The wealth management industry, once booming, is at a major inflection point. Despite more than a decade of uninterrupted growth and the sector hitting a record high in 2021 with the top 500 asset managers accounting for over $131 trillion assets under management (AuM), global AuM experienced its most significant drop in years to roughly $98 trillion in 2022. This resulted primarily from rising interest rates across the globe — and when it comes to adaptation and growth in this changing environment, many firms still struggle. This, in turn, is mainly due to customer acquisition cost.

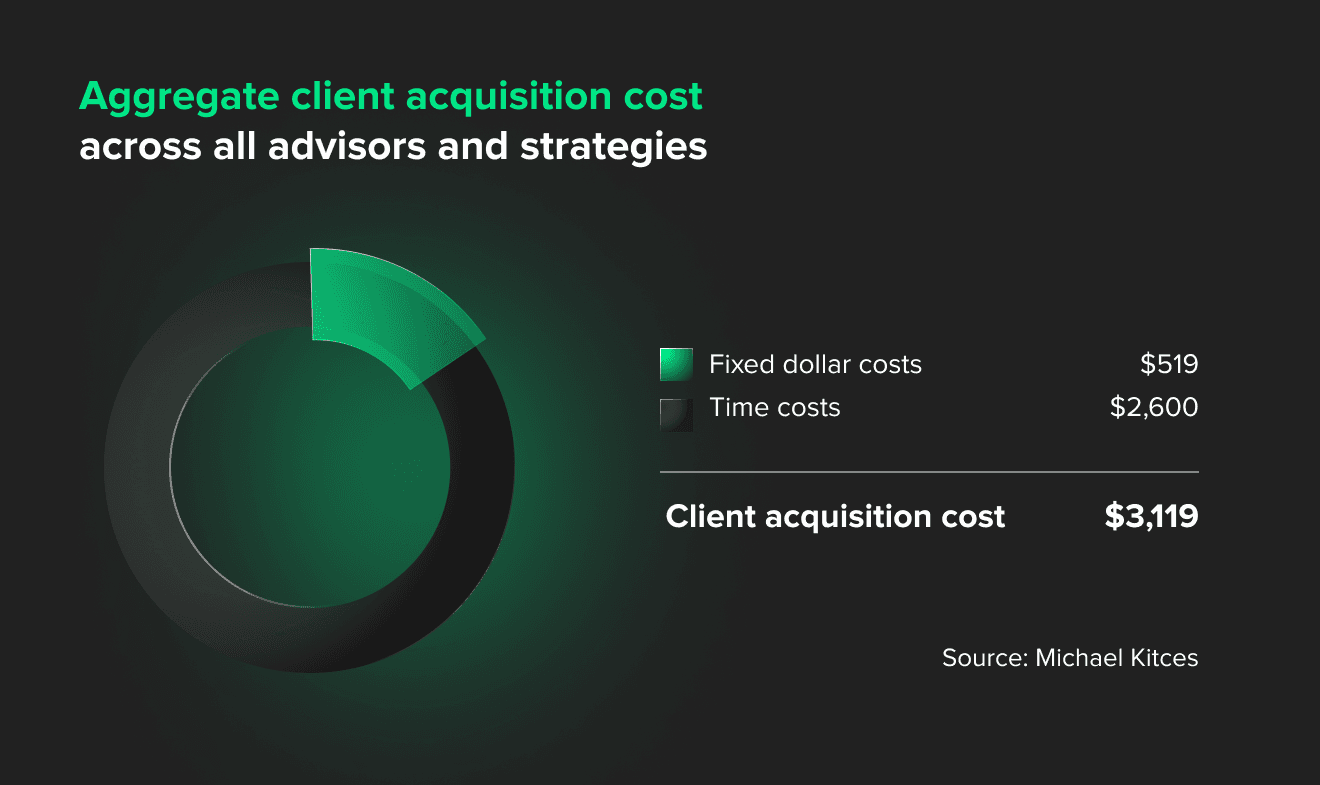

Kitces reckon customer acquisition cost in the wealth management market is around $2,167 per client, and this cost rises to $4,056 per client for firms with more than $250,000 of revenue. With competition ever-more stiff and recent AI disruptors across all markets — not to mention sky-high customer expectations — keeping new clients long enough to make this back (and turn a profit) is increasingly difficult.

So why is client acquisition strategy in wealth management so high? And what can asset managers do to address the issue?

What increases customer acquisition cost in the wealth management market?

Wealth managers face two big challenges when it comes to acquiring new clients:

- Finding a way to stand out in an extremely crowded market

- Creating a smooth onboarding process

In 2023, standing out is easier said than done. Robo-advisors, micro-investment platforms, crowdfunding platforms, and other tech companies deliver high-quality service at a fraction of what traditional firms charge. And this means the latter have to find ways to differentiate themselves without competing only on price.

But tech companies have challenges too. With 23,000 investment startups globally as recently as last year, it’s an extremely competitive space. But customer awareness — in the US, net usage of digital advisors fell from 27.7% in 2021 to just 20.9% in 2022 — is still low. And if you target customers who make lower-value investments, it takes longer for lifetime value to exceed acquisition cost.

The fact that wealth management is a regulated industry complicates matters further for everyone. According to Kurtosys’ Digital Marketing Survey, 78% of digital marketing executives in wealth management feel regulation makes marketing harder and drives up costs.

Soaring standards for wealth management technology

It goes without saying, but getting noticed is only step 1. Once you’ve persuaded clients to give you a go, you have to do due diligence. This is often where many customers change their minds.

Due diligence is essential, but it’s also tedious. Customers are increasingly used to effortless, friction-free digital services. So they resent lengthy forms, paperwork, and waiting around. As a result, across the UK and EU, the application abandonment rate in financial services was 68% in 2022 — and it’s only going up.

Our research into consumer attitudes towards onboarding show that financial service providers are struggling to keep up with consumer’s digital demands — and it is costing them customers.

Asger Hattel

CEO at Signicat

When less is more in the wealth management industry: the benefits of carving your niche

If technological disruption has made customers harder to please, it has also made them easier to reach. Wealth management is more accessible to average investors than ever before. But, to attract them, you need to get smart about how you position yourself.

If you want to stand out, it's nearly impossible, like in the old days, to be everything to everybody. The tech companies that become leaders are those who focus on one segment of the market at a time.

This isn’t to say you can’t evolve. Or create new products and expand into new areas. In fact, once you’ve established yourself, it’s important to find ways to move quickly to more segments and scale, which has its own challenges.

But narrowing your offering, at least to begin with, helps make you more memorable and keeps client acquisition costs down.

Smart newcomers always go this route. They take a segment of the market that isn’t served well and figure out a way to make a success of it. This is easier and, so, less costly for marketing. And it’s also easier and less costly for app development.

Lowering customer acquisition costs with wealth management technology solutions

According to Forrester’s Future Fit Survey, 62% of business and technology professionals at wealth management firms anticipate increasing spending on emerging technologies over the next 12 months.

To develop a solid strategy, hit the right notes with your target customers, and lower customer acquisition cost, you need the right insights and tools. And that’s where tech comes in.

Here’s how tech can help lower client acquisition costs for wealth management firms.

Faster, smoother user experiences

According to a UK study, 82% of customers expect financial services firms to be at least as good at digital as Amazon, Netflix, and other tech giants.

Yet, onboarding takes 33% of wealth managers over four weeks to complete. This is often at eye-watering cost — major financial institutions spend up to $500 million a year on Know Your Customer (KYC) checks.

Robo-advisors, crowdfunding platforms, and other tech firms have it even trickier. Customers expect digital apps to be simpler and quicker to get up and running. But tech firms still need to get KYC right.

Tech can cut the time it takes for KYC by as much as 90%. That’s a staggering 5.4 million hours saved each year, at a value of over $1 billion.

On an ongoing basis, tech also helps cut costs. From better fraud detection to more tailored investment advice and even gamification, it can strengthen your reputation, lighten staff workloads, and help deliver a smoother experience that increases customer loyalty.

Better wealth management market analysis

The more you know about your customers, the easier it is to:

- Understand what type of relationship they want with you

- Identify behavioural trends

- Make improvements that give your products a competitive edge

AI and data analytics programs make it easier (and quicker) to parse this data and put it in your hands so you can make better decisions.

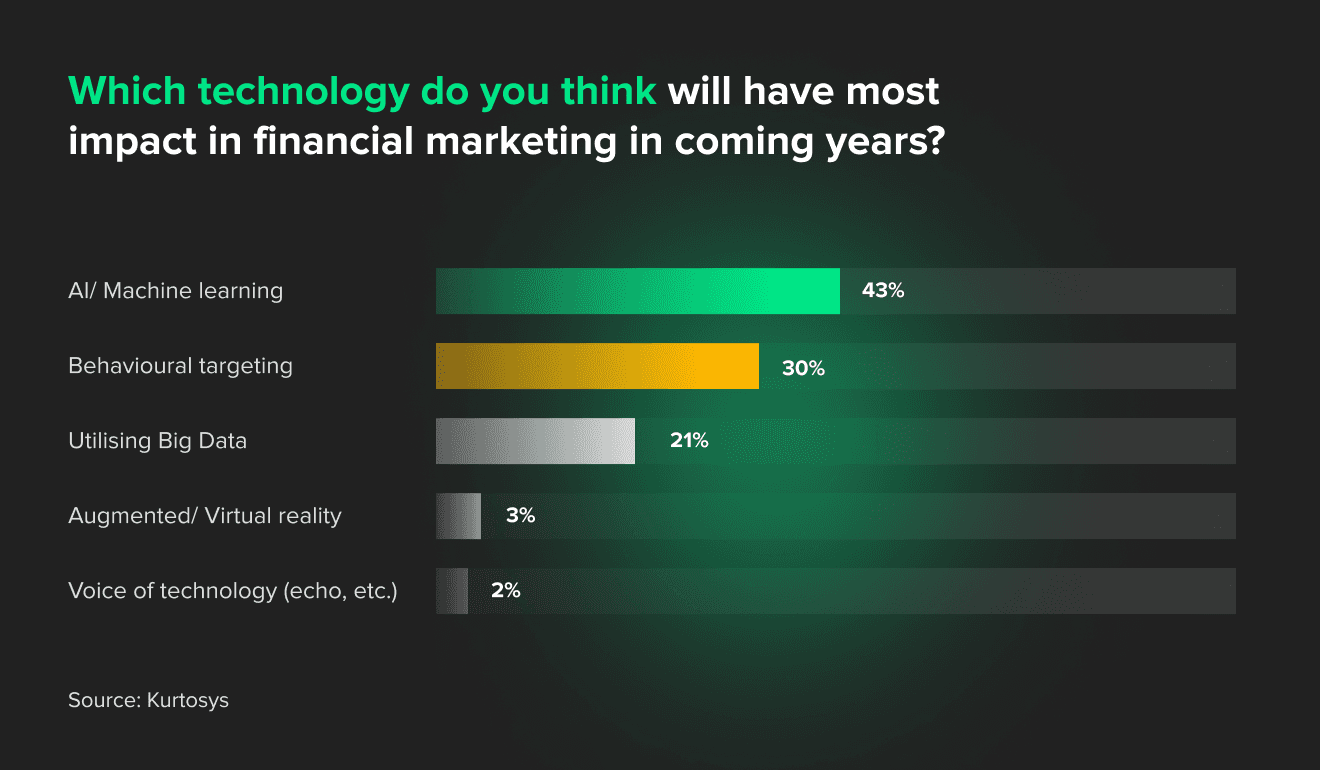

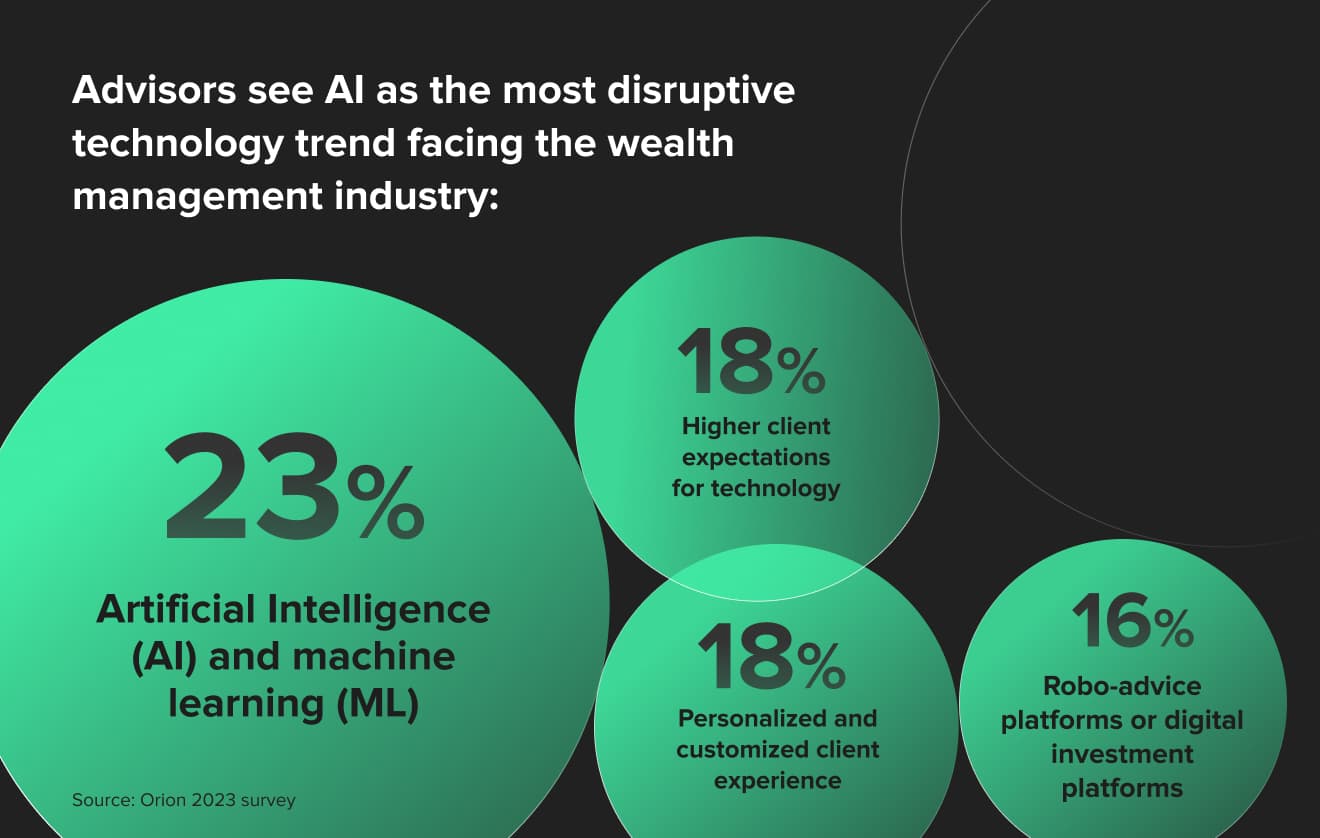

Despite AI being the most disruptive trend, few are planning to invest in it in the next 3 years:

- (67%) Personalized and customized client experience

- (46%) Higher client expectations for technology

- (44%) Personalized and customized asset management delivery for clients differentiated in-house asset management solutions providing a tailored investor experience

- (18%) Artificial intelligence (AI) and machine learning (ML)

Traditional financial services firms have the most to gain. As things stand, they have more data than any other industry. But legacy technologies, silos, and other priorities mean they’re only using a fraction of what they have, and a transformation in the front, middle, and back offices is necessary to get their services up to speed.

But with tech companies, and robo-advisers in particular, struggling to break even because of small portfolios, they stand to gain from access to better data too. This holds especially true when it comes to understanding how customers prefer to communicate.

People often think digital journeys are only for young people. But that’s not the case. Facebook, for instance, is now more popular with over 55s than under 55s.

At the same time, young people don’t necessarily want digital-only services. Context matters. A 25-year-old with $500 will be fine investing online. But if that same 25-year-old wanted to invest $5 million, they’ll probably want to speak to someone face to face first.

Want to build tech tools that empower you to make better-informed, data-backed business decisions?

AI’s fast-evolving role in wealth management

The AI revolution, of course, includes wealth management — as its multifaceted capabilities can be successfully harnessed throughout the financial services industry. Yet the technology is far outpacing data collection about its relevance in the overall ecosystem. For instance, ChatGPT was first launched in November 2022; in January 2023, Orion — a WealthTech firm — conducted a survey where only 18% of wealth management respondents said they’d invest in exploratory AI and machine learning technologies over the next three years.

Then, in March 2023, OpenAI launched API access for both ChatGPT and Whisper, its speech recognition AI, leading Eric Clarke, Orion’s CEO, to admit, “All of a sudden, those survey results seemed very dated.” Even Orion has started using ChatGPT in various ways like responding to RFPs, comparing and contrasting portfolios, refining marketing content, and more. FMG Suite, a financial advisor marketing platform, also announced its ChatGPT integration in the form of a content personalization engine, and these are just the tip of the iceberg when it comes to firms exploring how best to integrate the technology.

With API introduction and beyond, wealth management technology can truly begin harnessing AI’s opportunities by making customer acquisition more efficient and exploring further customized company needs. When it comes to customer acquisition cost, financial services have much to gain as they represent 25% of the global economy. Machine learning APIs will allow wealth managers to deploy solutions quicker, and thereby reducing development costs. Moreover, these tools will help the industry offer infinitely more relevant and targeted solutions to multiple client segments spanning multi-region to global scale.

It’s time to put tech to work

Whether it’s finding ways to stand out from the crowd, getting noticed by the right people, or onboarding new clients quickly and smoothly, firms are increasingly facing towering customer acquisition cost in wealth management.

With over a decade of experience designing powerful, user-friendly tech for the FinTech industry, Star can help you tackle these challenges head on and catch the wave of opportunity that 2023 and beyond will bring.