Star is a global team of product creators.

Whether you are a start-up or an enterprise, we help you innovate, transform, grow and prosper.

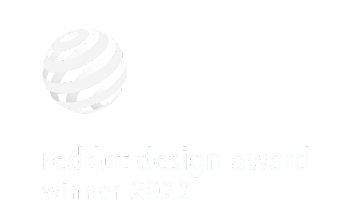

Client stories

See how Star helps companies

go from idea to market and beyond

Services

At Star, we’re all about co-creation. From ideation through launch,

we work with our clients every step of the way.

Contact us now

Learn more about how Star can help you bring game-changing ideas to market.

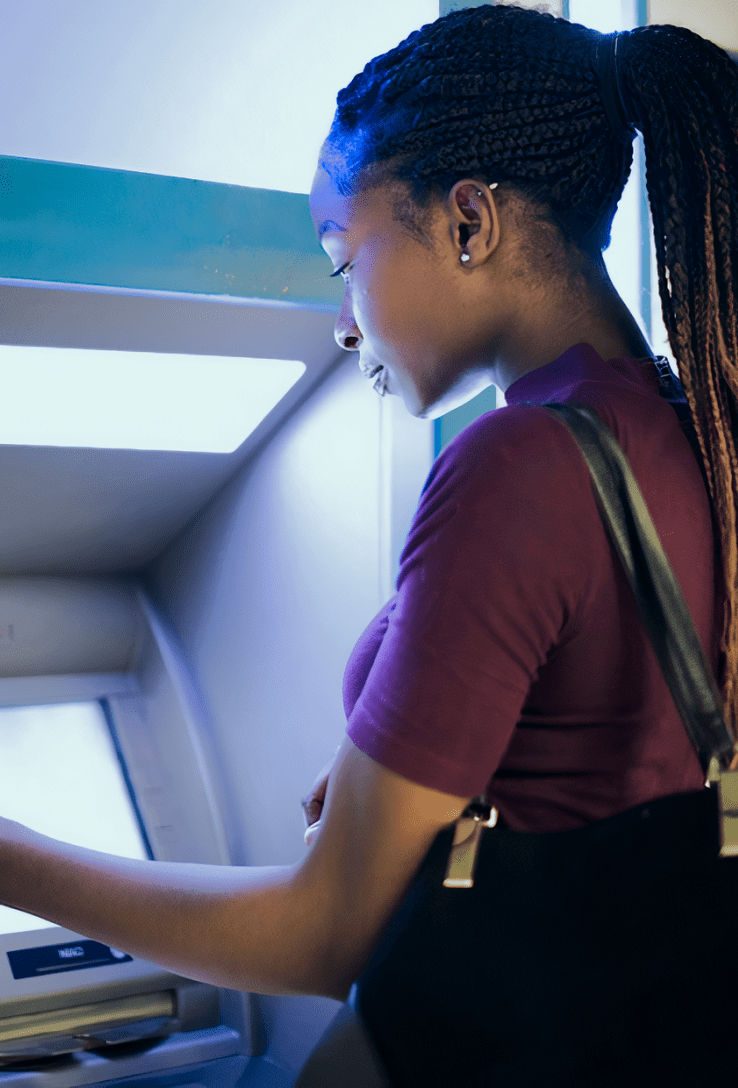

Industries

We harness the latest technologies, cross-industry expertise and endgame thinking to ideate, build, launch and scale superior, user-centric products that drive impressive commercial results.

Our Work

Human-centered design, strategy and engineering in one seamless workflow.

Here’s how we help our clients define and reach their endgame.

Co-create with our

cross-functional teams

Partner with Star to accelerate your product journey.

350+ delighted customers

We are trusted by...

Achieve excellence with Star

Check out the awards and recognition our partners have received.

Get in touch