We are at the crossroads of a tumultuous past and nervous future. With COVID-19 not even fully behind us and a financial crisis possibly ahead, it’s easy to feel anxious. But considering FinTech’s revolutionary journey over the past years, at Star, we feel optimistic.

FinTech has matured rapidly out of necessity and so is exceptionally suited for harnessing the power of change to translate these tensions and challenges into new opportunities that can offer value to the entire ecosystem.

It’s easy to take for granted just how much has evolved in finance in the past few years. Just look at what open banking, mobile banking, digital payments and other technologies have already done to increase accessibility to digital finance services in the ecosystem. Further innovation is on the horizon, including Digi-ID, Big Data, and Blockchain applications.

At Star, we see the road ahead as full of opportunities. The challenge is picking the best ones for your business and audience and seeing them through to market. This is exactly where Design Thinking fundamentals are immensely valuable, not only in identifying where new opportunities lie, but for which ones are most important for your business and the people that it serves.

How we apply Design Thinking at Star

First, some level setting. Across all our work in healthcare, automotive and digital finance (and everywhere else we work), we focus design thinking on the three classic metrics:

- Desirability: does it resonate with people and will they buy it?

- Feasibility: can we do it?

- Viability: does it make commercial sense?

Looking at the Desirable, Viable and Feasible aspects of an opportunity ensures it’s right for your business from all angles. Design Thinking can take you from your business challenge right through to market launch and ensure that the user-centric and commercially savvy threads are there in the final solution.

This is incredibly important in the rapidly changing world of finance. FinTechs are taking entirely new groups of people on board who may have never had access to financial services, personal wealth management, which has long been out of reach for most consumers. To compete, banks and other incumbents are rushing to offer comparable services or partner with these disruptors.

Let’s start with the speed of technology evolution. In a recent study, 61% of people reported: “the pace of technology is too fast.” This is just one of the many change drivers we need to consider right now, including:

- COVID-19 has created collective isolation we have never experienced before. This calls for greater connections and digital inclusivity.

- Confusion on even relatively simple questions like “Where should I store my money considering all this uncertainty?” Further, more people are using tech than ever before. Companies need to provide reassurance that they are the right partner for consumers.

- Society is examining itself, and there is a desire to contribute and take greater responsibility for our actions. This is an opportunity to build inclusive and, above all, usable FinTech products that connect with people.

- Forced behavior change because of the pandemic. Vast groups of people are working, shopping and learning from home, and things are likely to stay that way. What can we learn from data streams and insights on these behaviors from the past 18 months?

- Internally, there are huge operational stressors for providers: scaling up and managing to service spikes in demands while being secure and surviving an economic downturn has meant that providers must accelerate digital products, automate operations for efficiency, but that they also need to take controls through partnerships, so they right-size their capacity and response.

Phew! Choices, choices! But Design Thinking’s ability to unlock decision-making and creative problem solving not only helps you find the best road ahead. It also ensures you don’t get lost along the way.

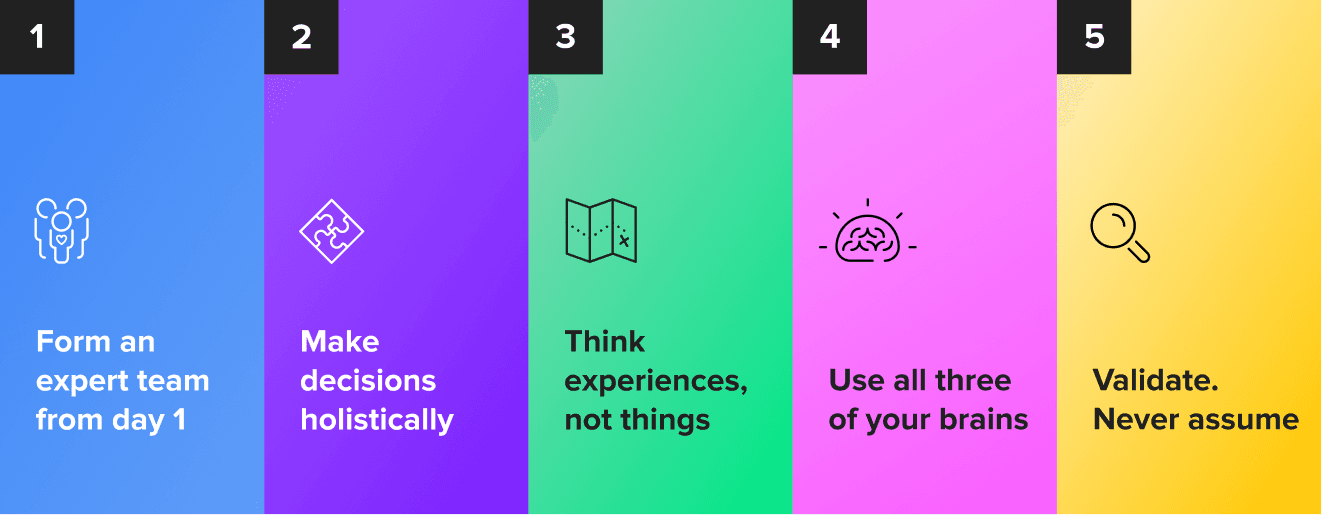

5 fundamental Design Thinking Principles

We are entering a renaissance that will fundamentally alter the sector’s DNA and result in new businesses, better and more agile execution, and evolution we can only guess at right now. There are many aspects to design thinking but these 5 fundamental principles are crucial in times of change:

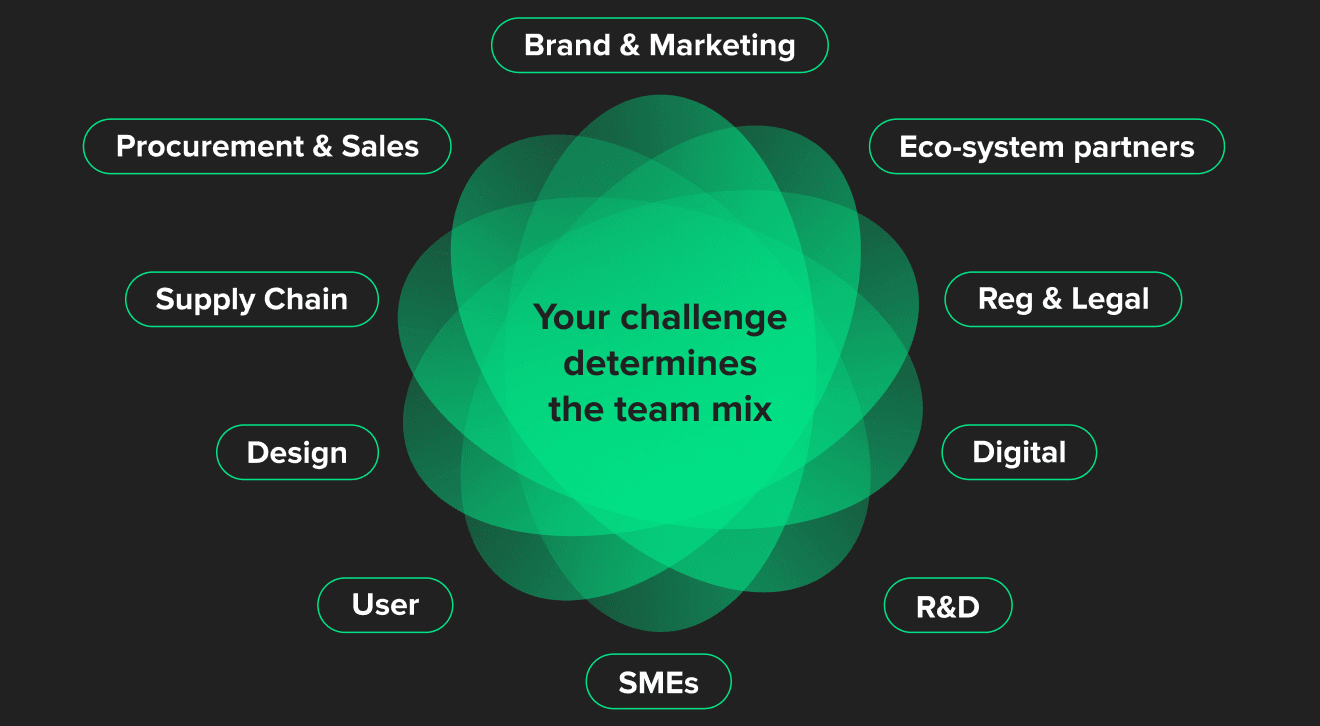

1. Form an expert team from day 1

To effectively solve challenges with multiple variables and fluid dynamics of a changing context, you must gather expertise from inside and outside your business. How else can you ensure your FinTech product development strategy would be robust?

You might need trend forecasts, product managers, supply chain knowledge, ecosystem partners and more, giving you a holistic vision for the road ahead. For FinTech, this is incredibly valuable as you figure out the best approach to emerging and often unfamiliar technologies (at least to your audience) to uncover the right strategies from the start.

2. Make decisions holistically

Once you have the team, you need to get everybody aligned on your endgame. Know what your destination is and then map the journey there. Make sure all your horses are pulling in the same direction to that same ambition.

By doing so, you will overcome the hurdles that come your way whether that’s navigating new messaging standards like ISO20022, overcoming security and trust issues or understanding the impact of generational change on the landscape.

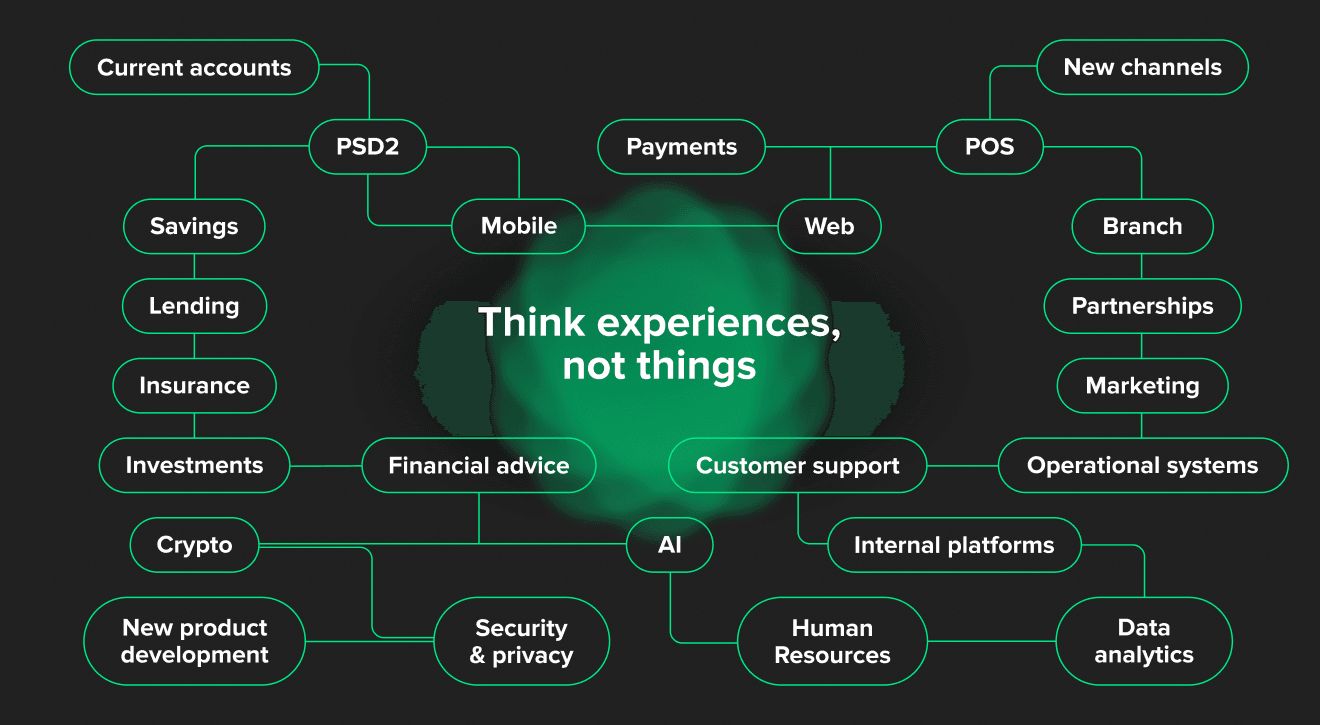

3. Think experiences, not things

From our work across sectors, and not just in digital finance, it’s clear people invest in experiences. We know FinTech is great at transforming previously mundane or stressful experiences (i.e. transferring money, paying bills, etc) into something delightful. With more players in the ecosystem, come more levers to pull that can dial up or down an experience like never before.

Look at all the different components in FinTech and financial services and see how they come together. Think about the journeys people take to experience your product and these essential questions:

- What are the digital touchpoints?

- What platforms do people use?

- How do you want them to feel and experience your service?

- What will they measure you against both in and out of the sector experiences?

Balance the creative potential with the practical needs of the sector. With more fraud, more data and the need to embed trust into experiences, financial institutions need their ecosystem partners to ensure their future resilience.

Make sure you are using best-in-class technology from around the ecosystem, not necessarily what’s already available in-house. Simultaneously, you need to overcome trust gaps by working with the right industry partners. This is how you deliver trust-driven, user-centric FinTech experiences and build resilience for your brand.

4. Use all three of your brains

Empathy is the foundation of design thinking. Fundamentally, placing the user at the center of decision-making is what drives us to deliver products that are delightful to use, whether that’s for your end users or internal teams that interface with FinTech solutions every day. Empathy is the most well-known fundamental of Design Thinking and arguably, the most overlooked in practice. How do you interpret your audience’s psychology to extract the right insights? Then how do you deploy them into your product strategy?

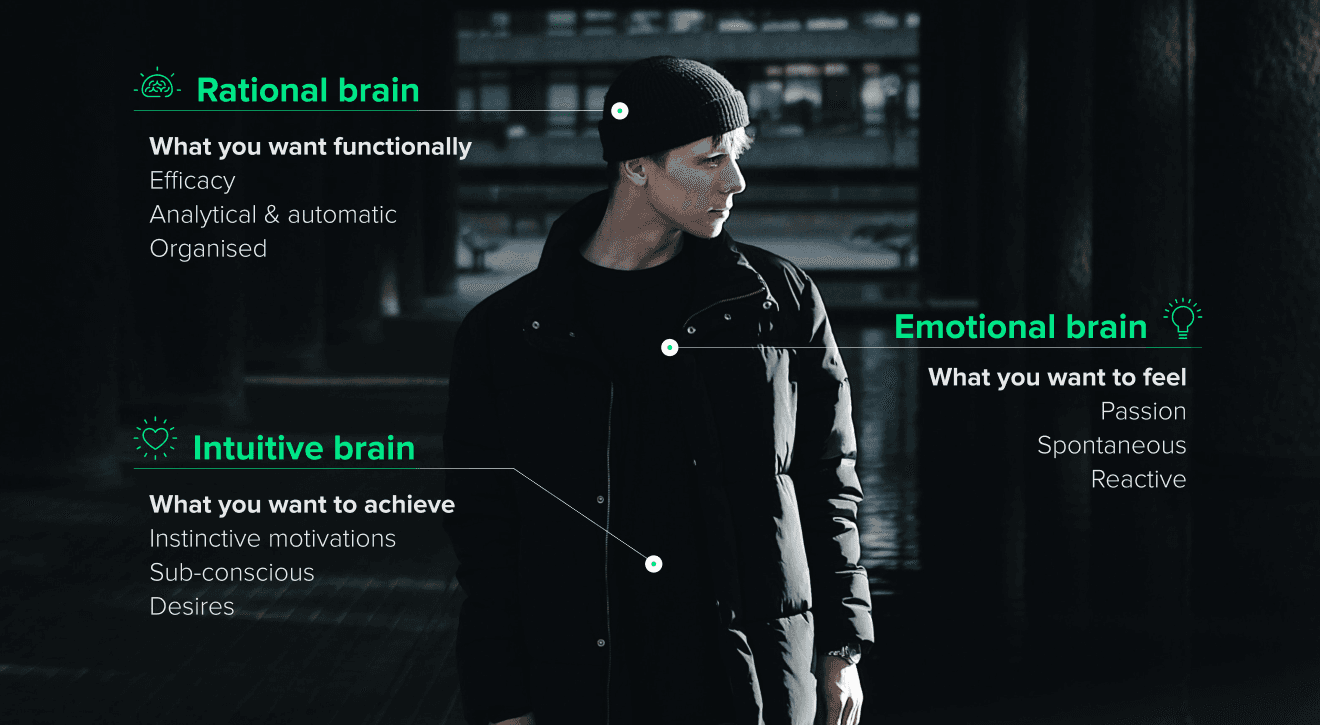

At Star, we do this by approaching users holistically and understanding their “three brains.” Metaphorically speaking we have three brains: the rational, the emotional and the intuitive.

- Rational: What do you want functionally? (Your head)

- Emotional: What do you want to feel? (Your heart)

- Intuitive: What do you want to achieve? What are your underlying motivations? (Your gut instinct)

Understanding what drives people at every level is key to overcoming the challenges of adoption, adherence and trust going forward.

5. Validate. Never assume

You need to get out there to test, learn and iterate. This is where executional design skills including visualizing, storytelling, prototyping and iterative FinTech design truly become vital.

To really validate, you have to look at how people use a product in context. How does people’s context impact their ability to interact with your finance product? How would being on public transport vs. at home impact it? This helps you become more agile, overcome hurdles and validate that approach very early in the process and with very little fidelity and investment required.

Design Thinking in FinTech fundamentals

Dive further into how to incorporate Design Thinking into your digital finance approach. Watch this informal and informative chat from Tech London Advocates FinTech with Star’s Strategy Director Ed Adamson. He goes into more detail about each of these principles and outlines more strategies you can start leveraging now.

While you’re at it, see Star in action and discover more about our FinTech capabilities. You can start by checking out this case study about our partnership with Expensify. We helped their users go from receipt to reimbursement in a few simple clicks while ensuring a secure and compliant integration between Expensify’s platform and users’ bank accounts.

From ideation through launch, discover how we’ll help you harness Design Thinking fundamentals and end-to-end product development to help you thrive in FinTech.

To see where FinTech evolution can take you, we have visualized some new experiences for personal wealth management (PWM). Find out how our designers think as they translate user needs into new PWM features, inspired by cross-sector innovations that embed trust into the experience by design. Learn more in this trend report now.