In brief

Identifying and securing value is a key challenge in any market, none more so than buy now, pay later (BNPL) — the fastest growing payments sector. As the BNPL market reaps the rewards of its meteoric rise into the hearts and minds of global merchants and their customers, it faces an inflection point with increased scrutiny from regulators and an ever-growing number of competitors in the space. So, what’s next?

Our expert report goes beyond the surface and provides real value to players in the disrupted finance ecosystem. With input from Paidy and Mastercard, we dive deep into the inner workings of the minds of those at the forefront of strategically navigating BNPL businesses who are creating iconic brand experiences that have catalyzed growth.

Get expert answers to questions like:

- BNPL has clearly cracked an underserved user need, but what makes it so appealing and where can it go next?

- The market is becoming more competitive. So, what are the key challenges to focus on going forward and how do I navigate them?

- How can I combine technology with finance models to truly innovate in the market?

- How can I resolve the tension between consumer spending patterns and responsible finance, while aligning this to my business goals and brand purpose?

What you’ll gain from this report

Our report focuses on three key areas: innovation, differentiation and growth. You will specifically get in-depth perspective and insight on:

- Why BNPL is so enticing for the different layers of its ecosystem: from technology players, finance providers, customers and merchants to even potential new sectors

- How BNPL fits into and is merging with other POS financing models

- The change drivers impacting the BNPL trajectory and strategy

- Areas of opportunity that can identify and secure value for your business

We believe our experts will ignite inspiration and offer you actionable insights that you can take back into your business.

Understanding BNPL’s appeal and its popularity

Buy now, pay later or BNPL is one of the fastest-emerging forms of payment of the FinTech services revolution. BNPL enables you to do just that: take home a purchase without having to pay for it until a later date, often with 0% interest and zero late fees. The buy now, pay later model is true payment innovation focused on flexibility, convenience, and personalization.

While everybody in the ecosystem benefits from the proliferation of BNPL, perhaps it’s the consumer who has the most to gain. First and foremost, we’re talking about a major boost to accessibility, especially for mid-ticket items. Traditionally, large-ticket purchases such as mortgages or car loans could qualify for low-interest bank financing. However, if a consumer needed a new laptop, the option was usually to spread the purchase over several high-interest credit card payments.

In fact, BNPL is so accessible now that often, BNPL providers don’t even conduct credit checks. Instead, an email address and a phone number are enough to determine eligibility. Compared to high-interest credit cards and a lack of transparency, BNPL is easy to use. So it’s no wonder why it’s such a hit with customers.

The average BNPL user may surprise you

While BNPL usage has traditionally been associated with younger users, this is rapidly changing. Over the past few years, the uptake of BNPL has increased for older Gen X and Baby Boomer population segments. Nonetheless, Millennials and Gen Z are the most likely to seek out stores that offer BNPL.

It is true that BNPL is especially appealing to people who may not be as financially stable or have low credit ratings. This trend should not be disregarded given that 33% of consumers say they are still facing financial insecurity because of COVID-19.

But you can’t pin down BNPL usage to just one demographic. Research indicates that 70% of BNPL consumers make $75,000+ annually and 75% have at least a bachelor’s degree. What we’ll see over the next few years is that more people of all backgrounds will begin incorporating BNPL as a primary payment mechanism.

The size of the BNPL market and the biggest players on the scene

In 2020, the global BNPL market size was $90.69B. By 2030, it’s projected to reach $3.98T growing at a CAGR of 45.7%. Right now, the leading players are not the incumbent financial institutions but startups like Afterpay, Affirm, Klarna, and Paidy. Klarna alone boasts over 90 million active users and 2 million daily transactions. On the other hand, Zilch was the fastest European company to reach double unicorn status after it closed a $110M funding round in November 2021.

Although BNPL only reflects a small percentage of the wider payments market (UK 5%, US 2%, Japan 3%), it seems to only be at the start of a dramatic growth journey. Even incumbents are starting to pay attention to it: Mastercard and Visa are linking traditional financial institutions to BNPL. For example, Citi is rolling out its own BNPL service in Australia.

While there are plenty of major players in the space, the field is wide open for leadership.

Unpacking the success of the BNPL business model

The key differentiator for BNPL providers compared to traditional financial service providers is that they offer options like 0% interest and no late fees. This begs the question: how do they make money?

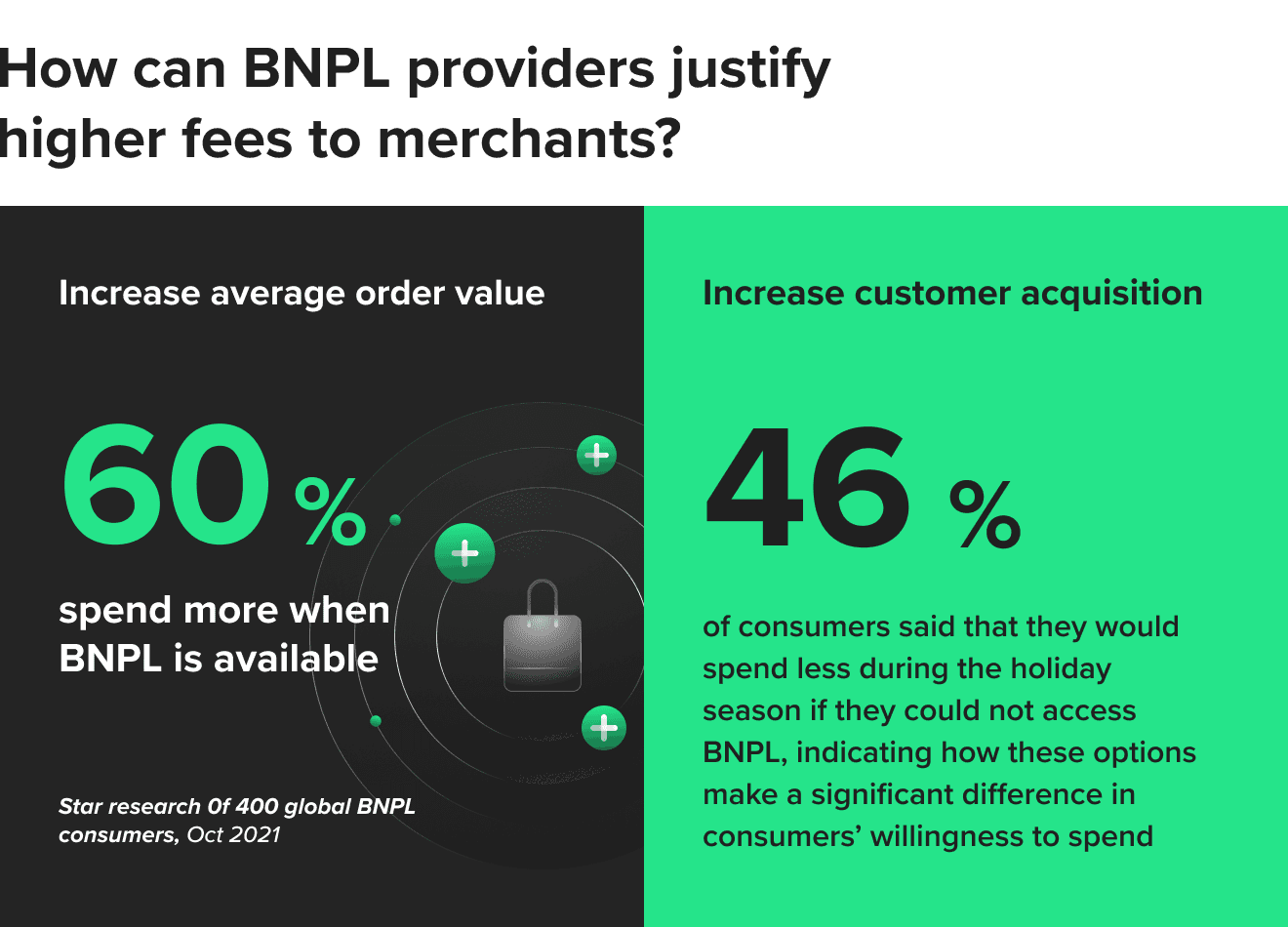

Traditionally, the BNPL industry's biggest revenue source has been through merchant fees. While the average debit or credit card transaction might include a 2-3% transaction fee and sometimes a flat service charge of $0.30, BNPL fees are much higher — often ranging between 2-8% in addition to the service charge.

So, why do merchants even consider adding BNPL as a payment method? That’s because merchants who adopt BNPL see their average order value increase by around 45%, which is a remarkable trade-off.

One of the biggest BNPL challenges we’ll see, however, is a race to the bottom. As more players enter the space and offer lower merchant fees, providers will need to work harder to find additional sources of revenue and distinguish their offerings.

BNPL companies also do make some of their money from the consumer. Some companies like Affirm do charge 10-30% on longer installment periods. On the other hand, Afterpay does have late fees under certain circumstances. But this represents the minority and not the majority of money that BNPL companies stand to make.

Further analysis shows there are numerous other ways that BNPL companies derive revenue. Forming partnerships with key retailers is an important source of income, and companies are increasingly finding ways to monetize the vast amount of data at their disposal.

Buy now, pay later: the future (and present) of payments

One needs to only look at record BNPL’s growth to see that it’s not just the future of payments. It’s the present. As for usage growth globally, more value is created for merchants that include BNPL services. BNPL is a major part of the POS (both online and increasingly in-store) landscape.

What we foresee happening is the evolution of BNPL into “super apps” that merge payments, financing, banking and even the shopping experience as they capture more market share. This will manifest across three core models:

- Integrated shopping apps (currently the most common form of BNPL). These providers monetize customer engagement through apps that offer installment payment options and engaging shopping experiences. Here we see ticket sizes of around $100.

- Card-linked installment offerings. Payment plans are linked to existing consumer cards, often through neobanks like Monzo, Zilch and industry titans like Mastercard Installments. These provide pre, during and post-purchase solutions for tickets sizes averaging $1000.

- Off-card financing solutions. This is the widest room for BNPL growth. Off-card financing enables installment plans for purchases ranging from $250 to $3,000 with customers paying an APR (a potential new revenue driver). This creates a whole sector of mid-range purchase opportunities from home appliances to electronics and beyond.

Specialization into just one of these areas is unlikely, especially as integration increases. Instead, we’ll see BNPL providers target broader market share through enabling a combination of these different service offerings.

Above all, the future of BNPL must be tied to increasing top-of-funnel activity regardless of ticket size. If a retailer can experience traffic boosts by harnessing BNPL solutions, they will be more than willing to accept the merchant fees currently fueling BNPL’s ascent.

Designing BNPL solutions that maximize user engagement and drive growth

At Star, we know the future of payments is BNPL. But as with any technology, the key is how you deploy it. BNPL offers a unique edge over traditional payments by creating hyper-personalized user-centric experiences.

The BNPL user experience is a key differentiator. Merchants rely on BNPL to not just attract customers but retain them. This is through customer journeys that fuse shopping and payments while staying on top of the ever-changing demands of consumers and merchants.

Szilvia Kovari-Krecsmary, Chief Marketing Officer at Paidy, emphasizes, “The beauty of BNPL design is not only the end benefits for consumers but the super simple UX. For our service, you just need your phone number and email, and we can instantly approve you.” The consumer payment paradigm has been radically transformed and what we’ll see is even incumbents mirroring the simplicity of BNPL’s user-centric UX.

Design principles for BNPL imitate every other digital product. However, there are key differences. Many users wonder about whether customers truly understand what they are signing up for when they make a purchase with BNPL. Ethical design and transparency are essential. So, too, are educational tools that can help customers better manage their spending. By focusing on these areas, BNPL players can distinguish themselves from their competition.

Understanding the brand personality and target audience must be the guiding light of BNPL development. Focusing on these two aspects will help companies get to a more advantageous place than just concentrating on the tech.

Brand purpose must resonate with the customer and their needs. Paidy is a great example. Their brand purpose is “to provide people room to dream.” They don’t focus their message on the finances or even their technology, but on experiences. If you can follow suit and have an equally impactful message, then your customers will naturally stay engaged.

Lead the BNPL revolution

As the competition heats up in BNPL, there will inevitably be winners and losers. Dive deeper into the strategies you need to think beyond the POS, holistically embrace what BNPL has to offer and build future-forward digital finance solutions.

Don’t extinguish the potential BNPL has for your business. BNPL providers must apply the same superpowers that enabled them to break into the market so dramatically and challenge the paradigm with clarity, simplicity and transparency. Read our report to find out how.

Dive into more BNPL expert insights

from Mastercard, Paidy, and Star.

Download the complete report now.

About Star

Star is a global technology company that connects strategy, design and engineering services to help companies accelerate product innovation. We support our customers every step of the co-creation journey — from ideation and concept crafting to full-stack development and putting solutions into the hands and minds of end-users. Our FinTech Practice work alongside name brands like Paidy, 1-800Accountant and many other leaders to identify their best approach and then execute it.

Discover more about our end-to-end FinTech and digital finance capabilities in this case study about our partnership with Paidy, Japan’s leading BNPL provider. Together, we reinvented the e-commerce shopping experience, aggregated a multitude of Paidy merchants from all over Japan and helped Paidy chart their next bold move.