Through open banking, financial are now able to build innovative, personalized products and services that they couldn't before. And it's reshaping A2A payments and the entire banking system.

What is an A2A payment?

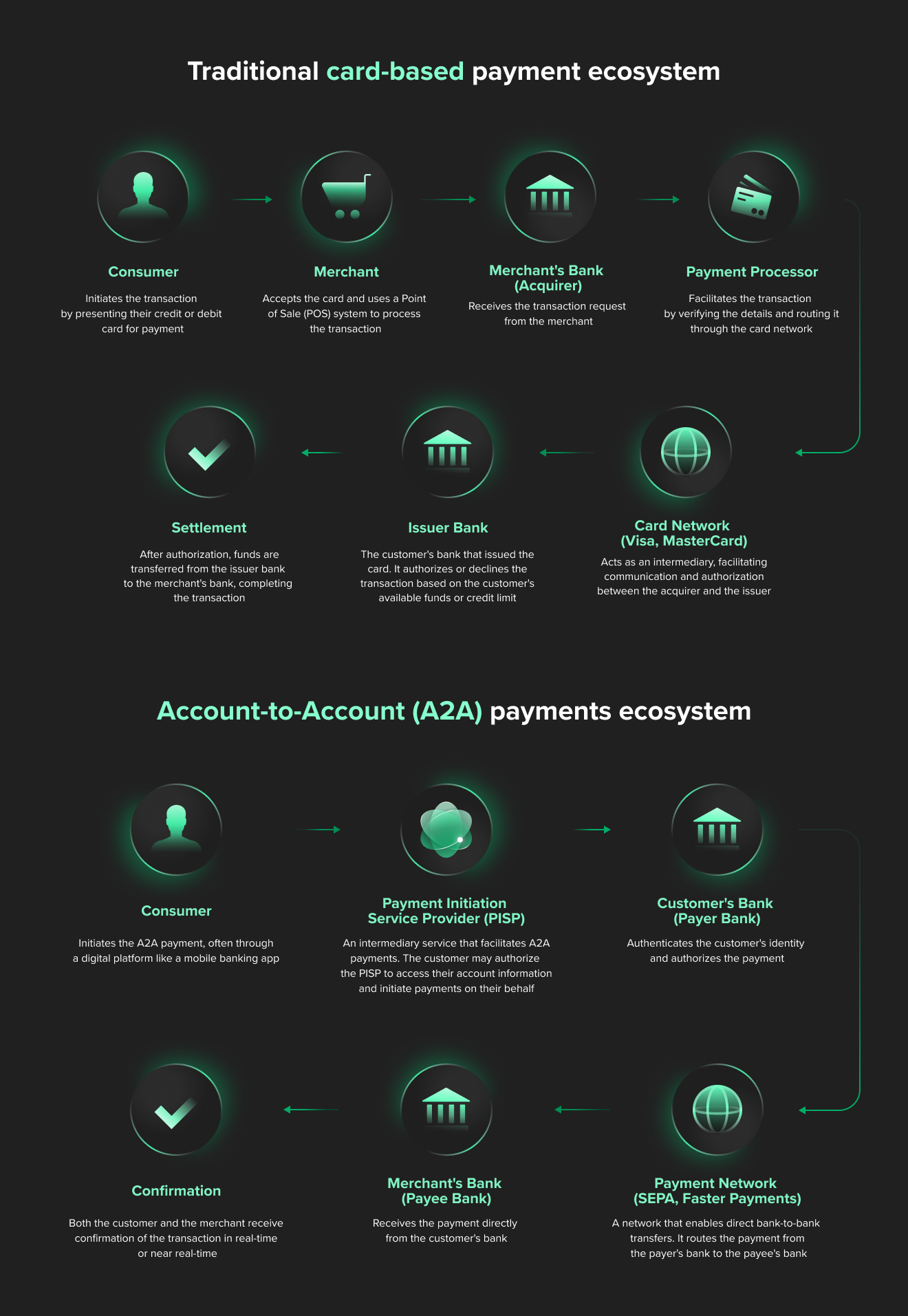

An A2A (account-to-account) payment is a direct transaction exclusively between two bank accounts, without the need for intermediaries like bank cards. In contrast, Open banking serves as a technology enabling the sharing of financial data among banks and third-party service providers, facilitated through application programming interfaces (APIs).

It's therefore useful to point out a key difference: whereas open banking payments are A2A payments, A2A payments are not necessarily open banking payments.

According to The 2023 Global Payments Report, A2A payments are expected to grow 13% annually through 2026, driving the global e-commerce market to $850 billion. Notably, A2A payments have already claimed the throne as the leading online payment method in some markets such as Finland, Poland, Nigeria, Malaysia, Thailand, and the Netherlands

Types of A2A payment

There's two types of A2A payment:

- Push payments are when a customer sends (or "pushes") money to you. For example a bank transfer

- Pull payments are when a business (or individual) withdraws or "pulls" money from a customers account. An example would be a direct debit or any kind of subscription.

Within these, there's a variety of different A2A payments, each serving different needs, transactions and scenarios:

- Business-to-business (B2B): These are transactions between companies, often involving large sums for goods, services, or operations. Account-to-account (A2A) payments streamline cash flow and can integrate with ERP systems for automated processing and reconciliation

- Business-to-consumer (B2C): Used by businesses to send funds directly to consumers — for example refunds or payroll — offering speed and convenience

- Me-to-me: Also called intrabank or interbank transfers, this refers to moving money between one’s own accounts, useful for budgeting, saving or investing

- Peer-to-peer (P2P): Commonly facilitated by mobile apps and online platforms, P2P payments allow individuals to transfer funds directly without using traditional financial institutions. This type of payment is popular for splitting or other transactions among friends and family

Disrupting traditional networks with A2A payments

By creating transactions that flow directly between accounts, you can "buy-pass" the card networks and the associated service and interchange fees levied on the merchants on those transactions. It will also simplify peer-to-peer (P2P) transactions as well as the disbursement e.g. central bank digital currencies (CBDC).

In response, and so they won’t miss out on the shift in payment technology, the major card network operators have invested heavily in Open Banking and A2A capabilities. Visa acquired Tink, a major European open banking platform and Mastercard bought Finicity in the US and Aiia in Europe to offer these services. They are also building so-called multirail solutions allowing payments to flow across networks without the merchant or end-user needing to adapt their processes.

Open Banking vs A2A payments

Not all merchants are equipped to accept card payments, and not all consumers and small businesses have a payment card. A2A payments enable merchants to receive payments directly into their bank accounts, bypassing the card networks. This accelerates settlement times, enhancing cash flow and eliminating the often cumbersome and error-prone data entry process.

Consumers can seamlessly approve payments within their banking apps, often utilizing app-to-app redirection and biometric authentication, streamlining the process and eliminating potential issues like false declines and authorizations.

However, it's important to acknowledge that A2A payments come with certain trade-offs. While they offer efficiency, consumers may forego loyalty benefits such as air miles or discounts associated with card usage. Additionally, open banking payments lack the chargeback protection afforded by credit cards, a significant consumer benefit. Credit cards also provide the flexibility of installment payments, spreading the financial burden of a purchase over time.

Open banking also simplifies the sharing of data for use by lenders and others who need to verify someone’s income for affordability purposes for example. By using actual data (as opposed to volunteered information from the applicant, or manually collected documents such as bank statements) you can reduce operating costs and improve the accuracy of credit scores.

This again should lead to lower default risk and credit losses, and subsequently better pricing for customers (or improved margins for lenders).

Other examples are companies using A2A payments to pay contractors or service providers for their work. This streamlines transactions, reduces costs, and enhances security and transparency, or businesses can use A2A payments to directly pay their customers or clients. This can include processes like paying employee salaries, vendor bills, issuing customer refunds or settling insurance claims.

Lead the A2A banking change

In e-commerce, payments have emerged as a pivotal element in a compelling customer proposition. The rapidly innovating payment space presents both exciting opportunities for early adopters and inherent risks for those lagging behind. Recognizing the fickleness of customer loyalty, ensuring a seamless and satisfactory payment experience becomes a critical aspect, often serving as the concluding touchpoint in the customer journey.

At Star, we assist our clients in navigating this dynamic terrain. From aiding in partner selection to facilitating decisions between buy-vs-build approaches and devising effective go-to-market strategies across diverse geographies, our expertise ensures clients stay ahead of the curve.

Our non-exclusive partnerships with key vendors with cutting-edge payment technologies, enable us to orchestrate swift and successful market launches for new payment solutions, catering to the needs of FinTech, banks, and other enterprises.

Moreover, our user experience (UX) and customer journey teams can craft tailored user interfaces that go beyond mere functionality. These interfaces are designed to deliver impressive customer experiences while also streamlining backend processes. This dual focus not only enhances customer satisfaction but also simplifies internal workflows and elevates data management practices.

At Star, we are committed to ushering our clients into the future of A2A payments, ensuring they have the most competitive solutions in this era of transformative financial technology. That's why we put together this guide on the future of digital banking, so our clients know how to stay ahead of the game for the next decade. Check it out below.