For banks, it’s time to wave goodbye to brick and mortar. The new meeting ground for them and many other financial service providers is the metaverse. By delivering impactful, accessible and personalized service-driven experiences in the programmable world, they have the opportunity to resurrect the strong customer relationships of the pre-digital era.

Moreover, the metaverse is more than just a place for banks to conduct customer interactions. Goldman Sachs predicts it’s an $8 trillion opportunity fueled by digital assets and novel value exchange models. And, you don't need to look far into some distant sci-fi future. Its roots are already here. According to the World Bank, the digital economy is equivalent to 15% of the global GDP, growing 2.5 times faster than the global GDP during the previous 15 years.

The metaverse and the digital economy are closely linked, and this connection will be deepened and defined more tangibly over the next decade. We already know that the metaverse is the evolution of the internet, and major banks and financial institutions have already begun shaping their footprint in it.

As capabilities, use cases and technologies emerge, we'll see a blending of digital and physical worlds across realities and business models. The implications are vast and apply to all business aspects, from consumer relationships and employee training to virtual property and real estate – all modulated across today's most transformative technologies such as AI, extended reality, blockchain, edge technologies and more.

Banks are in a powerful position to broker, usher in and make sense of all this change for their customers. By 2026, 25% of people will spend at least one hour per day in the metaverse – and this number doesn't consider people already involved in metaverse adjacent activities such as video games and other forms of immersive entertainment.

Now is a pivotal moment for banks to leverage their size, scale and customer base to make a definitive move that will not only set them up for success in the metaverse future but better prepare them to deliver the personalized, customer-centric experiences that consumers demand now.

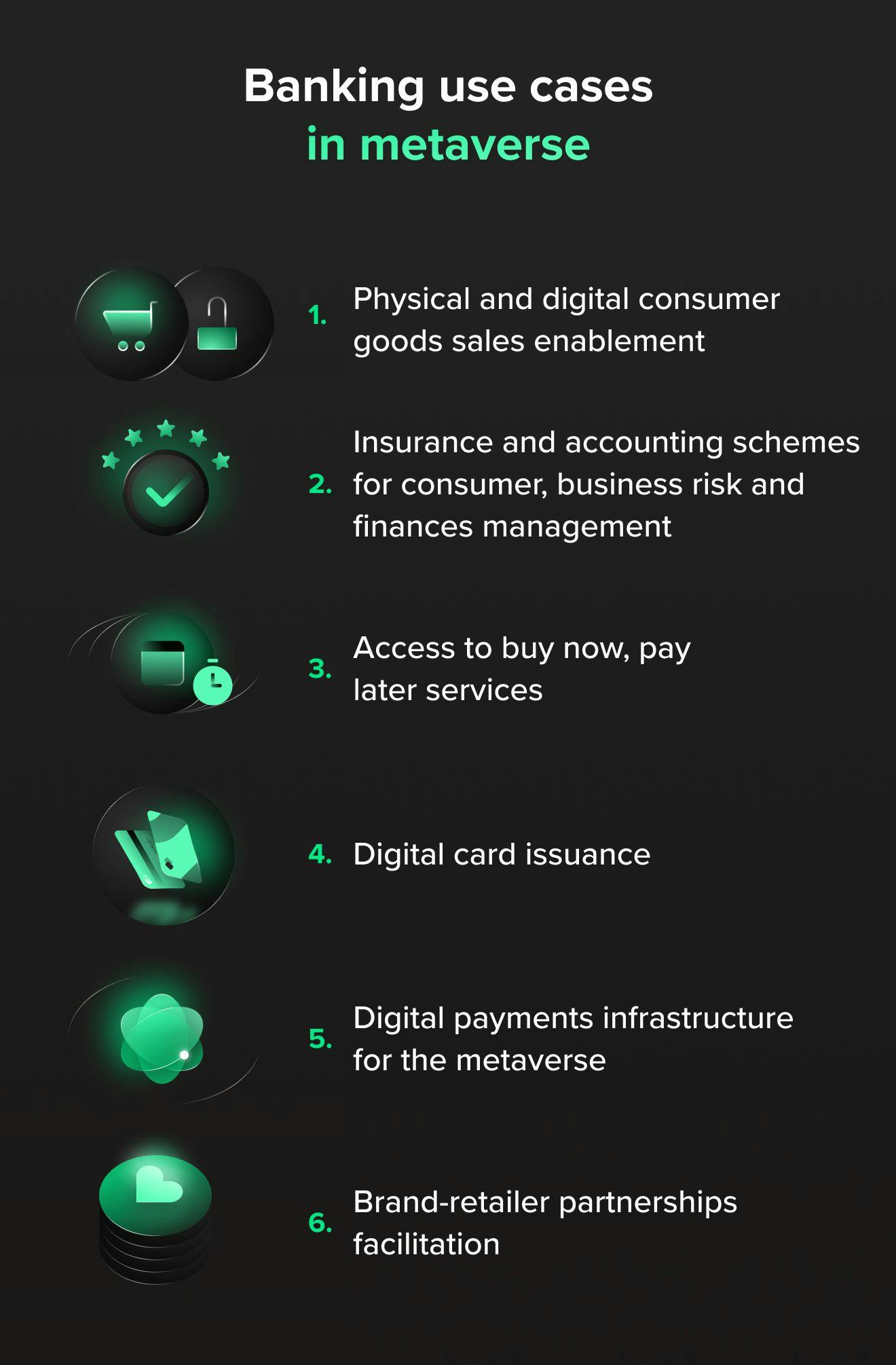

The metaverse is a fundamental technological breakthrough. Whether you are a bank, legacy financial service provider, payments processor or anywhere in the FinTech ecosystem, focus on these opportunities to capture and deliver value in the programmable world.

The metaverse impact on banking

The central tenant for all players within the financial ecosystem in the metaverse: if the metaverse replicates the world digitally, people will need to transact digitally. Banks and FinTechs alike, both in the form of challengers and incumbents, will be the major drivers of financial transactions in the metaverse.

Volodymyr Bort

Head of Business Analysis at Star

Banks have faced stiff competition from FinTech and technology companies over the past few years. These newer companies can move quickly, rapidly capture financial technology market share and have taken sizable chunks out of traditional revenue sources such as account fees and even stalwart revenue earners such as credit and lending.

Banks must not be caught off guard as more transactions move into the metaverse. Most banks have closed the gap on the technology and user experiences that their lighter FinTech counterparts offer.

However, they must ensure they are not left behind but embrace this opportunity to become central future platforms for fueling e-commerce. We are already seeing this happen with some of the major players.

South Korea's KB Kookmin Bank has already opened a virtual bank in the metaverse offering one-on-one interactions with advisors and access to personalized financial information. Meanwhile, JPMorgan has opened metaverse banking services, including a virtual lounge where they conduct the activities such as foreign exchange and financial asset creation as they would in physical branches. HSBC is another provider seeing the benefits of the metaverse — investing in a plot of land in The Sandbox metaverse, where they will eventually engage with users interested in gaming and sports.

While all vary in function, these examples serve as a reminder of the way metaverse software is used to create innovative brand experiences with remarkable revenue-driving potential.

Key focus areas to start your metaverse banking journey

It's critical to remember that there is no one fixed metaverse. Rather, there will be a series of interconnected metaverses, many of which banks are perfectly suited to serve:

Break down data silos and enable centralized data-linking

Many banks still rely on legacy software built without integration in mind. For example, many ATMs were still running Windows XP until just a few years ago. These older systems keep user financial data in siloes that are difficult to access outside the institution.

Customers expect their money to be available instantly. They don’t want to wait for ACH transfers and have seen how immediately services like Venmo, Paypal and Coinbase can make exchanging money.

While ecosystem integrators like Plaid are helping solve some of these issues, for banks to thrive in the metaverse, they need to make data even more accessible and create better digital experiences through centralized data-linking systems. With them, they can create a unified platform that pulls the spectrum of customer financial data, assembling it onto a unified platform that can be used for insights and opportunities to develop value-add financial products.

Legacy system modernization is an incremental and complex process involving the integration of cloud and mobile technologies, cybersecurity, analytics and novel AR/VR technologies. To pursue these goals, banks have two options – partner with vendors or build.

The right strategy depends on internal competencies, resources and how far along you are in your digital transformation journey. Regardless, your priority must be on securely linking disparate data to create personalized, flexible and on-demand customer experiences that work just as well in the programmable world as in the real one.

Consider “meta-like” experiences

As metaverse environments continue to coalesce and evolve, we see an immediate opportunity for banks to offer "meta-like" services to enhance customer experience and dip their toes in metaverse words.

The metaverse is a blending of physical and digital experiences. One relatively simple example is video calls. During the pandemic, video calls were essential for wealth managers and everybody in the finance industry to conduct meetings despite health and safety restrictions. This lightweight form of the metaverse was key for enhancing expandability, saving time and building connections.

Likewise, while you might not be ready to throw a grand gala in Decentraland, there are numerous ways to leverage financial technology to improve and personalize the banking experience because the metaverse is just as much about the bleeding edge devices of tomorrow as the proven tech of yesterday – online platforms, messaging and digital services are just a handful of examples.

Remember, the winner isn’t necessarily the farthest along

You don’t have to be farthest in the metaverse race. It's essential to consider your FinTech strategy in the metaverse continuum. The winners aren't necessarily those who are farthest along but those who have found ways to create value and strengthen consumer relationships to cement themselves as a central digital platform for financial transactions, especially in these chaotic and thrilling transition years in which metaverse technology moves away from the hype and into the indispensable.

Returning to "meta-like" experiences, however, we can see how much has already happened. For example, 61% of borrowers used an online application for their mortgage in 2020. This number will continue to grow as digital loans simultaneously skyrocket in upcoming years (This year even marked the TerraZero Technologies first-ever metaverse mortgage for digital real estate).

Your north star should be creating a fully-featured financial data and transaction management solution with add-on services that are packaged in user-friendly technology. This will fuel enduring user adoption and be among the most competitive and lucrative segments of the metaverse – especially as FinTech companies leverage blockchain technology in unimaginable ways.

Be metaverse-ready: 5 steps to take now

The metaverse is in its early stage. Like the internet, which continuously evolves, it's hard to know what it will look like in 5 or even 10 years. This story isn’t entirely new, however. A similar familiar journey for banks was mobile banking in the previous decade and the opportunities it has since created.

Begin by analyzing the FinTech market and technology landscape to understand where you stand and identify potential opportunities and partners. Take this time also to evaluate your technological readiness. Financial institutions, especially banks, should be cloud-native and shift quickly from on-premise solutions to strengthen security and reduce both risks and costs of physical infrastructure.

Shifting to the cloud enables easy scaling, prevents dependence on one location/region and moves you closer to your customers – in the digital world.

It's not unimaginable that all transaction information will be decentralized and enabled by blockchain technology, so build in-house competencies now. This is especially important as crypto gains popularity. You need the infrastructure to support transactions and exchanges before it becomes a daily payment method in the real world and the metaverse. Plus, by expanding into crypto, you tap into a new segment of opportunities (that’s why we've seen companies like Revolut even entering the area.)

Farther afield, we foresee transformations to traditional credit cards rapidly happening. With digital wallets, BNPL, and more payments shifting to NFC technology, the necessity of physical cards will continue to drop. Holding a credit card is more or less a way of identifying your persona, and with the rise of biometric security systems, they may head out sooner than people realize.

Advantages like these are important not only for banks but other FinTech ecosystem builders. Either way, pay attention to your KYC processes and make sure you have the latest technology solutions available as more physical world payments shift to digital and happen in the metaverse.

Last but not least, incumbent banks should be leveraging their scale. Start testing programs now. Big banks can spread fixed costs of branches and marketing across many customers. This also allows them to offer cheaper products. Moreover, since the efficacy of payment platforms scales with the size of the network, banks are well-positioned to experiment and implement metaverse initiatives, especially by testing virtual marketplaces and AR/VR-driven immersive experiences that can improve customer experience and create new value-add opportunities.

Be the metaverse virtual bank of the future while strengthening your growth position today

The banking industry is well-positioned to lead the metaverse economy as an enabler and facilitator of service and a value creator in its own right. This is the opportunity for banks to deliver personalized and accessible financial services that will renew the strong emotional relationships characteristics people had with their banks during the pre-internet era.

Now is the pivotal moment for banks to make their move. Take the time to strategize, understand the business reality you'll inhabit and what the future might bring. If not, you could find yourself looking at the metaverse from the outside in.