FinTech companies are native to the digital arena, agile, have efficient cost structures and, vitally, have high customer loyalty rates. And this last point is of critical importance for all FinTech & digital finance providers looking to thrive in the ecosystem. Building trust through design is foundational for enduring trust and success.

This was the main theme for our participation at this year’s Munich Creative Business Week (MCBW). For the fourth year in a row, Star’s Munich Team hosted an event at this influential gathering of German and international design, business, finance and multi-industry professionals.

In “The FinTech revolution: UX as a key driver for establishing trust,” Star’s Design Director Adrian Waibel describes how industry players could harness frictionless and meaningful user experiences to grow long-term trust and engagement. He also detailed design-driven strategies businesses of all types should start embracing now to maximize their potential in the digital finance world.

From here, Iven Kurz, CEO of German’s first free-of-charge robo-advisor, Evergreen GmbH, presented key strategies new entrants, as well as legacy FS players, can leverage to grow and enhance trust in FinTech products and solutions.

Whether you’re in FinTech, financial services or any digitally-enabled industry, these user-centric growth insights apply to you.

Watch the webinar and get a sneak preview of the fascinating ideas these two experts shared below.

A landscape transformed

People will always care about money. But be aware that the time of chasing the next big dividend for shareholders is over. Customers want to be a part of something more meaningful and bigger.

This idea strongly illustrates how FinTech firms have managed such remarkable growth over the past decade. Incumbents need to wake up and start paying attention. Likewise, if you’re a new entrant and looking to disrupt finance, these lessons apply to you.

The landscape has radically evolved over the past 10-15 years. While there are many reasons for this, here are three major change drivers you should start paying attention to:

- A rising generation of digitally-native customers with high expectations

- The lingering impact of the 2008 Financial Crisis and deeply rooted distrust against the banking industry

- Payment Services Directive (PSD) regulations which have increased pan-European competition and participation while increasing the rights of payment providers and users, especially in areas of data accessibility

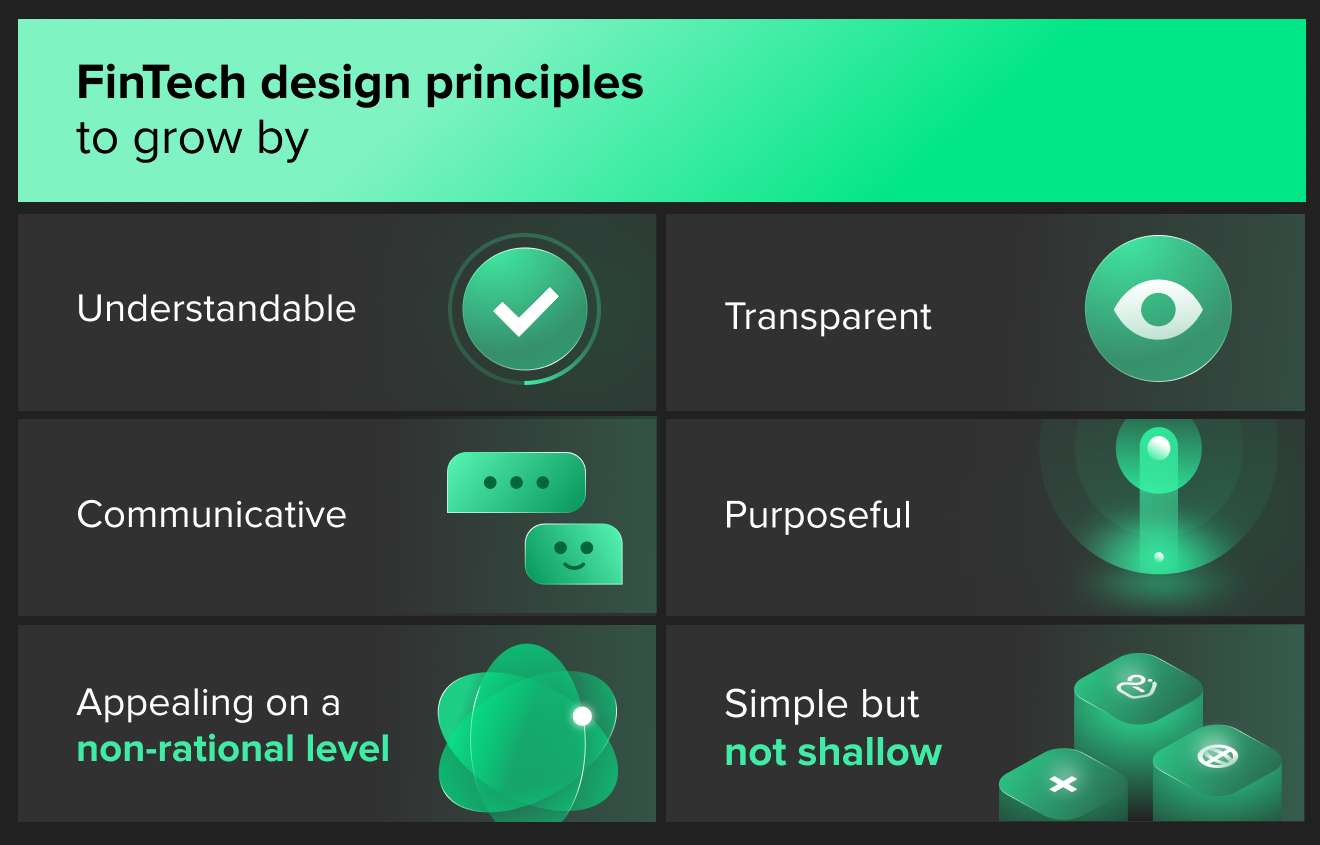

FinTech design principles to grow by

To distinguish your FinTech solution and deliver user-centric value, start implementing these six integral FinTech UX principles:

Watch the webinar now to get a concise breakdown of each of these key focus points, along with examples from leading players in the ecosystem.

More expert-driven FinTech strategies to discover

We’ve only scratched the surface of the key FinTech topics covered during the session. Adrian Waibel shared more actionable strategies while Iven Kurz dived into the trust equation in FinTech.

The race is far from over. We are only at the beginning. Leverage these expert insights and define your success in 2021 and beyond.