Welcome back everyone to the next installment of our brand-new season of Shine: a podcast by Star.

In case you haven’t heard, Season 2 is all about uncovering new and exciting answers to what we call the big WHY – the questions, ideas and challenges transforming every major industry and our world at large.

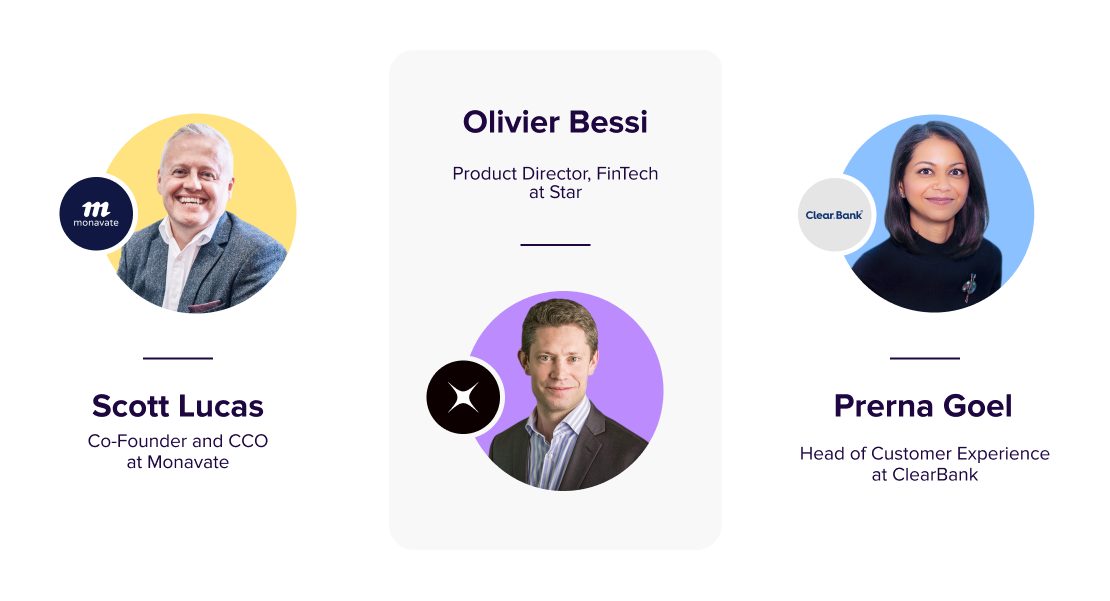

In this second episode, our host Tom Hunt kicks things off with Olivier Bessi, Product Director of FinTech at Star, Scott Lucas, Co-Founder and CCO at Monavate, and Prerna Goel, Head of Customer Experience at ClearBank, to take an in-depth look at why the evolution is happening in today’s FinTech ecosystem.

Below, we’ve put together just a few of the thought-provoking insights they explore, but this FinTech-focused podcast is one you don’t want to miss. Make sure to listen to the full episode.

Defining FinTech technology and its roots

With decades of their careers dedicated to the development of modern FinTech, our expert panel starts by looking at its origins.

Here’s what they had to say:

FinTech is technology-enabled finance. For anyone new to this world, FinTech is short for financial technology. It started with firms that were essentially competing against traditional financial service providers, such as banks and brokers, to provide financial services to consumers or businesses. But, as Olivier Bessi notes, what made them different was “putting technology at the core of their financial processes and customer offerings.”

Crisis and distrust led to FinTech’s rise. Scott Lucas remembers the global financial crisis of 2007-2008 as a critical part of this story. While governments around the world provided massive bailouts to prevent a collapse of the world’s financial system, it did not stop people from losing trust in their institutions, including banks. Together with a better understanding of electronic money institutions (EMIs), consumers were more open to non-traditional methods and had different financial options through digital technology.

Regulators and consumer behavior fast-tracked the trend. FinTech wouldn’t be what it is today without these two major influences, according to Prerna Goel. She says, first, that regulators did an exceptional job rethinking a financial ecosystem that promotes competition with more players offering better customer outcomes. The second was a shift in consumer behavior with smartphones and users getting better awareness of the possibilities of technology, which “creates a perfect environment for technology to start solving consumer needs.”

Subscribe on Apple Podcast | Subscribe on Spotify

The new global norm of open banking

Later in the discussion, the panel reflects on their own services offered at Star, Monavate and ClearBank to dive deeper into the most disruptive technologies and how both startups and banks are benefiting from them throughout the industry.

Some of these end-to-end opportunities include:

Bank Identification Number (BIN) sponsorship: For a small startup, a BIN sponsor can be transformative. Basically, Monavate uses its card scheme license and card scheme collateral with Visa, Mastercard, and others to help clients to cheaply and efficiently issue cards for target consumers or business colleagues. Scott says, in the past, “anything less than 9-12 months [for this service] was just unheard of” because of the endless form filling, multiple certifications and payment fees that were needed. Now, with a BIN sponsor, anyone can go “from scratch to issuing cards in four to six weeks.” This speed to market is often the deciding factor for many innovative concepts to survive.

Banking as a service (BaaS): This describes the ability for licensed banks to provide their banking license to non-banks so they, in turn, can offer banking products like payment processing, current accounts and secure API services. Similar to BIN sponsorship, BaaS providers deal with another extremely expensive and time-consuming process, in this case dealing with the banking license, to make banking technology and services accessible. As Prerna explains about ClearBank, “we are enabling FinTechs to focus on their core competency [of interesting customer experience], and they can outsource their banking management to us.”

“X-as-a-service”: In addition to these, there are a number of other “X-as-a-service” functions popping up that make up the ever-expanding world of open banking. While traditional banks and legacy systems are adapting in different ways, open banking is finally providing that user-friendly link between financial institutions, third-party developers and consumers to fuel innovation across the ecosystem.

Sustainable FinTech solutions for the future

While many FinTech startups will come and go, there will also be the ones that stick around to transform the industry for good. And that’s kind of the point. The ease and affordability that FinTech brings to once-unimaginable financial services are bringing a newfound consumer-first approach into finance and an open competitive environment for ever-more players.

But is FinTech as we know it today just a fad, or will it be around forever? Listen to the podcast now to hear directly from the experts about what opportunities and challenges lie ahead for banks and startups alike.