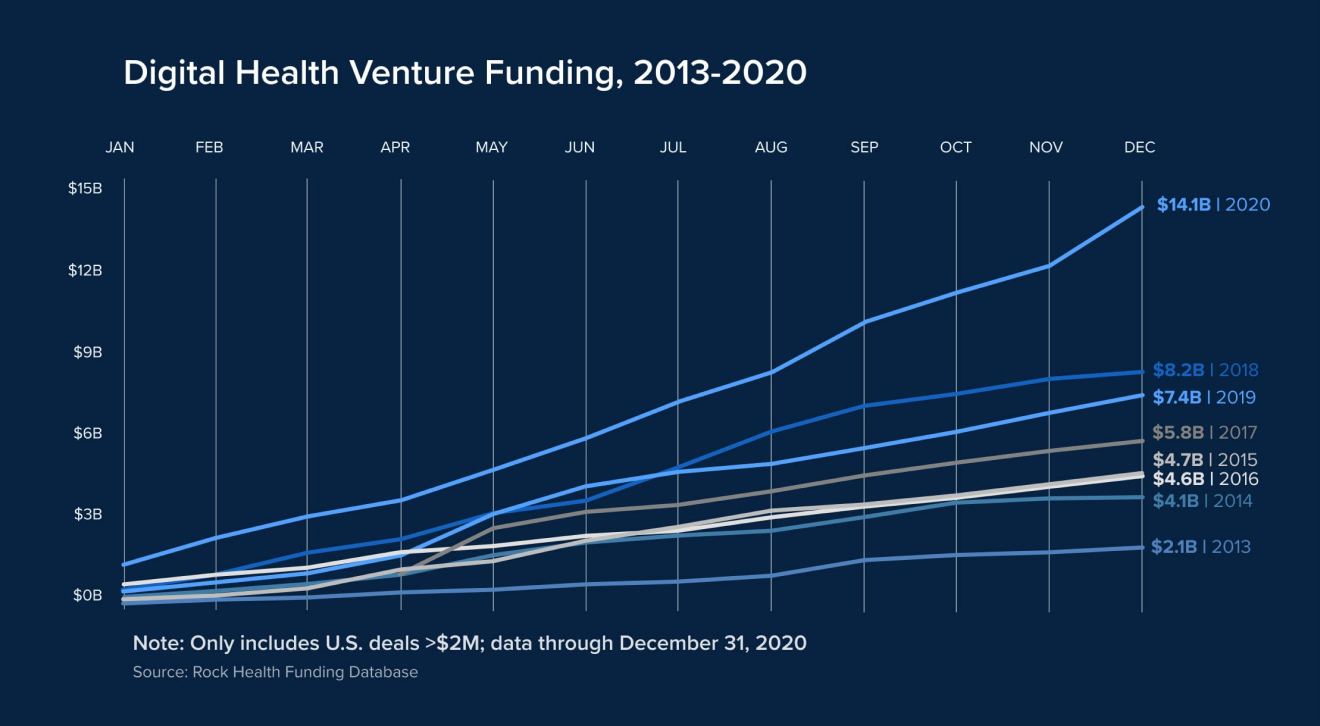

Digital health seemed to accelerate from 0 to 60 in about three seconds this year. That doesn’t tell the full story, of course. Before the pandemic, 2019 saw 359 US digital health startups raise $7.4 billion from over 600 investors. It was nearly a record-breaking year.

But what a blockbuster year 2020 was for digital health! As healthcare facilities struggled with pandemic-driven challenges and continue to do so, digital health technologies — from remote consultation to remote patient monitoring, AI-driven solutions, and more — have managed to relieve an incredible burden from them. Consequently, the broader consumer, provider, payer, and investor bases have all started to understand digital health’s immense and transformative potential.

It was one huge acquisition, merger, IPO, or another market move after another. For example, one huge surprise from Q4 2020 was Babylon. Babylon is another telehealth startup that specializes in AI chatbots, information technology, remote triage, and genomic data analysis and in $737M in funding just from Vostok New Ventures.

In 2020, not only were more deals closed, but digital healthcare companies raised more on each deal, raising a total of $14.1 billion. Average deals reach nearly $30M, though this also into account the 40 mega deals that exceeded $100M.

The pace only seems to be accelerating as many of these deals were inked in the past six months speeding up rounds from months to just weeks.

Investment isn’t just in startups but also in enterprise companies that are acquiring startups and investing in new technologies. In short, even with a vaccine and the promise of an end to the pandemic in sight, the market has woken up to how much digital health will revolutionize the healthcare industry.

See DTX in action. Check our recent webinar co-hosted with Neurotrack.

Trending technologies and sub-industries

There were 440 deals in 2020 ranging across a wide array of digital health sub-industries.

Although COVID-19 created a new health paradigm, a significant portion of investment remained consistent with trends from previous years. On-demand healthcare and research and development are still the dominant categories. It makes sense as the pandemic has focused the importance of further developing these key investment areas.

On-demand health particularly is the most tangible investment for the market to grasp. Teladoc’s $18.5 B Livongo Acquisition is essential to pay attention to for a few reasons. This sensational deal makes it clear just how valuable the virtual care model will continue to be. But there’s more to it than that. Teladoc is also integrating further services to expand further its connected devices, virtual touchpoints, and AI-driven health offerings.

Research and development have seen a flurry of activity as well. Alphabet-backed Verily raised another $700M to bring their total disclosed funding to $2.5B. Verily received acclaim as an early responder to COVID, creating a large number of testing sites so this wasn’t too surprising. From here, they leveraged the data to develop tools to help employers and schools safely bring back people to the office and classrooms.

What we’ve seen from Verily is this potent combination of data science, personalized medicine, user-centric apps and dashboards, and disease modeling that all prove incredibly now and in the future.

The bottom line is that whether it's a merger, acquisition, or new funding, enterprise activity will continue. There is a lot to look forward to, including solving reimbursement, regulatory, and just generally improving user experience to ensure digital health stays on this growth path.

2021: The year of DTx

At Star, we’re also deeply interested in digital therapeutics (DTx). While DTx companies didn't have the same staggering numbers as other digital health firms, they are attracting more attention and they’re such a great example of mobile health beyond the traditional healthcare facility. DTx investments have grown on average by 40% over the past seven years. For example, leading DTx provider, Omada Health raised $57 million last year, less than 12 months after raising $73 million.

We’ve also been following Click Therapeutics closely. During our recent DTx webinar, we featured a small segment on their Software as a Medical Device (SaMD) DTx breakthrough that harnesses big data, benchmarks, peer support, and other powerful tools to help people beat their smoking addiction.

And that’s just the beginning, Click Therapeutics is diversifying its portfolio of medical apps and extending into mental health, insomnia, migraine, and even acute coronary syndrome.

In 2021, we anticipate the speed of DTx investment to accelerate further as more DTx products and solutions are achieving FDA clearance like Mahana and NightWare.

Startups/early stage and new funding in 2020

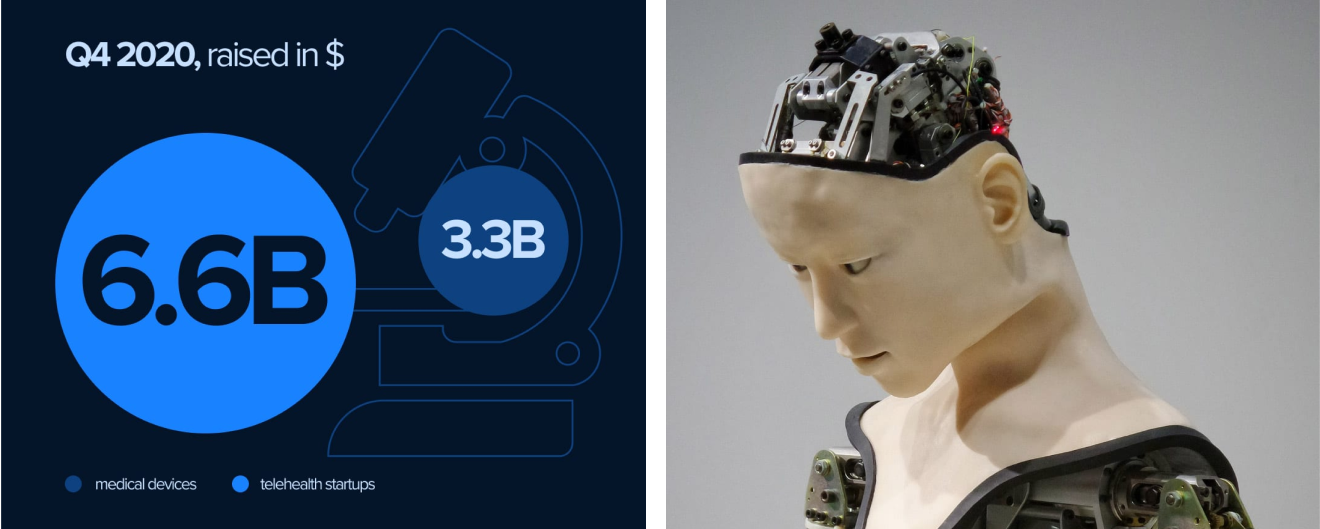

2020 was a healthy blend of investment into early, mid, and late-stage deals. Telehealth startups alone raised $3.3B in just Q42020, while Medical Devices raised $6.6B in the same period.

There’s so much activity here that it can be challenging to know where to even begin looking at. One area worth paying attention to is AI. While that’s a broad term as AI is everywhere in digital health, keep an eye on a few highly significant applications.

First is genomic and precision medicine. We saw numerous deals like the $110 million that SOPHiA raised. SOPHiA is a precision medicine startup that uses machine learning to analyze genomic data to assist providers with making clinical decisions.

Likewise, investors have seen the importance of AI for facilitating provider workflows. AI’s ability to crunch numbers and improve efficiencies and reduce clinical burden as work behind the scenes in delivering interoperability has been impressive. Olive harnesses robotic process automation to reduce manual provider workflow across a wide range of non-clinical and clinical activities such as claims processing and revenue cycle management. They raised $226M with backers, including Google and Sequoia Capital.

No look at the market would be complete without exits, and there were some major ones toward the end of the year. We’ve already mentioned some significant mergers and acquisitions, but we also had IPOs and special purpose acquisition company (SPAC) activity.

Exits

We saw six major digital health IPOs: Accola, Amwell, GoHealth, GoodRx, Outset Medical, and Schrödinger. Nobody was too surprised by GoodRx's $1.14B IPO in late September considering both the importance and convenience of its telehealth and prescription health services. But it is worth noting the more than 50% jump in its stock prices on opening day. Though share prices have gone down slightly since then, they’ve remained stable — and remember we are only talking about a couple of months!

SPAC activity is equally, if not more impressive, and may signal a growing trend in that direction. SPACs raise money through IPOs but then use that capital to acquire or merge active companies. Oaktree Capital Management’s SPAC acquisition/merger of telehealth provider Him & Hers for $197M was just one of the major deals to roll in toward the end of the year.

Finally, looking outside the US, we can’t mention exits without talking about the phenomenal IPO of Chinese e-commerce giant JD on the Stock Exchange of Hong Kong. Its health unit JD Health raised nearly $3.5B. With more Chinese tech giants pushing into digital health, we can expect further blockbuster numbers like these in the Asian markets.

What’s next?

Expectations are high. So much capital has been invested in digital health. Now it’s time for these companies to show what they can do. Whether it’s scaling up to reach wider audiences, integrating new technologies, focusing on developing interoperability, or all this and more, 2020 will be remembered as the landmark year for digital health.

At Star, we’re driven by digital health innovation. We work across the ecosystem from breakthrough startups to large and established enterprises looking to harness innovation to drive disruptive growth.

We offer end-to-end product development from ideation through launch to help you discover and execute game-changing value-based healthcare. From here, we bring the latest technology from AI and ML along with deep interoperability, certification, and compliance expertise.

Deliver on digital heath’s potential. Connect with our experts now to learn how.