Like so many digital aspects of FinTech services, the use of e-wallets has skyrocketed since the start of the COVID-19 pandemic.

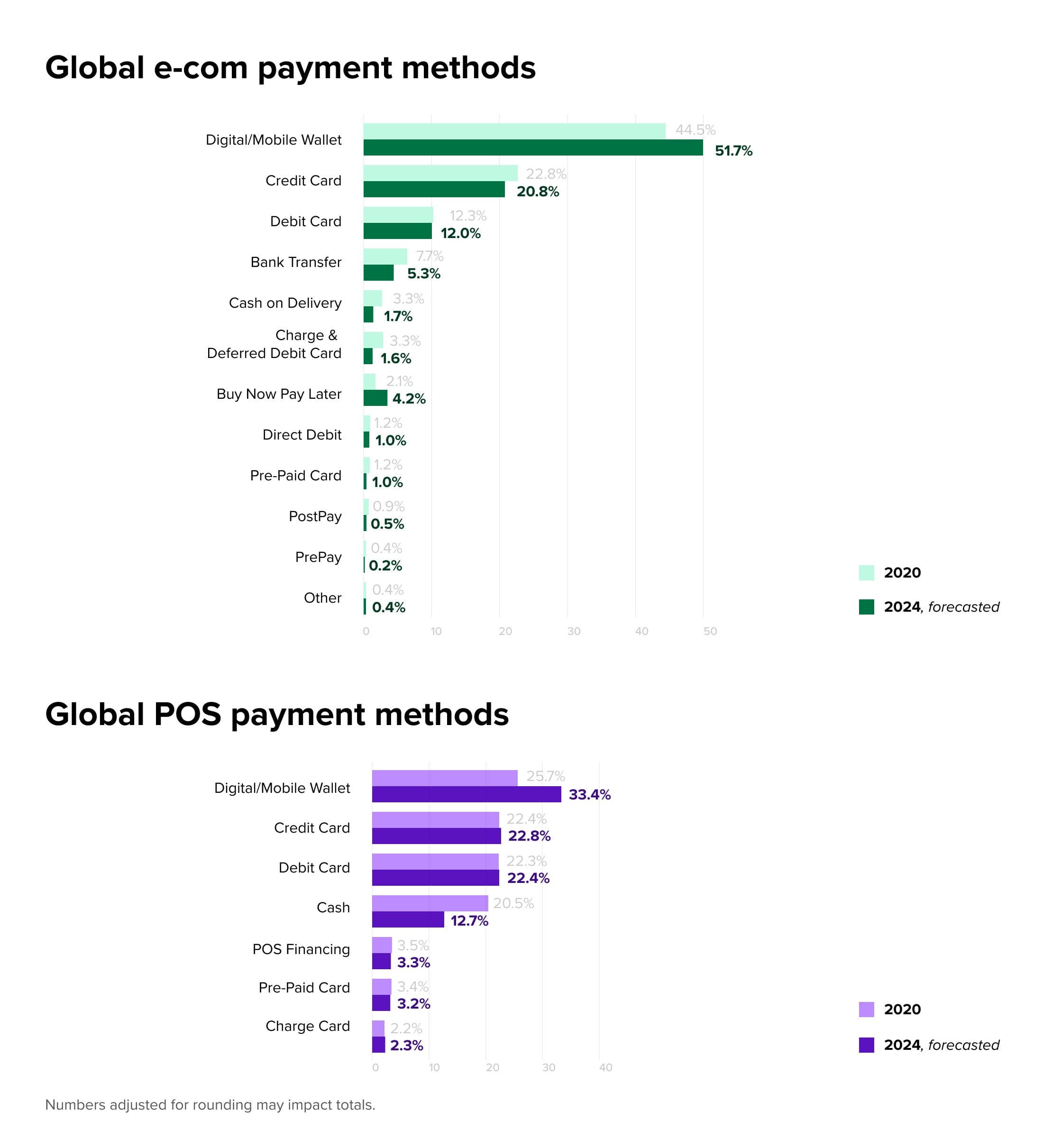

By 2020, digital wallets were already the top payment method used for both e-commerce (44.5%) and point-of-sale (POS) (25.7%) payments. This outnumbers all other forms of payments including traditional methods like credit cards, debit cards, bank transfers and cash, and its dominance is only expected to rise in the next five to ten years.

Source: The Global Payments Report by FIS

In this deep-dive piece, we’ll take a closer look at the asset types and payment methods for e-wallets and how they work. Most importantly, we’ll highlight the endless benefits from developing e-wallets that consumers, businesses and PayTechs are buying into on a daily basis.

E-wallets: asset types and payment methods

E-wallets are combinations of secure storage and payment acceptance gateways that are used for online transactions with a computer or smartphone. In other words, they provide the same service as a debit or credit card. But, instead of plastic, they are fully digital and eliminate the need to carry a physical wallet.

But how does this business model work for merchants, startups or FinTechs that are trying to enter the market? This all depends on the e-wallet asset model and revenue structure that is chosen. The main asset types allow people to store their funds and be sure that their money is safe. Let’s break these down:

- Closed wallet applications: This model stores funds for users and allows transactions exclusively with the issuer of the wallet, such as Amazon Pay. Any money from returns, refunds or cancellations is also converted and stored in the wallet. Companies that sell products and/or services have the best opportunities with a closed wallet app, with some businesses able to earn a small interest on the money within the wallet.

- Semi-closed wallet: For both merchants and users, this option offers a bit more freedom by allowing consumers to complete transactions at pre-identified stores and locations, such as PayPal. This platform is a centralized web storage of e-money which is accepted for both offline and online purchases. This allows these platforms to have a form of e-money license and can emit this e-money into virtual wallets that are managed centrally by PayPal.

- Open wallet: Typically developed by banks or institutions partnered with banks, this is often a simple and secure model that is accepted at most retailers, such as Visa or Mastercard. It not only accomplishes all the features of a semi-closed wallet but also facilitates in online purchases, contactless in-store payments, and even the withdrawal of funds at select ATMs or other physical locations.

For anyone making an entrance into this ecosystem, identifying the best e-wallet asset model to develop is a critically important launch-off point. Engaging design principles in FinTech services can also be transformative to the end product. Whatever stage you’re at, make sure to perform enough market research and use this to establish a strong foundation for future growth.

Consider these 6 digital wallet strategies to unlock new opportunities

How and where? Storing money with e-wallets

All e-wallet development involves advanced encryption to safeguard that the user’s payment information never leaves his or her device, and many platforms feature additional security measures such as one-time PINs and two-factor authentication. But when it comes to storing your currency, there are two distinct structures at play:

1. Centralized system: Since e-wallets are entirely digital, there is always a backend financial system with a database that contains accounts and currencies. These databases are owned and operated by a central third party that retains ultimate authority when it comes to the e-wallet, account details, and all exchanges and transactions. Often, there is a single data center or multiple centers that are horizontally scaled, that holds information about accounts and the money stored.

Key examples: For this type of storage, neobanks and neofintech applications such as Revolut or N26 provide users with virtual wallets and the ability to store and access funds on their devices. With the smartphone app, users can view their personalized list of accounts or wallets but in reality, depending on company structure, these are backed up by one or multiple real bank accounts. More importantly, many of these centralized neobanks are getting their rise through innovative Bank Identification Number (BIN) sponsorships and Banking-as-a-Service (BaaS) options, a topic we talk about in depth on a FinTech-focused episode of Shine Podcast.

Source: Infographic by IJEAT

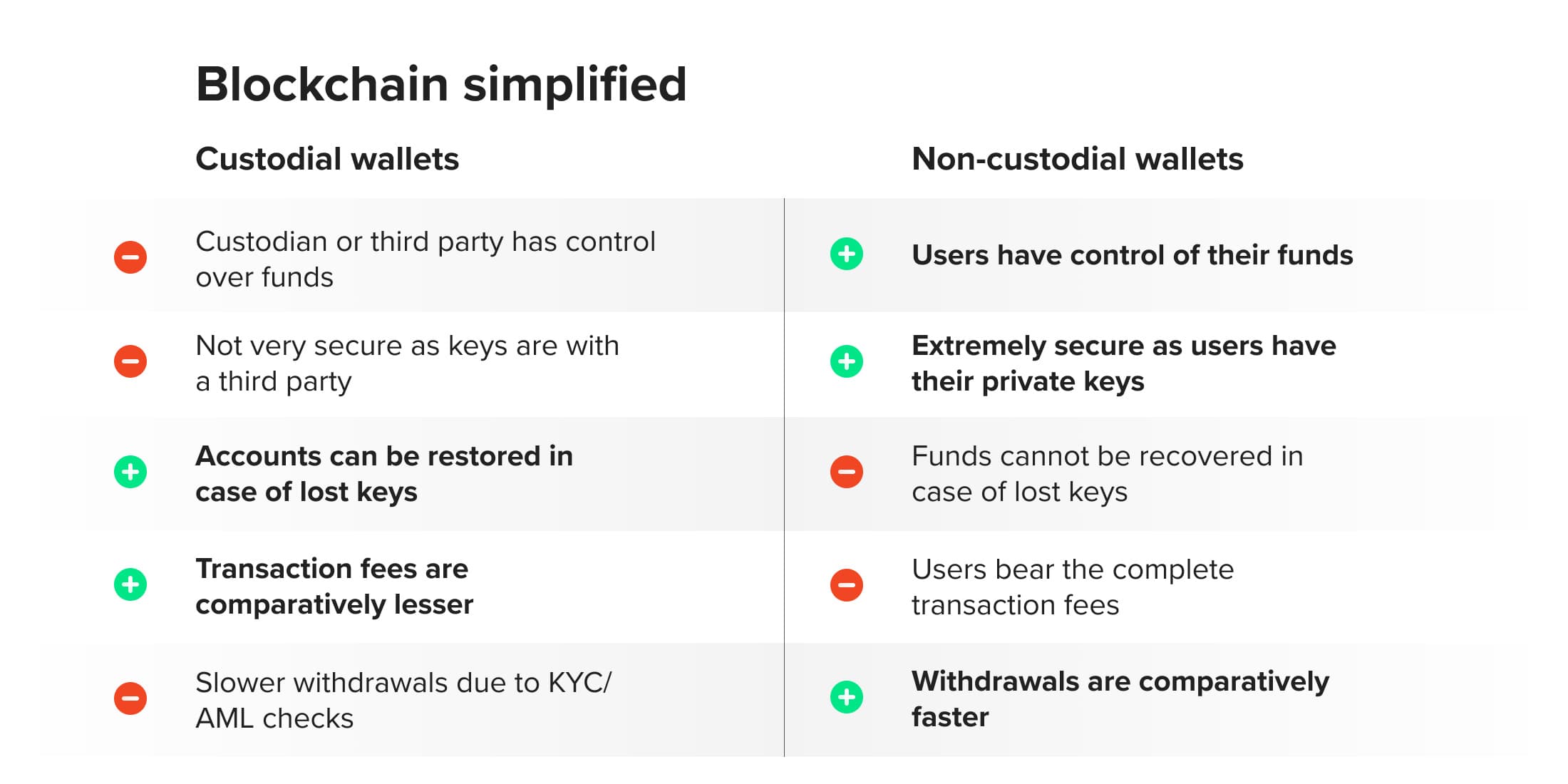

2. Decentralized system: Best known in the form of cryptocurrencies and blockchain technologies, these applications store money in a system where a distributed ledger of transactions made in cryptocurrencies are validated and maintained across multiple computers in a peer-to-peer network. Unlike its centralized alternative, these wallets provide the digital tools to access and use funds rather than holding the currencies in one central database. These technologies are exploding globally for the freedom they provide from outside regulatory forces, and the experts at Star are ready to start developing the latest blockchain applications based on personalized enterprise needs.

Key examples: Even within cryptocurrency and blockchain networks, there is an important distinction to remember: custodial versus non-custodial wallets. Custodial wallets essentially mean “centralized” platforms where funds are controlled by a third party. So, even though you can buy, sell and trade cryptocurrencies with platforms like PayPal and CoinBase, these are viewed as less secure in the crypto world. Non-custodial wallets are regarded as the epitome of the decentralized system for e-wallets because they provide users total control over their funds and only the user, not a third party, has access to private keys. The APIs for both Exodus and Ledger are great examples when looking at non-custodial wallets.

Source: Custodial wallet vs non-custodial wallets article

Next up: accessing your assets

With centralized and decentralized systems setting the foundation for all e-wallet platforms, banks, companies and third-party startups have developed a variety of secure and convenient ways for users to access their funds. This broad digital functionality has evolved more in recent years with:

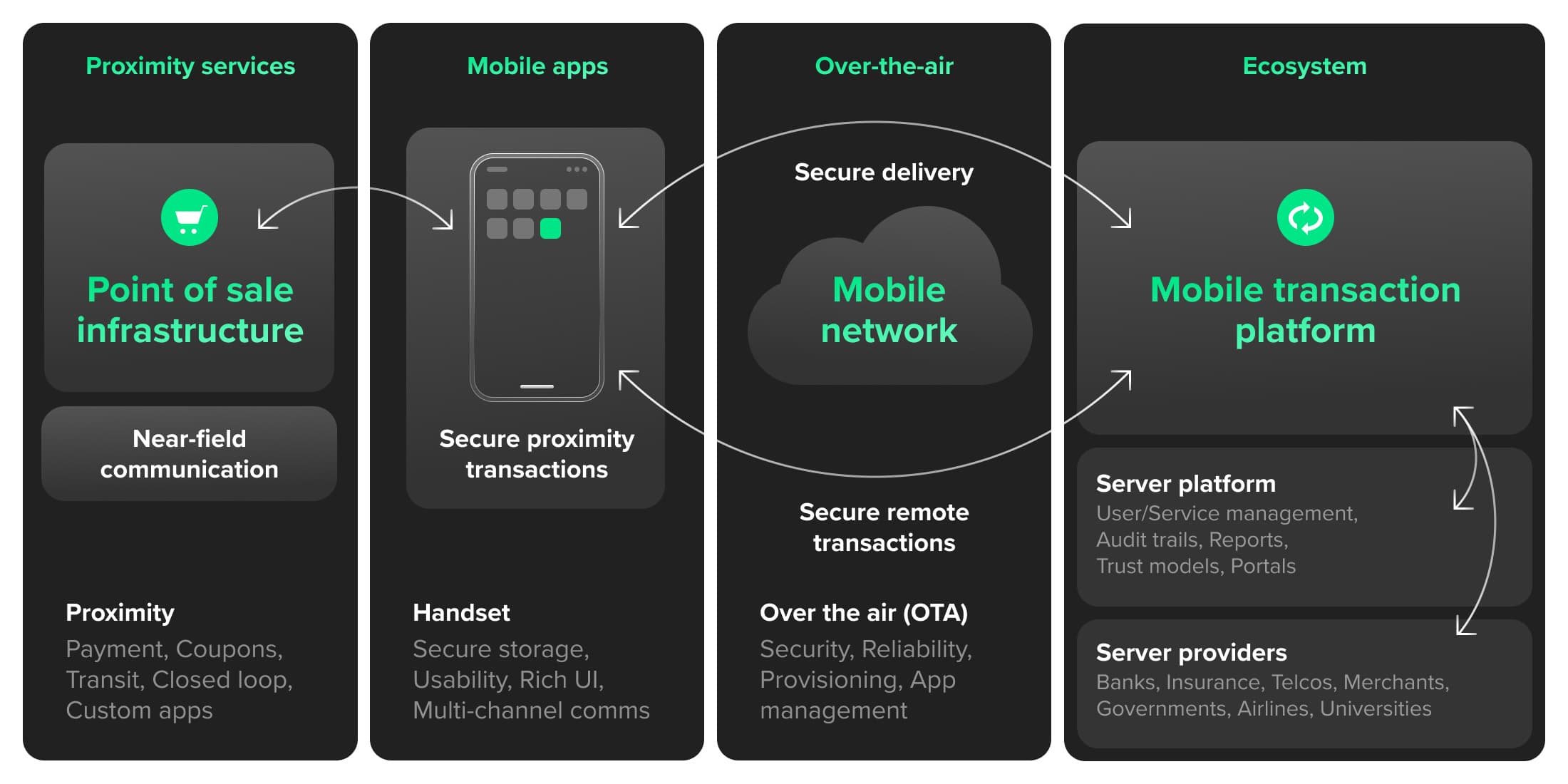

- Mobile-only access: These online and offline wallets are available on smartphone devices. Especially popular with neobanks and the biggest e-wallet platforms, these APIs allow users to add and manage accounts, transfer funds and make payments all from within the app. They can also be used for point-of-sale (POS) payments using smartphone near-field communication (NFC) technology.

- Web access: More common among big banks and legacy systems, these are websites or desktop applications that store all user assets and data. This online banking allows the customer to access and manage accounts and even provides e-wallet access.

- IoT access: These funds are available via Internet of Things (IoT) devices, from cars to watches, and allow for purchases directly from there. For example, Samsung's Family Hub refrigerator allows users to order groceries from the Groceries by MasterCard app while Whirlpool's Smart Dishwasher, when synced with an Amazon account, can estimate when detergent is running low and order a new one automatically.

- Crypto access: Typically in the form of a smartphone app, these wallets store users’ keys to access their cryptocurrencies and conduct transactions. While most are digital, some crypto wallets, including Ledger, come as physical hardware similar to a USB stick.

The proliferation of novel digital access and smart devices is making the e-wallet ecosystem more competitive and, as a result, pioneering new FinTech experiences that will disrupt the industry.

How e-wallets made our lives easier

From a user experience perspective, the increasing user adoption of e-wallets boils down to a few main factors:

- Bye-bye bank. Thanks to internet connectivity, e-wallets have largely eliminated the requirement for physical banks and enterprises in order for customers to open and maintain bank accounts. Instead, all of this can be organized quickly from the comfort of one’s home.

- The COVID-19 upswing. For obvious reasons, with strict lockdowns and COVID measures globally, many people increased their online payment habits. Salesforce’s Q3 2020 and 2021 Shopping Indexes illustrate this dramatic change best. Global online sales saw a colossal 63% growth year-on-year in Q3 2020, while they saw an additional 11% increase in Q3 2021 — meaning that online sales have quickly become the norm for many consumers.

- Oh-so-convenient. One of the biggest draws is the seamless ability to manage various financial accounts from a single platform. Users can keep track of their spending, organize cards, and request and share money with their contacts.

- To infinity and beyond. Last but not least, users can create as many as possible accounts as needed. Whether for personal, business, shared organization, or family, e-wallet platforms allow you to continuously open and close accounts based on your needs.

Key opportunities for PayTech players and startups

More than anything, the takeaway lesson is that e-wallets are here to stay. They’ve become a global phenomenon, and the best move for today’s FinTechs is to harness the emerging opportunities within the sector, including:

- Truly global access. From consumers to merchants, people everywhere are quickly adopting e-wallets, making market access much more universal for new products or services.

- Perfect UX. Consumers are drawn to the accessibility and convenience designed into e-wallet apps. This has simplified many of the complexities of traditional financial services, from canceling the need for in-person account opening to seamless P2P payment options, and this approach should be a focal point for any FinTech.

- High security. Users demand heightened security for their finances, and e-wallets deliver. With security technologies becoming more sophisticated, novel security service provider options are opening up. In one of our FinTech-focused podcasts, we learn about this fascinating world from a company known as Onfido, an AI-based and facial biometrics verification service.

- Customization options. There are different business models and revenue structures to choose from, and FinTech players must choose wisely. One of the most innovative types of digital wallets these days is the buy now pay later (BNPL) service.

- Wide-ranging user features. In contrast to traditional financial services, e-wallet services are seemingly endless thanks to today’s digital and mobile solutions. For any unmet consumer or merchant needs, digital wallets can provide groundbreaking in-app services.

Capitalizing on the enormous potential for e-wallet products and services first requires a professional approach. No matter what continent, Star’s team of digital finance experts collaborates with its partners to innovate on a wide range of products — from FinTech builders and blockchain applications to digital finance experiences and IoT solutions. Discover all the steps needed to transform your idea into a tangible product today.

Gain insight into our capabilities

Connect with our experts to unlock e-wallets opportunities and ways of simple end-to-end integration for your business.

Header image source: dribble.com