FinTech and digital financial services still have a long way to go before they reach universal and long-term adoption—and trust is one of the biggest stumbling blocks that’s standing in the way of reaching that goal. Every step of the FinTech creation process, from product development to user-centric design, is essential in identifying resilient solutions.

Let’s start with a simple fact: 96% of global consumers are aware of or use at least one FinTech service. Mint, Acorns, Robinhood, you can probably think of at least a dozen from the top of your head.

This familiarity with FinTech services can partially be attributed to recent changes brought on by COVID-19. But the real game-changer has been the digitization of daily life that’s been happening since the dawn of the smartphone era. Simultaneously, the swift adoption of smartphone apps and services has always far outpaced consumer literacy of these same products.

To help today’s Digital Financial Services leaders better address these challenges and embrace opportunities, we recently facilitated an in-depth discussion with industry leaders about the key strategies for avoiding trust gaps in FinTech.

Star’s Director of Strategy Ed Adamson led the panel discussion and was joined by Ren Yi Hooi, Founder & CEO at Lightning Social Ventures, Mathias Klenk, Co-Founder at Passbase (backed by Lakestar VC), as well as fellow Star Experts Fabian Vandenreydt and Jawad Bhatti – Managing Director, Fintech at Star.

They discussed some of the most important questions in the finance ecosystem, including:

- How do you build trust at the FinTech service provider and the ecosystem level?

- Where do the FinTech trust gaps lie?

- Which tools are available to ensure trust at every step of the FinTech product consumer experience?

- What can you do internally to establish credibility for your FinTech product?

We’ve captured a selection of their insights below.

Avoiding trust gaps in FinTech

Watch the webinar now to get their complete and in-depth perspectives and strategies on mastering the trust challenge in FinTech.

How trust gaps arise in FinTech

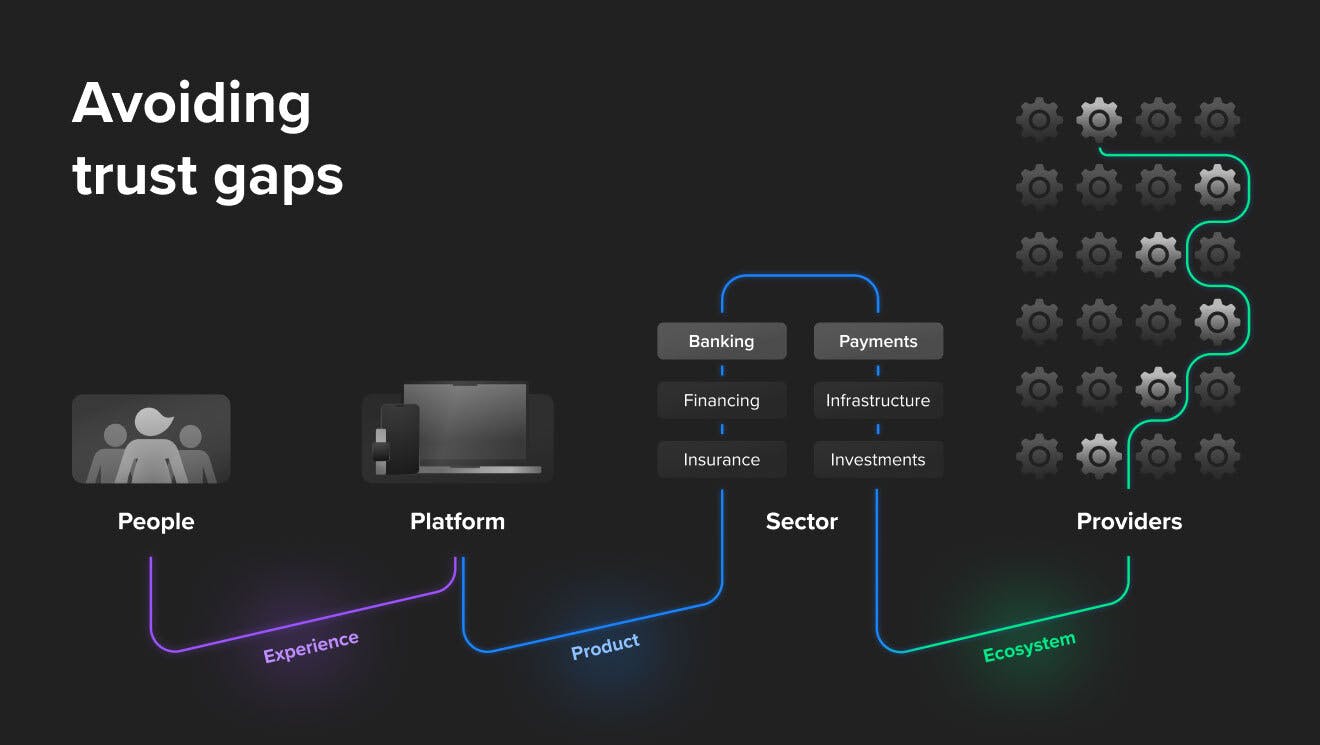

Trust gaps appear across financial ecosystem interactions. They start at the FinTech service provider level, and pop up everywhere. You can find trust gaps separating sector services, products and platforms, and especially the end user.

At each stage, trust is required between all digital finance players. FinTech providers need to trust the ecosystem. Likewise, the financial sector needs to trust the provider’s technology to represent their brand responsibly. Then, of course, users have to trust the platform for these FinTech services. If trust breaks down at any interaction, its impact ripples and affects all stakeholders.

This is where it gets complicated because there are nearly infinite opportunities for trust gaps in FinTech to emerge including:

- During the user experience

- What product the FinTech platform offers and even how it offers it

- How the sector selects the API providers that fuel their brand experience

- The FinTech product fit in the overall ecosystem

Each of these has an impact that can positively or negatively influence relationships.

Key questions to consider in your FinTech product strategy:

- Are you working with the best financial technology to help you build trust?

- How do you ensure your technology provider collaboration will build trust for your service through product features?

- How do you use data in your specific FinTech product?

- How does this influence the features you offer?

- How will you deliver the experience to your customers in a way that connects with their head and heart?

This last hurdle is experiential and perhaps the most challenging. Are people really going to resonate with this? How will it be delivered? Customers are used to effortless, frictionless digital services. They are not just comparing you to other players in your digital finance sector. They bring in experience using apps from other industries raising the standards even higher.

You have to get things right from the start by understanding users and their needs (both your target audience and internal teams). Building empathy allows you to step back and build the right FinTech products and features. Most importantly, it helps you avoid trust gaps.

Trust in FinTech is earned bit by bit

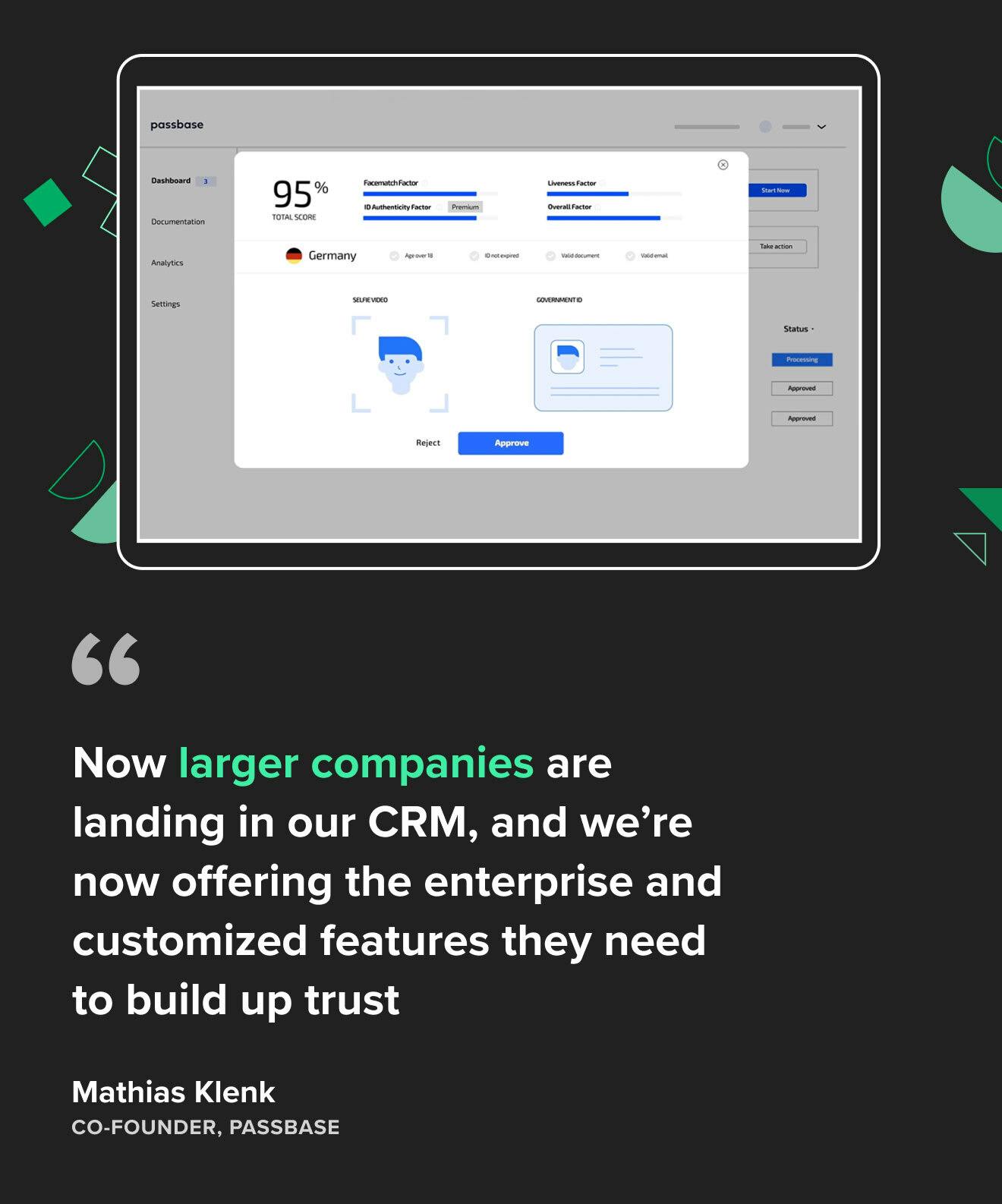

To build trust, you have to earn it. Mathias Klenk personally lived this axiom as he launched Passbase. Passbase is an identity verification solution. It is not only useful for financial services also but also healthcare, mobility, remote work and the gig economy.

Facilitating trust in FinTech is at the core of what Passbase offers, but, as a startup, they’ve had to prove themselves to potential customers. Though they know the strength of their product, they couldn’t immediately approach a major bank or FinTech incumbent and ask them to use Passbase. They needed a track record of successful projects to showcase their credibility as an identity verification services provider.

In the beginning, they focused on founding companies of similar sizes to themselves. This was a win-win. These companies needed secure, identity-verification solutions for their user bases. Thus, Passbase took this “barrier” of needing to build sector credibility and transformed it into an opportunity to not only demonstrate their value at the provider but also user level. Concurrently, they also used these engagements to further refine their product and expand capabilities further taking advantage of what could have been a serious stumbling block.

Over time, they’ve increased the size of the customers they work with and have evolved their approach accordingly. As Mathias notes, “now larger companies are landing in our CRM, and we’re now offering the enterprise and customized features they need to build up trust” with their customers.

This type of approach is crucial for overcoming trust challenges in FinTech. In this case, it’s an API provider establishing credibility in the wider sector ecosystem. The same strategy translates across all ecosystem players in financial services. For example, a FinTech startup might begin gaining traction by offering a fee-free digital bank account. As their credibility builds, they could then roll out other investment tools, gaining traction via clear milestones such as their number of users and assets under management. The lesson remains the same.

Conveying the benefits of new services to users

Trust gaps are fuelled by knowledge gaps. Digital financial services are still very new to the majority of people. How do you even convince users to trust you with their data in the first place? It all boils down to demonstrating the clear value of your services.

Ren Yi Hooi shared insights on how to do this. As Co-Founder and CEO of Lightning Social Ventures (LSV), her team enables financially vulnerable people and organizations to receive instant support from grant providers. They bridge many trust gaps. Above all, LSV bridges the divide between vulnerable people and the barriers that prevent them from receiving assistance.

For LSV, it’s sharing data electronically instead of cumbersome paper statements as was done in the past. This is a simple thing that people can quickly and easily grasp to build a foundation for trust. But the real benefit to this is speed. With Open banking and access to financial instruments, LSV can rapidly respond and deploy funds to those who need it most.

As a new FinTech company founded in response to the pandemic to support financially vulnerable people, building trust at speed with consumers as well as the institutions serving them has been of paramount importance to us. We enjoyed participating in this insightful panel on Avoiding Trust Gaps in FinTech, which was brilliantly moderated by Ed Adamson from Star.

Ren Yi Hooi, Co-Founder and CEO at Lightning Social Ventures

“They’re with me”: partnerships and the impact of vouching

There’s no quicker way to gain trust than to have a known entity vouch for you. We do this all the time in our personal lives. One expression like, “he’s with me” or “she’s cool” establishes credibility way faster than any list of credentials.

That’s exactly what LSV does by working with established and recognized partners. LSV recognizes they are a very new name that most people aren’t familiar with. To enhance credibility they partner with organizations like Do IT UK which has over 20 years of volunteering and social welfare projects in the UK.

Despite being at the other end of the FinTech ecosystem, you can see the overlapping trust journey that LSV shares with Passbase. Rather than expecting to be trusted immediately, LSV recognizes that it takes time to build credibility. When possible, reach out and lean on your partnership.

Trust comes from within (and without)

Establishing trust is an external and internal process. Only through this holistic approach will you be able to successfully overcome all trust gaps in FinTech.

Partnerships and consumer education signal external trust. Internally, your processes must be equally robust.

Thus, an incredibly important consideration is the underlying technology you use to power your digital finance solution. As Star Advisor Fabian noted, “The more high tech tools like AI and ML you need to crunch data…and provide vital recommendations like credit scoring and loan determinations, the more important it is to have people who understand what these tools do.”

In short, he described the rigorous guidelines that must be in place before a product ever comes to life. The goal must be “authentic, transparent, ethical AI.” Alongside it, tight supervision of the way these algorithms are working is vital to ensure they do not create exhibit biases or other trust destroying behaviors.

But this is just the beginning of the journey. Next, you layer in the APIs. As Jawad described “no product is an island anymore…and before we [Star] build something, it is very important to trust the APIs we are receiving to ensure safety and security on behalf of the customer.”

What we’re talking about is more than cybersecurity or securely handling PII. It’s about layering trust through every stage of product creation.

Building bridges over trust gaps

Trust gaps in FinTech are not insurmountable. They can be overcome and with less difficulty than you realize. Now is the perfect moment to get started.

People are more inclined than ever to try out FinTech themselves. Capture this opportunity, and you won’t just win them over now, but maintain their trust and loyalty for the long term.

That all begins with the right partner for success. Star has 12+ years co-creating and building innovation that all types of users, from global companies and disruptive startups to personal consumers, trust and love to use.

Watch the webinar and connect with us to see how our FinTech industry experts can help you deliver innovation that creates sturdy bridges to bring together those separated by trust gaps.