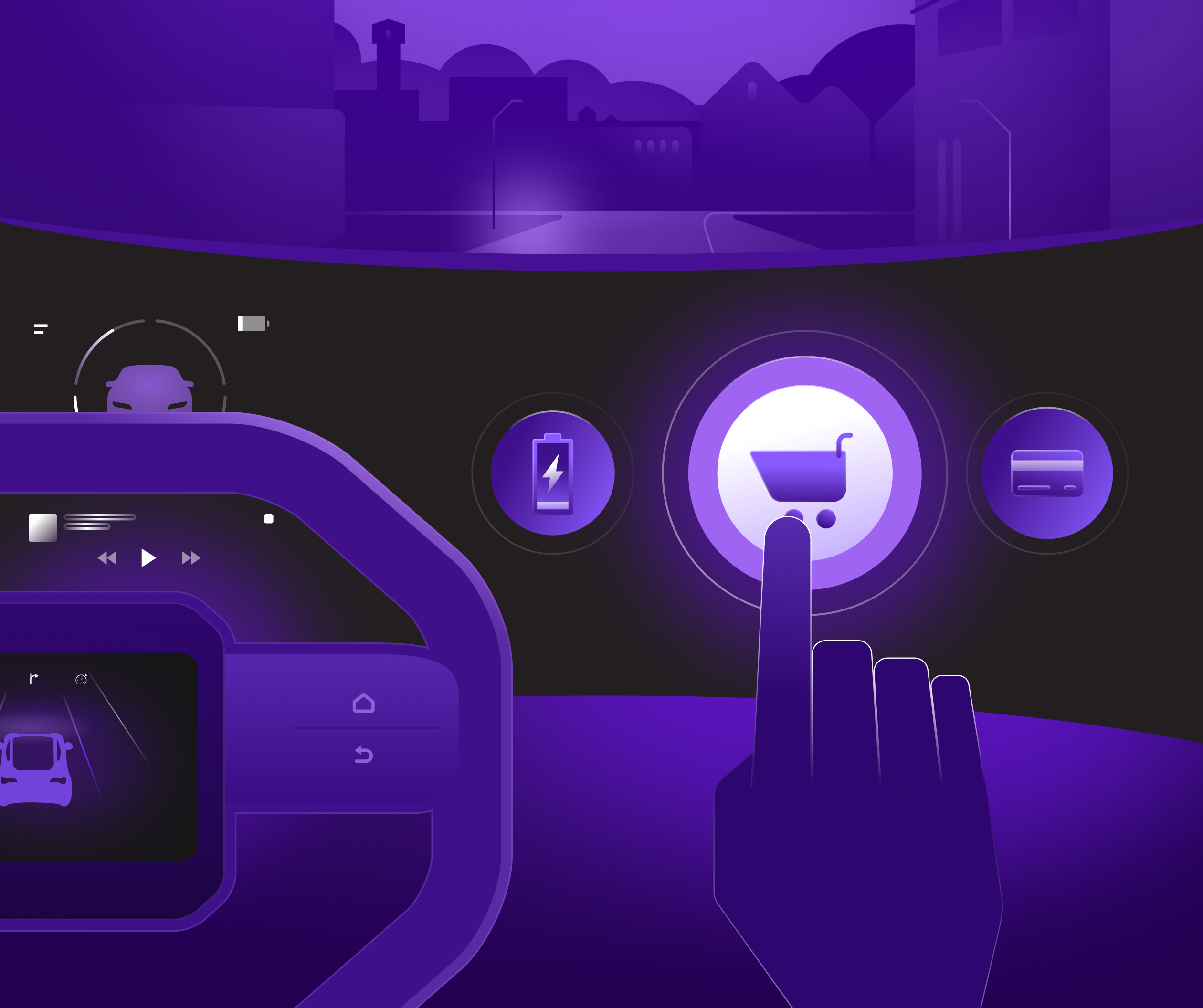

In-vehicle payment solutions are bringing together the best configurations in software and hardware for seamless, connected consumer experiences in the integrated mobility ecosystem. In 2023, global in-car payments services grew to $3.87 billion, and this figure is expected to soar to $5.5 billion by 2027.

The incentive for OEMs to develop in-car payments is not driven solely by its potential to diversify and increase revenue streams but by its promise to elevate the user journey. From gas, tolls, parking, maintenance, registration, and even insurance, companies like Mercedes-Benz have already developed an in-house payments solution, Mercedes pay+, for the German market. Hyundai has brought the smartphone experience into their EVs, with a connected car system that allows drivers to pay for food, parking, and EV charging. Other exploratory use cases span an even larger network, where car manufacturers may even offer their own marketplaces for used and new cars at the expense of the dealership model, and card issuance.

At Connected Vehicle Systems Alliance (COVESA), Star's Head of FinTech, Olivier Bessi, joined a panel of FinTech and Automotive experts to discuss the growing pains and key considerations for automakers embarking on their own payment solution journeys.

Getting payments right the first time: customer needs and sensible offerings

In-car payments are easing the customer journey for getting the car on the road and keeping it in motion. So, how can OEMs get their payment solutions right the first time? The answer lies unsurprisingly, in understanding your target consumers’ needs and shaping your offerings accordingly. This includes sensible subscription models for car ownership or data services within the vehicle, providing personalized content to consumers with traffic alerts, data plans, and various entertainment and service levels.

While in-vehicle payments may seem like a logical extension of the in-car customer journey, customers still need to have a reason to make in-car payments safely, efficiently, and effectively. Turning the vehicle into another connected device in the payments and mobility ecosystem could considerably differentiate your brand and services from other car manufacturers. For example, if a customer has a flat tire and needs roadside assistance but can’t afford to pay for one upfront, providing buy now, pay later (BNPL) solutions as a roadside payment solution could boost subscription-related services and foster customer loyalty. Alternatively, imagine your customers receiving service alerts, scheduling and paying for a service appointment, and stopping for a meal along the way – all without leaving the car or navigating multiple clunky payment methods and devices.

Learn more about the in-car payments landscape in our research report

Developing in-car payment solutions: key OEM considerations

While the customer remains the focal point for car manufacturers, differentiating your vehicle from the competition requires several nuanced, technical aspects beyond developing your own in-car payment solution or outsourcing it to a third party. These considerations include:

- Standardization versus personalization. Striking a balance between seamless, customizable, and enjoyable touchpoints for in-car payments will invariably change with OEMs’ target group. When it comes to configuring for customer segmentation, user experience, and personalization in the vehicle, the priorities of an OEM will depend on their core competencies and willingness to use approaches like the payment facilitator model.

- The right expertise at the right time. Automakers should partner with financial services companies that have the appropriate expertise, strategy, and roadmap to handle and protect consumer data, develop safe payment solutions, and comply with consumer data privacy. The ideal partner could develop bespoke payment solutions, considerably easing OEMs’ entrance into complex regulatory environments and the digital payments ecosystem.

- A holistic FinTech approach. In addition to tokenization, API integration, card and subscription management, devising a holistic approach to payments and access to a strong network of payments partners is crucial for OEMs looking to launch their own payment solutions.

- Regulatory compliance, security, and consumer data privacy. Transforming your vehicle into a device in the payments ecosystem depends on how securely and seamlessly you can protect, store, and analyze customer transactional data. Panelist Dan Strunk (Sr. Enterprise Ecomm Business Development Manager, WorldPay) underlined the importance of regulatory guidelines and country or region-specific consumer privacy, cybersecurity, and payments compliance. Connectivity and reliability will also differ, creating further challenges for OEMs depending on their customer base.

Car manufacturers gearing up for the challenge of developing their own payment solution (or outsourcing it) should also recognize that rolling out an in-car payment solution or payment-related features in the car is not enough without sustained customer adoption. This means linking payments to loyalty or rewards programs, viable subscription models, and seamless payment features across the in-car and companion app user journey. Ideate, develop and create thoughtful experiences from the get-go that will help OEMs establish enduring customer loyalty in the long run. Develop vehicles that are more than just another digital wallet or payment device.

Ready to take on the payments challenge?

The largest hurdle for automotive manufacturers venturing into financial services is the lack of sufficient payment specialists in the automotive space. Although customer base and connectivity will differ from country to region, car manufacturers must devise payment solutions that meet consumer privacy, financial data, cybersecurity, and payment compliance while attending to evolving customer needs.

Partnerships are paramount for the longevity and success of OEM payment solutions in the automotive space. Establishing the right financial ecosystem partnership will translate to building better solutions well-suited to your customers and offerings in the short and long term.

Whether it’s payments acquiring, card issuance, digital design, companion app development, regulatory compliance, or transactional data analysis, Star’s FinTech and Automotive & Mobility Practices can help car manufacturers progress through their development lifecycle efficiently with tailored solutions for your business and customer needs.

Tap into our cross-industry expertise and network of payments experts and partners today – experience what a productive partnership can do for your business goals.