We are now operating in a new digital reality. Lean digitally enabled fintechs are exploiting the “digital opportunity gap” left by the incumbents, intensifying competition in an already-cutthroat industry.

The stakes of the game will soon be even higher. Over the next decade, anywhere from $15 trillion to $68 trillion — 12% to 56% of global investable assets — will be passed down to the next generation. This “Great Wealth Transfer” is jeopardizing the traditional wealth management model.

Already, wealth management is most vulnerable to fintech disruption, with 12.8% of financial advisors ranking this upcoming wealth transfer as their primary business risk. The soon-to-be custodians of these generational assets — millennials and Generation Z — are digital natives who have different expectations of their wealth managers. As global research firm Roubini Thoughtlab found:

- 72% of millennials would consider switching investment providers

- 66% are likely to fire or add on to their parents’ financial advisor after they inherit

- 41% plan to consolidate their assets into fewer firms

Wealth managers must upgrade themselves to thrive in the new digital reality

The upcoming great wealth transfer, greater customer expectations, and increased competition mean that wealth managers have no choice but to upgrade themselves if they want to thrive in the new digital reality.

To do this, there are four key areas wealth managers must focus on customer experience, omnichannel delivery, customer acquisition and product design.

Customer experience — the guiding principle

The late Steve Jobs said it best, “You’ve got to start with the customer experience and work back toward the technology, not the other way around.”

The tech giants have set the bar for customer experience. And investors now expect the same customer experience from their wealth managers. This holds true regardless of generation or wealth level. In fact, older and richer investors were more concerned about their levels of digital access.

Wealth managers must step up. Accenture studied over 47,000 financial services customers and found that:

- They increasingly want a “fully personalized offering” — and 80% are willing to share their data in exchange

- They long for a true omnichannel experience where they can seamlessly switch between digital and physical channels

To deliver this kind of experience, digital solutions in FinTech must be integrated into the entire process, from front-end onboarding all the way to back-end systems. A couple of examples of how this could look like:

- Blending “high tech” with “high touch”. Digital solutions should complement, not replace human financial advisors. A firm could be using advanced digital solutions such as facial recognition software for almost instant customer onboarding. At the same time, it could still offer clients personal advice through dedicated human advisors.

- Leveraging data for ever-more personalized and relevant advice. Data from external third-party sources — such as social media — could be used to track investor behavior and provide relevant recommendations. Imagine a wealth manager being able to automatically learn about a client’s major life events (like the birth of a child) from social media data and then immediately send out content on educational savings plans.

Customer experience — enhanced by digital capabilities — must thus be the heart of wealth managers’ offerings. And a key part of delivering this is omnichannel integration.

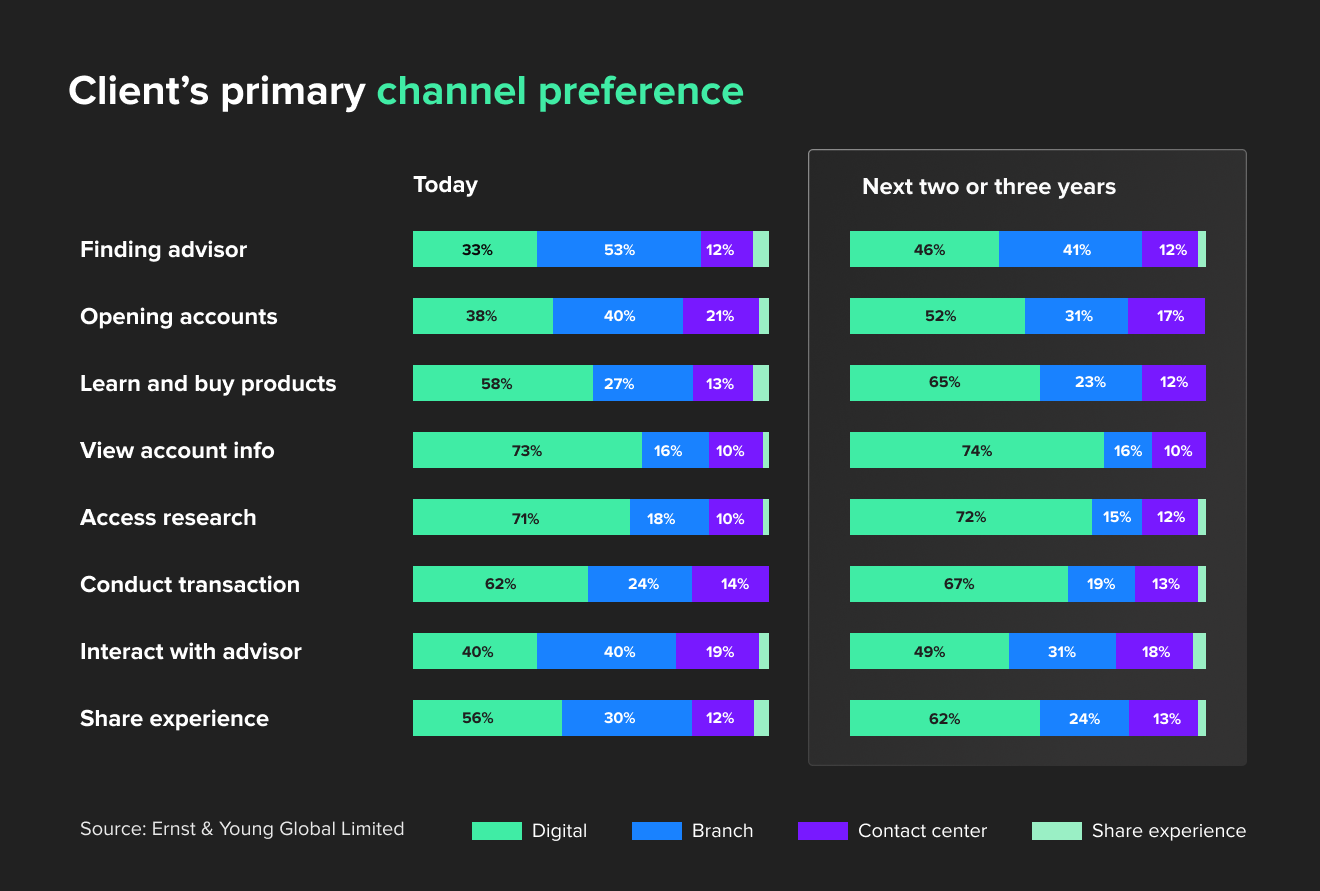

Omnichannel delivery — a non-negotiable part of a seamless customer experience

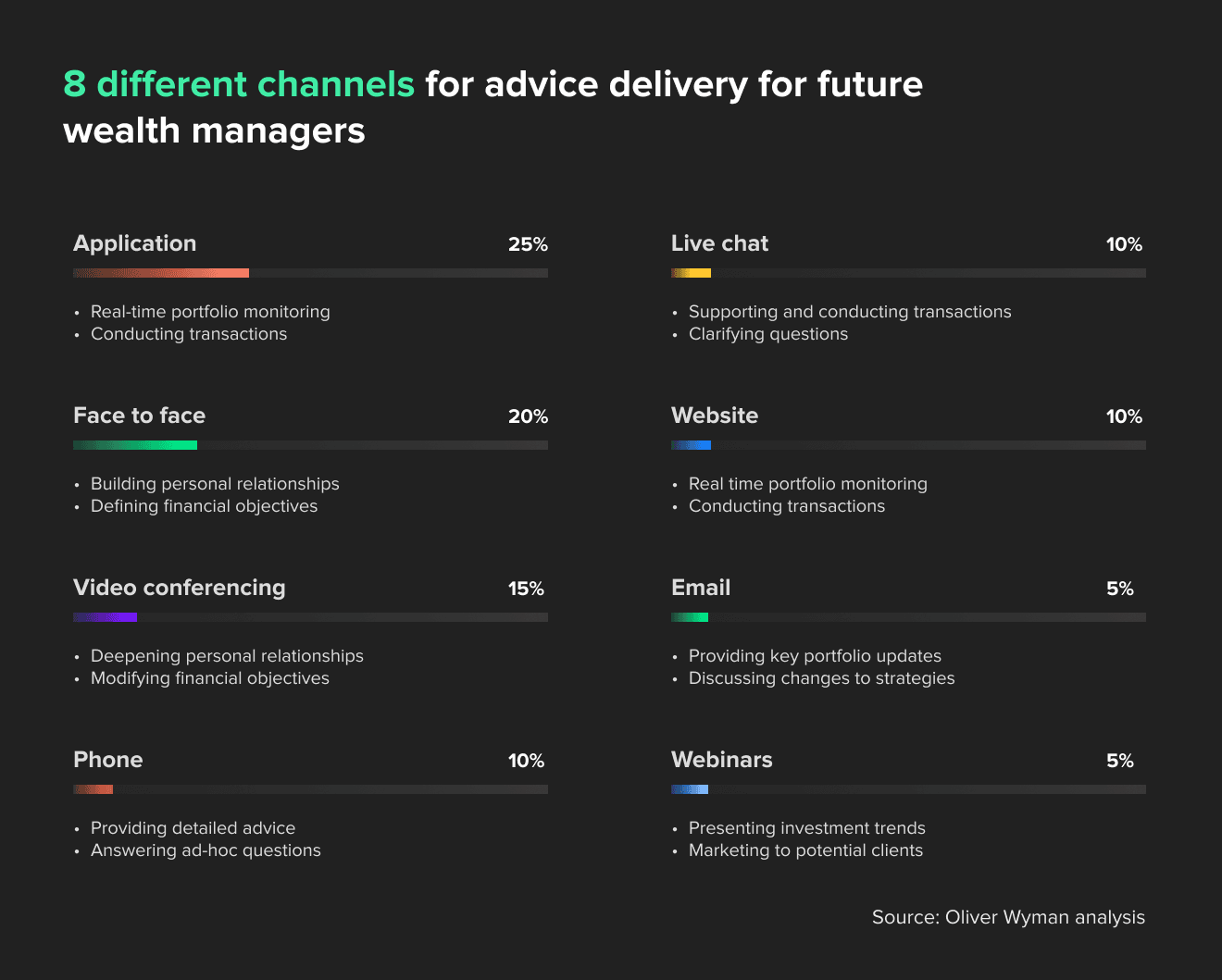

Today, we have a myriad of options to communicate, from face-to-face to video messaging apps. And our available options will only increase.

Client communication must reflect this reality. True omnichannel capabilities — with clients able to communicate through every popular channel — is a non-negotiable component of a seamless customer experience.

This does not mean discarding traditional channels. A significant percentage of clients still prefer more traditional means.

Still, we now live in a world of instant gratification. Clients expect immediacy from their advisors that is simply not possible without an omnichannel strategy. Wealth managers must thus build their capabilities across all channels.

Here’s how what Oliver Wyman dubs a “relationship manager-centered yet omnichannel” customer experience could look like:

In building such capabilities, global research firm Roubini Thoughtlab offers this guidepost:

“Incumbents should reverse their thinking, imagining the customer journey as if it were 100% digital, and then finding where a human touch might add value.”

In other words, succeeding in the new digital reality means putting digital first and only then identifying the points on the customer journey where human interaction can be a true value-add. That is a true omnichannel digital strategy — and one that can have a significant impact on the bottom line.

Research powerhouse Gallup has discovered just how powerful an advantage a true omnichannel customer experience can be. In its study of retail banks, it found that fully-engaged customers:

- Brought in additional yearly revenues of between US$402 to US$869

- Had a 14% greater wallet share in investments

- Purchased or subscribed to more than double the number of products

The benefits are clear: boosting client retention, increasing engagement, and growing assets under management (AUM). But these are irrelevant without first considering the top of the sales funnel — acquiring these customers.

Customer acquisition — the key to controlling cost efficiency

Every start-up out there is keenly aware of their customer acquisition cost (CAC) — the dollar amount they must spend to acquire a single customer. They are constantly exploring ways to bring this number down and how to bring their customer lifetime value (LTV) up.

The traditional customer acquisition model for wealth managers was to target high-net-worth individuals whose LTV could easily cover the CAC. Except for a few boutique firms, that model is quickly fading away. Today, the name of the game is scale — which means including lower net worth segments.

As such, using digital solutions to optimize CAC has never been more important. There are two main components to do this — standing out by going after your true target market and minimizing conversion leakage.

Standing out via in-depth customer segmentation

Standing out in a crowded marketplace — especially in a field like wealth management — is difficult. Doing so at scale, and without burning through cash, is even more challenging.

In-depth customer segmentation may hold the answer. Digitized firms, especially smaller ones, should focus on targeting a select demographic that is most likely to resonate with their brand image and value proposition. In other words, they must uncover and focus on targeting the “tribe” a customer identifies with.

As PwC notes, wealth managers should “pursue a customer, not a product”. Marketing should be personalized to a specific demographic, at least in the beginning. While this necessarily involves excluding other demographics, starting out with a smaller niche is likely to prove more cost-efficient in the shorter term. Further, wealth managers can always create “sub-brands” to target other demographics in the future.

Therefore, when it comes to acquiring customers, firms should keep one question at the forefront — who am I really targeting?

Minimizing “conversion leakage”

Another equally important aspect of digital client acquisition is “conversion leakage”. This is the number of potential clients lost due to things like:

- Cumbersome onboarding processes

- A lack of human support when they need it (for instance, for more complex products)

How do we minimize conversion leakage? It comes down to the core of all digital innovation efforts — product design.

In-depth read: how to slash customer acquisition cost in wealth management

Product design — the backbone of digital innovation

In the face of constantly rising consumer expectations and intensifying competition, how can firms ensure their product design process delivers?

The answer may lie in design thinking. It is both a powerful lens for conceptualizing the FinTech product design process and a practical 5-step process firms can follow for product design in FinTech. The stages are:

- Empathize: Understanding the problems and needs of the customer as thoroughly as possible

- Define: Using the information gathered from the first stage to define the problem and the desired goal in the form of a problem statement

- Ideate: The brainstorming stage, where as many ideas as possible are generated and the best ones selected

- Prototype: Creating simple and cost-effective prototypes of the ideas selected from the previous stage

- Test: Testing the prototypes and continually iterating them to make incremental improvements

Design thinking in FinTech can thus provide a concrete yet versatile framework for wealth managers looking to keep pace with the new digital reality. The process can be used regardless of the form digital innovation takes, whether it is Artificial Intelligence for advanced analytics, blockchain for enhanced security, or facial recognition for smooth customer onboarding.

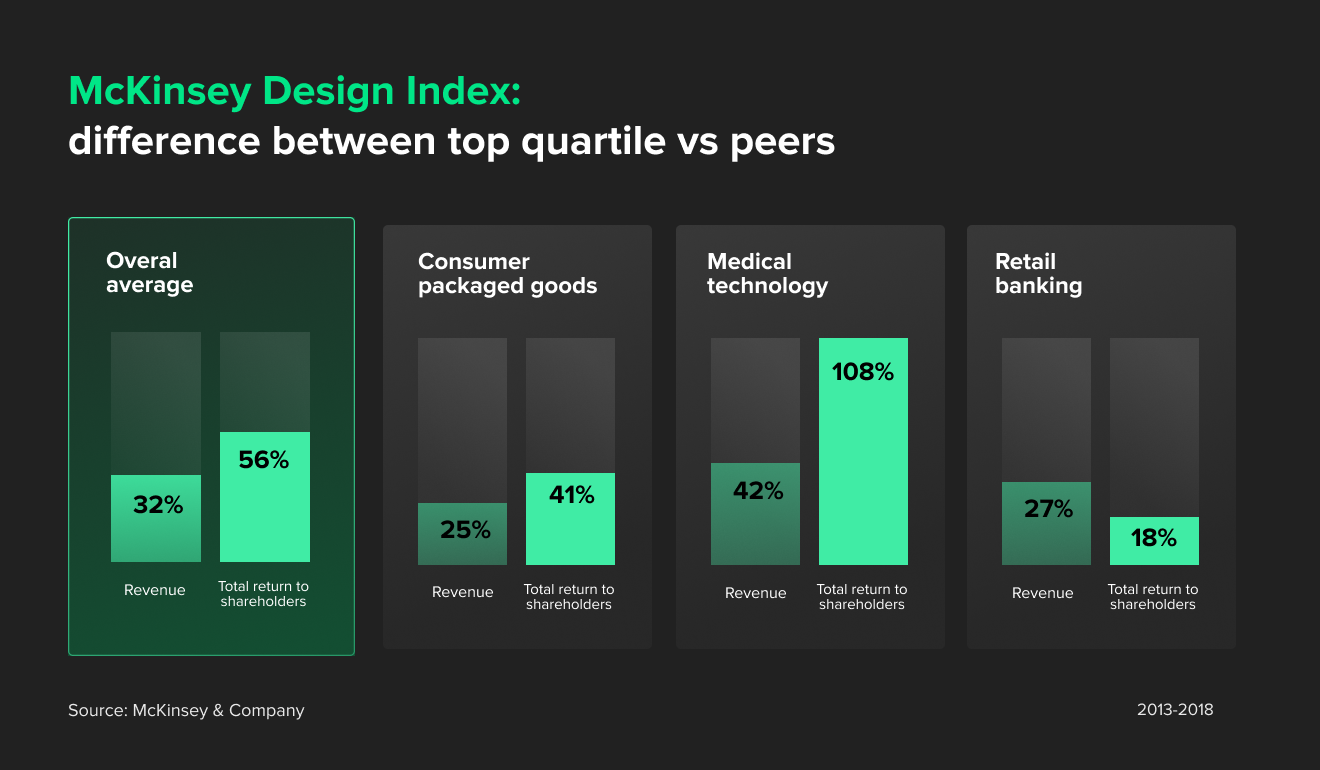

What does it take to succeed at digital innovation?

These four pillars of digital innovation serve as an essential foundation for wealth managers looking to stay competitive in the new digital reality. But while their necessity is unquestioned, execution is another matter.

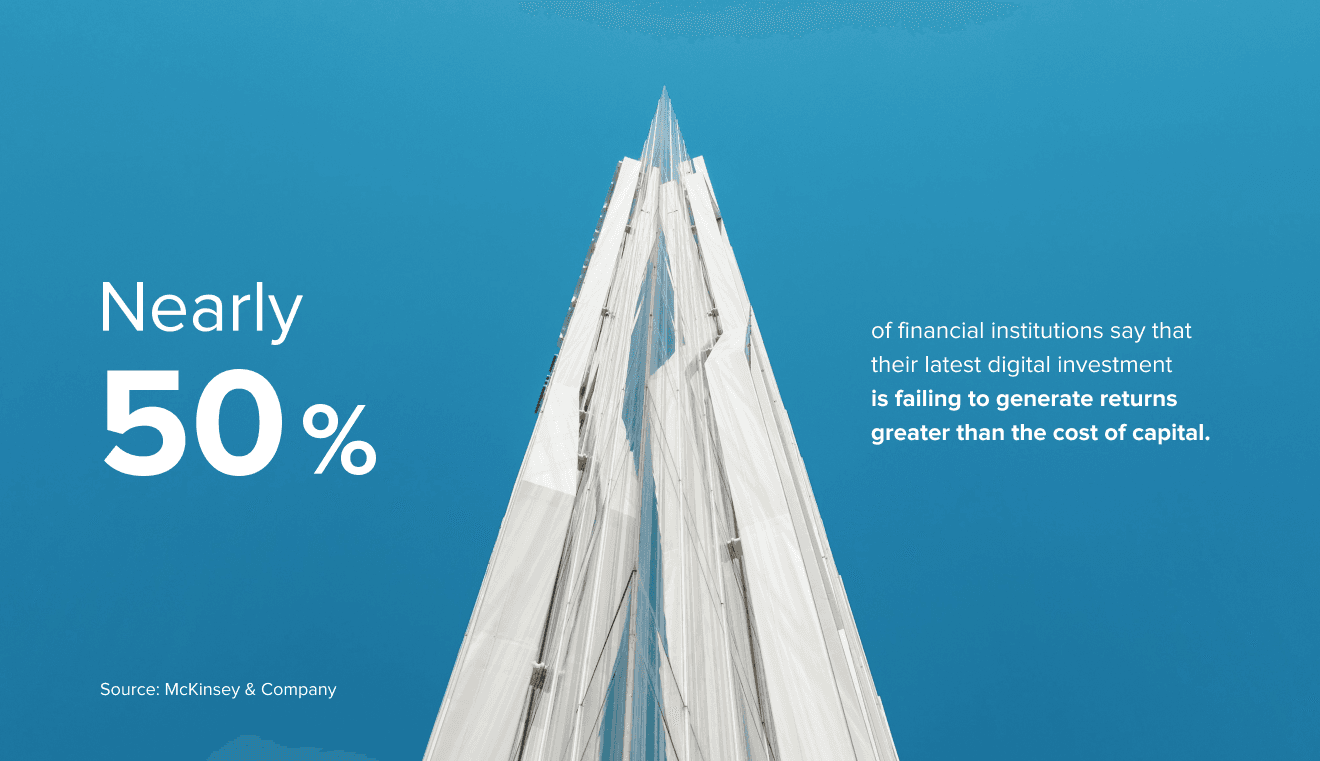

The data shows that not all efforts will create the desired results. As McKinsey found, 47% of financial institutions said their latest digital investments were not generating returns over the cost of capital.

What separates the successes from the failures? According to McKinsey, a lot comes down to something they termed the “flywheel mindset”.

In the flywheel mindset, improvements and innovations are not seen as a “one-off” thing. Instead, they are recognized as a continually evolving capability — a flywheel that can be turned over and over again over the long term. Think of the Japanese concept of “kaizen” or continuous improvement.

At Star, we specialize in helping firms build this flywheel of innovation that they will be able to keep turning for years to come. Supported by our expert team of designers, engineers, and strategists, we provide an end-to-end service that helps you take your idea all the way from conception to market. From building apps to platforms to entire ecosystems, we have you covered.

We have developed front-end apps that enable frictionless customer onboarding all the way to mapping and creating complete integrated omnichannel customer journeys for our multinational clients. If you are a financial services firm looking for a partner that can help guide you on your digital innovation journey, look no further than Star.