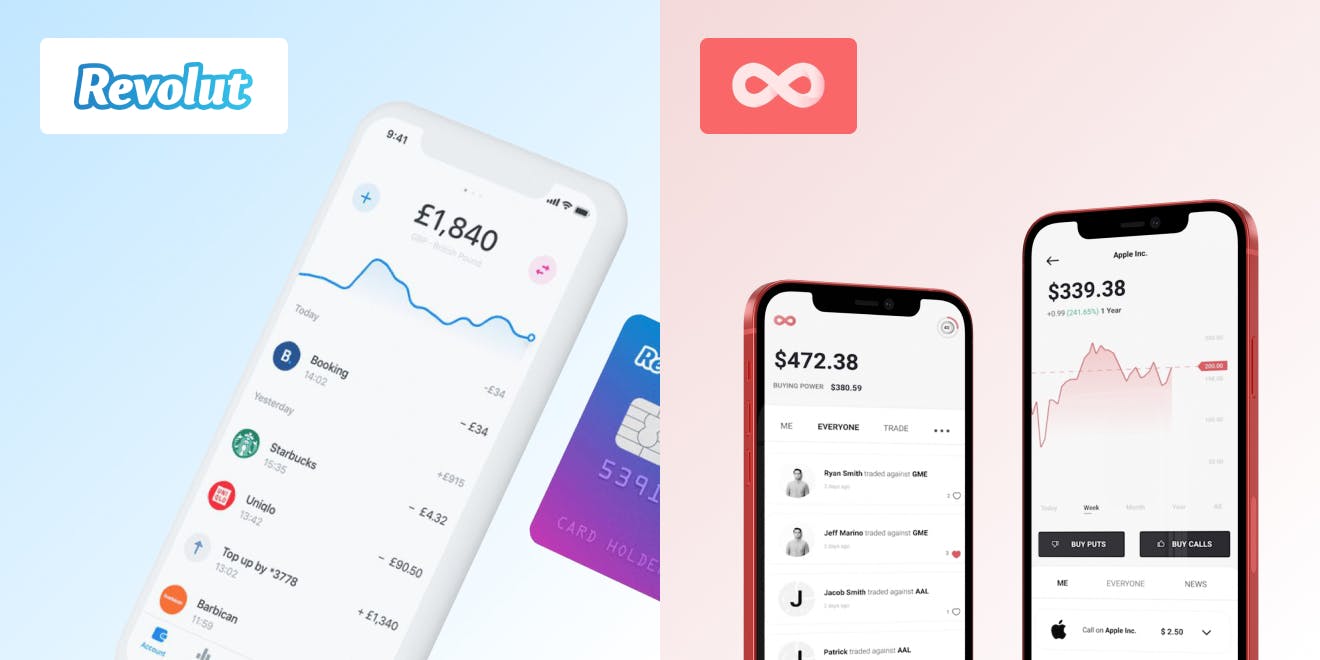

We have entered the next generation of digital payments. Thanks to FinTechs like Revolut, Gatsby and Stash and many others, staying on top of your finances is so easy, it’s automatic.

But where can FinTech go from here? How else can it transform our lives? So far, we’ve only scratched the surface. Being inspired by the tech trends across industries like digital health, automotive & mobility and others, we’ve found that there is a huge opportunity for emerging technologies to fuel the evolution of FinTech now.

The key is harnessing cross-sector tech and design codes that will fast track trust building and deliver on FinTech’s true potential.

Using our analysis of one of FinTech’s most dynamic subcategories - personal wealth management - as a foundation, we’ve created visionary concepts of how trustworthy, cross-sector influences can drive us to envision new ways of embedding trust into all FinTech experiences.

Don’t just keep pace with industry evolution. Here’s how you can ignite and lead change in digital finance.

Embracing change drivers in personal wealth management

Personal wealth management (PWM) is a microcosm of the greater changes in finance and broadly across our global economy and society.

As personal participation in the stock market grew 55% globally on mobile devices in 2020, trustworthy experiences are more crucial than ever as a new generation of millennial investors inherit wealth. That’s because they blend accessibility with affordability to empower everybody to invest - whether that’s $5 a month or $5000.

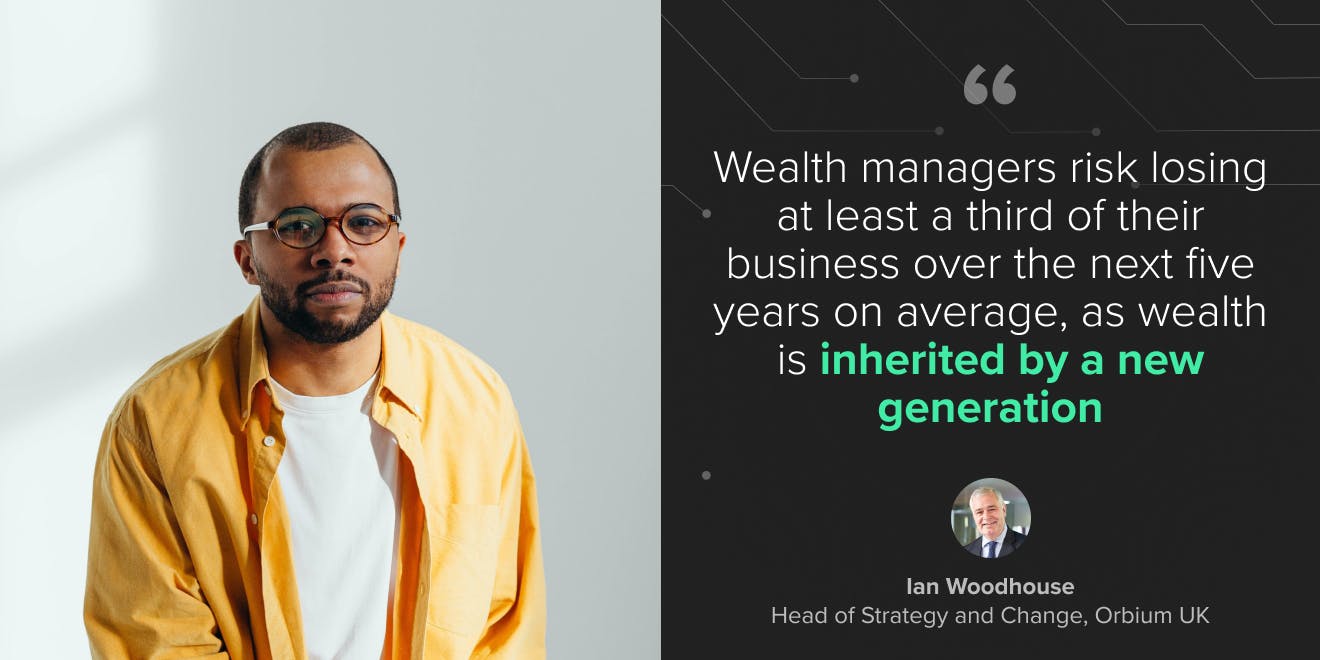

Meanwhile, over the next five years, traditional wealth managers risk losing at least a third of their business as this new generation inherits wealth. Not only do millennials have little loyalty to their parent’s wealth managers, their expectations are high for personalization. 66% of them are likely to fire their parent’s advisors after they inherit.

Engagement and empowerment, rather than just advice, are key to coaching the largely financially illiterate yet digital-aware generation. They will spend time investigating and exploring market dynamics but admit they need help to navigate the twists and turns of the wealth journey. This is especially true given the foundational link between financial health and overall health and wellbeing.

Finally, data-driven services for customers of all types are essential. Not everyone who needs or desires wealth management services can access (or qualifies) for face-to-face services. Scaling coaching services is tough if you don’t embrace technological solutions that either allow collaboration via remote access to more advisors or complement their expertise with AI functionality, and that's where robo-advisors will increasingly play larger roles.

It’s now or never for traditional wealth management - and similarly the broader ecosystem of finance incumbents - to step up and embrace these changes. It's up to them to create the next generation of their consumer experience designed specifically for the next generation themselves.

That begins by truly understanding what makes people tick, so there’s no better time for you to meet Ellie.

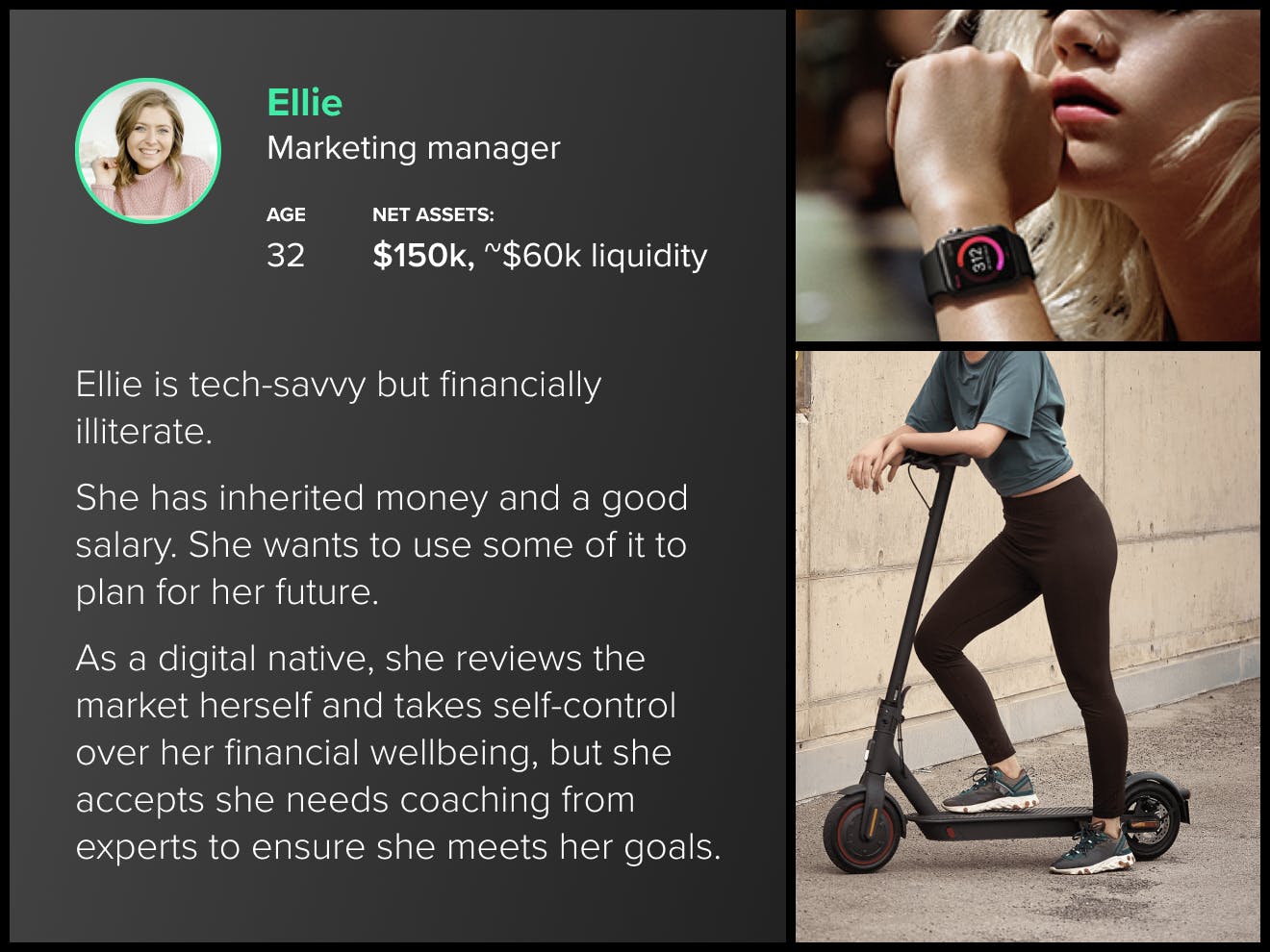

Meet Ellie

Aspirational user personas are a great way to build empathy for people’s needs and desires. They focus designers on what really matters to people and inspire them to translate insights into impactful designs that solve real needs in the context of their lifestyle.

Personas represent the attitudes of segments of the target audience, providing comprehensive and translatable insights that focus on real needs and engagement drivers.

Now meet Ellie, our aspirational persona. She is very tech-savvy but isn’t as financially literate. Not only does she have inherited money, but a stable career path and is looking to plan for her future.

Unlike her parent’s generation, however, she is prepared and able to review the market to find the right tools for her needs. But she does realize that she needs coaching and guidance from experts. Ellie doesn’t need a dedicated financial advisor at this point, despite her not insubstantial assets.

In short, Ellie’s financial management needs can be broken down into these three main components:

- Customer experience (CX)-driven FinTech apps that consolidate her financial interests

- Educational materials and coaching

- Long term planning and recommendations

Ellie may not be a millionaire (yet!), but she is the opportunity that FinTech providers like Revolut and Acorns have increasingly capitalized on. The average age of a Robinhood user is 31, relatively young compared to other investment apps. With 13 million users, it had the most finance app screen time in the US during 2020 and currently has 13 million users, and people like Ellie are far from their only users. People can start investing with as little as one dollar or transfer an existing portfolio.

But recent behavior from some of these firms has thrown their trustworthiness into the spotlight. On the consumer side, users like Ellie need to be grown enough to realize they aren’t perfect and have much room to grow in their financial literacy, which includes possibly replacing financial services from bad actors.

Simultaneously, providers can seize this window of opportunity to show why they are worthy alternatives to even some of the most well-known names in the space. Essentially, we are in an excellent moment for disruptors to come in and win over the Ellies of the world not just in the short term, but build enduring, lifelong relationships.

Enough theory… start designing!

Your end users will measure your digital experience against the others they trust everyday. That’s why we at Star inject cross-sector experience and deep industry expertise into everything we do to design frictionless and even joyful FinTech experiences that get the loyalty and trust they deserve.

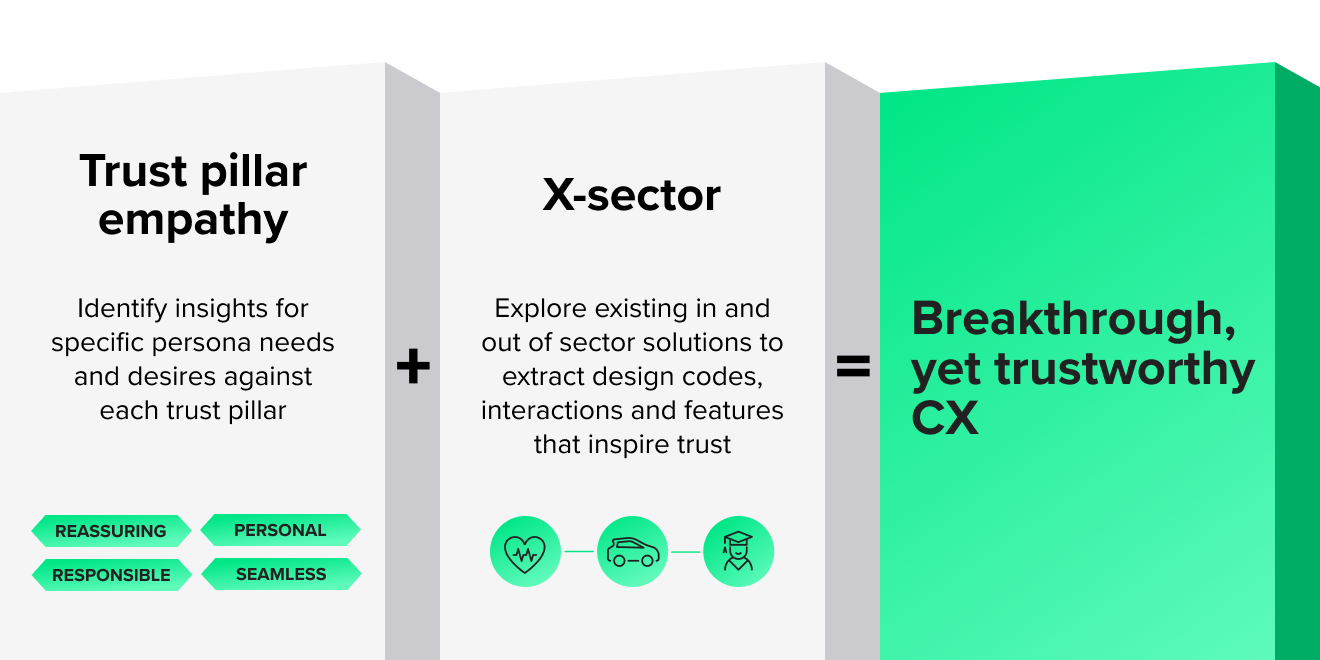

Fusing together familiar, reassuring details of existing digital solutions with user empathy on the 4 trust pillars, will equate to design directions that automatically embed trust signposts into your CX.

In case you’ve missed our earlier articles on trust, trust pillars outline foundational attributes for successful digital finance solutions that are:

- Reassuring

- Responsible

- Personal

- Seamless

Whether creating products for internal or external users, either B2B, B2C or B2B2C, empathy for your users’ perspective on these 4 trust pillars can inspire you to explore new ways to engage your ecosystem partners and end users in ways that will not only build trust, but enduring loyalty and engagement:

Using this formula, we have created these design concepts to give you a sense of how harvesting cross sector learnings and technologies can help you leverage the technologies of today to design breakthrough FinTech.

1. Finance Dimensions

Let’s hone in on our responsible trust pillar. Imagine a PWM relationship that considers financial decisions alongside personal health and wellness. Currently, there’s no shortage of excellent apps that connect data from wearables, sensors and other metrics to track health. While people may be familiar and even comfortable sharing health data, we believe they should receive value from it, especially for providing their trust in these providers.

What if we combined the best of health and fitness technology, including digital phenotyping, (using AI to track how you use your device to assess your physical and mental wellness), with PWM data to integrate all dimensions of your financial wellbeing into one multi-dimensional dashboard.

The result would be Finance Dimensions, an integrated feature that checks you’re in the best mental state to make the decisions that affect your financial future. Imagine receiving a word of caution if you’re about to make a risky investment maneuver because you’ve been stressed out lately. Even small interactions like these can greatly benefit inexperienced users and prevent them from making costly mistakes.

2. Finance Navigator

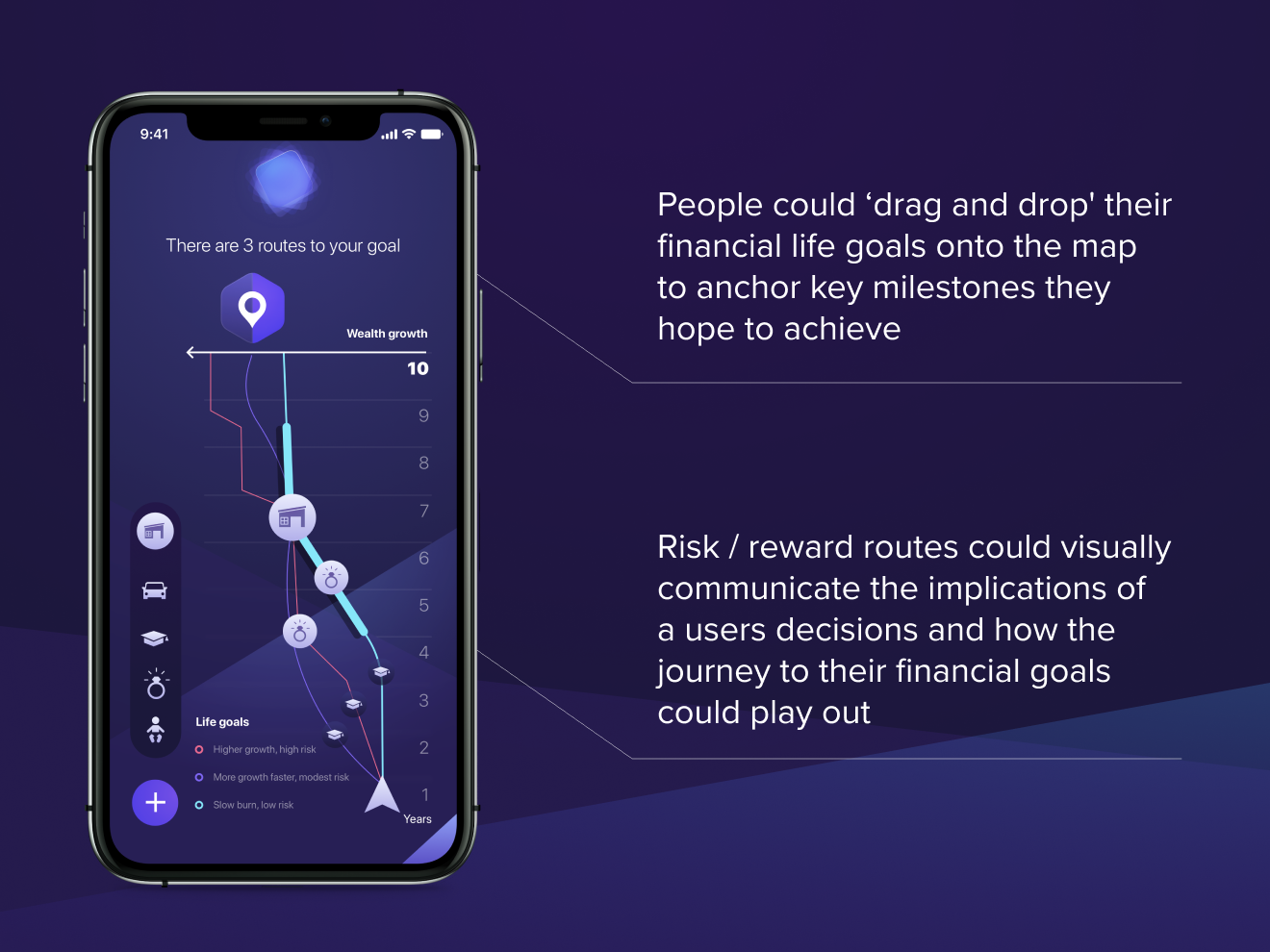

Now let’s zoom into the personal trust pillar. People want services that are flexible around evolving life goals to clearly visualize their wealth journey.

Imagine combining Google Maps, which offers multiple routes to your destination based on your preferences, with Nike ID’s best-in class ‘drag and drop’ experience to personalise your perfect Nikes.

What if you co-created your investment journey to your financial goals, visually comparing options against each other to understand the risk and reward impact of your decisions in real time?

Meet Finance Navigator. By overlaying the intuitive design codes of digital navigation onto a ‘drag and drop’ interface, investors could set their financial milestones and quickly understand the implications of their investment portfolio options. This helps them not just better understand short term decision-making but keeps them engaged in the long term.

3. Wealth Assist

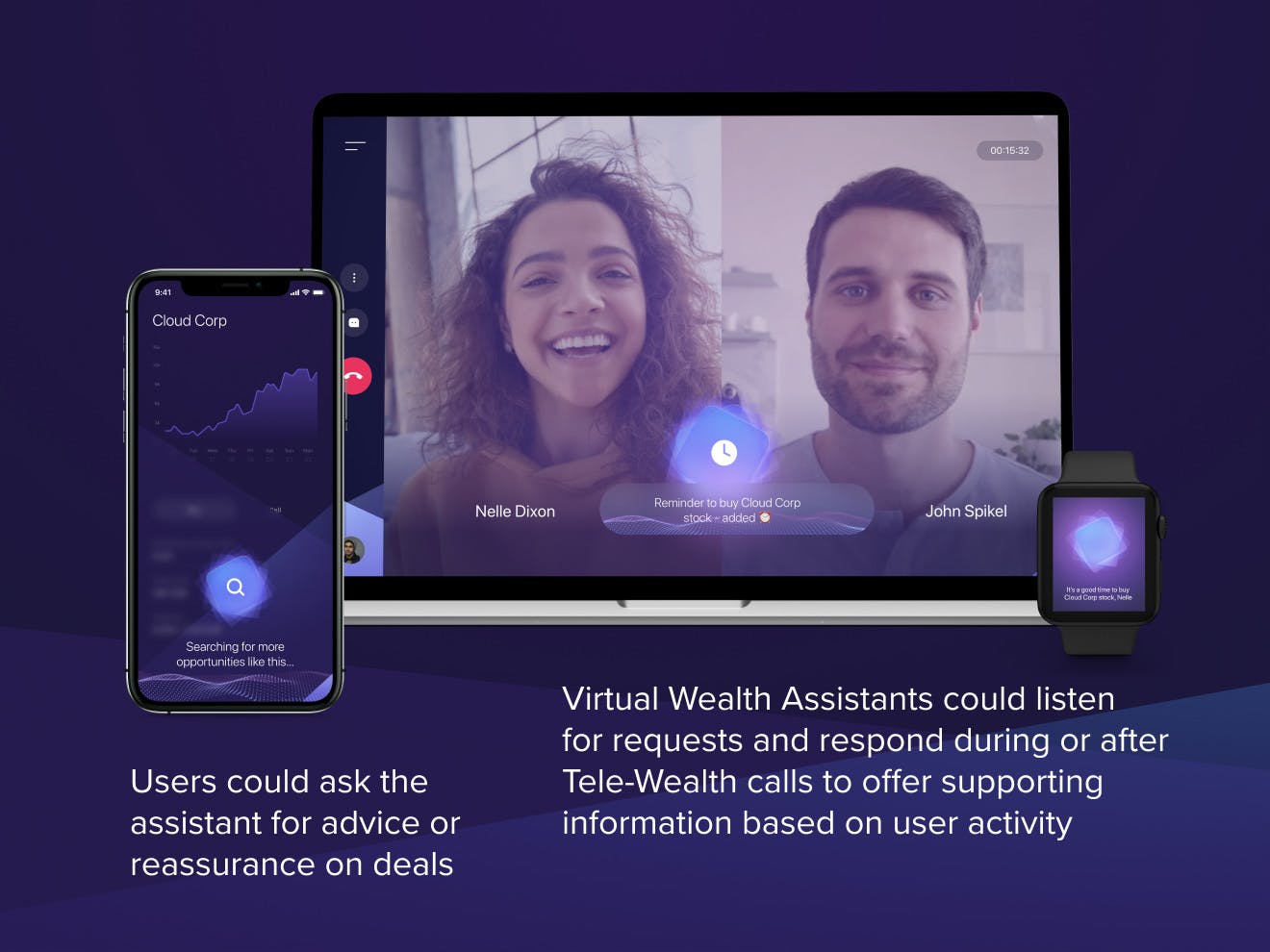

We’ll take a look at one last pillar: reassuring. We come full circle with the rising generation in personal wealth management who want more control over their portfolios but are also willing to share data in return for support, recognizing they are in significant need of coaching from financial experts.

Imagine combining the power of telehealth with virtual assistants to create access to personalized coaching both during and in between consultations.

This is Wealth Assist. During 1:1 video calls with Tele-Wealth Coaches, the Virtual Wealth Assistant listens in to track conversations so that it can offer support in between calls as users are independently using PWM services, reassuring investors 24 / 7 / 365.

From “What if” to “Let’s build now”

There’s nothing all that groundbreaking about the technology PWM apps use today. Online trading has been around for almost thirty years. The real revolution was that some people had the idea to leverage these tools in user-centric ways to reach entirely new audiences.

The same will be said of tomorrow's finance ecosystem disruptors. Download the “Inspiring trust in digital finance” to discover our complete insights, including:

- Detailed analysis of trust gaps in digital Finance

- Leading examples of in and out-sector trust-building digital products

- Further analysis of the trust pillars vital for building successful digital finance products

- An additional concept based around the ‘seamless’ trust pillar.

Act now to create trust-driven FinTech products. Download the “Inspiring trust in digital finance”

See how Star will help you shine

The future of digital finance starts now. Star has over a decade of experience designing groundbreaking, insight-driven digital innovation that resonates deeply with end-users.

Get another design-focused look into the future by checking out this case study about our recent collaboration with the Design Institute for Health to create a web-based tool that presents alternative future scenarios for health and wellbeing.