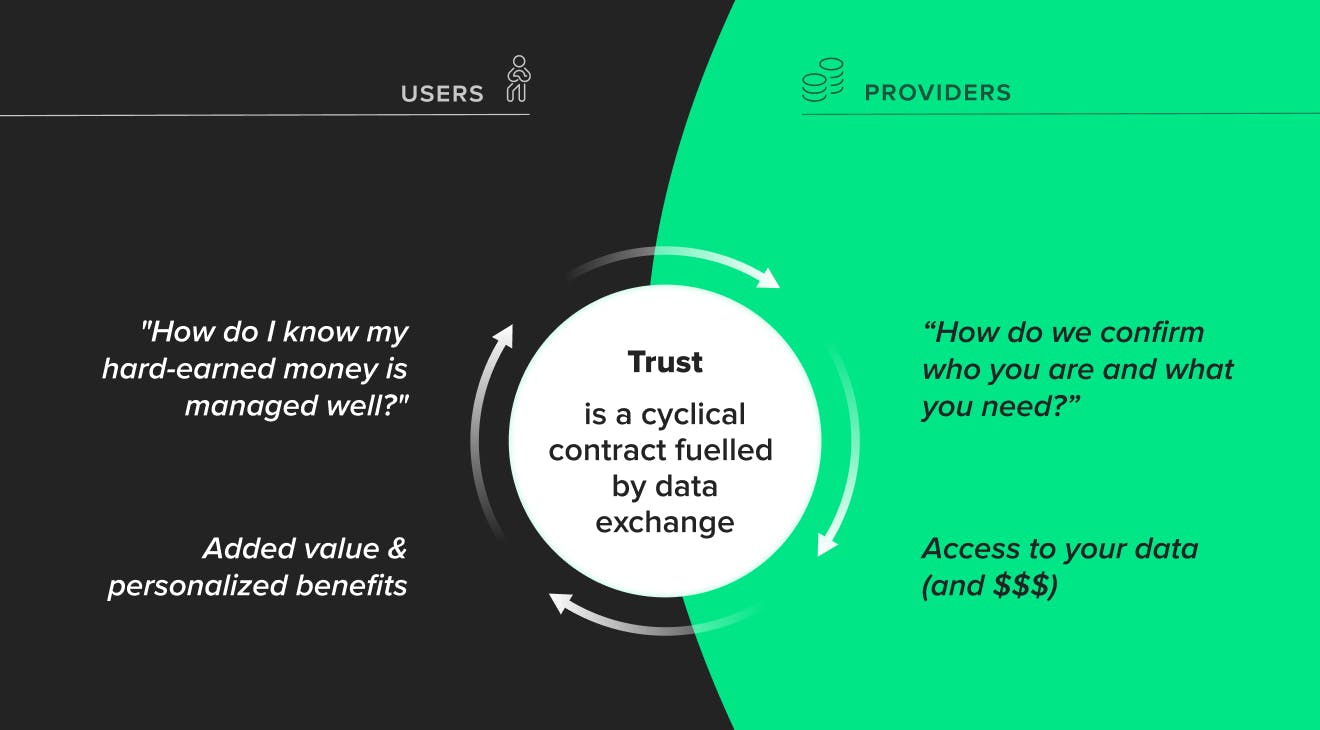

Trust is a two-way street between providers and users of FinTech products

During our research and analysis here at Star, we’ve concluded that trust in FinTech is a two-way street. Digital financial service providers and consumers must work together to grow it and quickly turn into a virtuous cycle that deepens relationships and prevents churn. This trust is cyclical and fueled by the sharing of data.

For providers, customers need to verify their identity and provide access to their data and money. When customers hand over these keys, they must know providers – from debit cards to bank accounts and even wealth management – will keep these assets safe and effectively manage them.

While this may seem simple, it takes consciousness, especially on the providers’ side, to demonstrate value and credibility in understandable ways to consumers. By succeeding in doing this, consumers will be more open to sharing even more data and using more services. This trust fans accordingly as these FinTech companies grow and partner with tech and system providers further.

We recently had some conversations on trust with Mastercard, Lightning Social Ventures, and Passbase on this seminal issue. Passbase’s path to growth perfectly embodies these principles though at the system level. As an API provider of identity verification services, they are on the frontlines of making digital finance more secure for everyone.

However, despite the strength of their core offering, they were also new entrants. So as much as they’d like to have won a massive client from the start, they knew they had to build their reputation and demonstrate their value. They began by working with founding teams of similar size to themselves. With time, they have been able to take on larger and larger partners.

They’ve also rolled out new services built through the experiences gained with these earlier clients. This is how trust in FinTech can organically grow, and this same approach applies no matter who you’re interacting with. Provide understandable value, get to know your users better as you evolve and grow over time.

Finally, be aware this process of growing trust doesn’t have to take decades. Passbase, for example, was only founded in 2018! You can do the same. Unpack what you need to know to create trust-driven FinTech product. We’ve only scratched the surface of growing trust in FinTech. Download the complete “Inspiring trust in digital finance experiences” to discover:

- INSIGHTS: learn from leading firms like Mastercard, Yapily and Star’s FinTech team.

- FRAMEWORK: build trust pillars to form a solid foundation for your digital finance solution.

- INSPIRATION: discover cross-sector concepts to envision new ways of embedding trust into Fintech experiences.

Star: your end-to-end partner for FinTech product development success

Star has 14+ years of delivering FinTech, digital finance and cross-sector innovation. We blend best-in-class technology, cross-sector experience and deep industry knowledge to build breakthrough yet intuitive and familiar experiences that resonate deeply with users across four dedicated service lines: FinTech Builder, FinTech Digital Ventures, Digital Finance Experience, Big Data for FinTech.

See our capabilities in action and dive into this case study about our partnership with Expensify. We purpose-built a cross-functional engineering team to create a new platform and approach to screen scraping while augmenting Expensify’s internal department to support back-end development and accelerate finance digital transformation. From ideation through launch, explore how Star can help you achieve FinTech success.