As we move toward the next generation of FinTech products, which involves vast amounts of user data and its monetization, plus a dizzying array of new services and industry evolution, Financial Services players must harness today’s central issues of FinTech product development, from ever-changing legislation to entering the right FinTech market.

Whether it’s the rise of digital banking from legacy institutions, the near universality of mobile payments and digital wallet services, or the steady success of a wide array of disruptors like Yapily, the prospects for FinTech services and product development are infinite. The global market is already set to grow to a market value of $324 billion by 2026, following a compound annual growth rate (CAGR) of 23.41%.

Despite the current success, FinTech digital strategy still has a long journey ahead of itself. For the most part, what we’ve seen so far is a translated version of financial services from the physical world into the digital — with many stakeholders still catching up with the technology’s rapid increase worldwide.

For starters, Star’s Ed Adamson recently led the discussion “Resolving trust tensions in FinTech.” Together with Star’s FinTech Managing Director Jawad Bhatti and Amrita Srivastava, Head of FinTech at Mastercard W. Europe, and Matt Cockayne – Chief Commercial Officer at Yapily, they discussed the roadmap to building successful digital finance solutions that people can really trust.

In addition to these insights, FinTech builder is a core service for any product development. And we’ve captured a selection of the most important factors necessary when pioneering your next FinTech product design solution, including:

- Legislative FinTech regulations in the US, Europe and UK

- Finding the best fit within the FinTech market

- Market research and FinTech product development strategy

- Choosing the right financial technology stack

These are all the essentials to consider when building a resilient financial technology product at scale, so get all the latest insights as we unpack the tools for navigating this digital finance ecosystem.

FinTech regulations are a vital factor

For any FinTech player, compliance should be the top priority because discounting it can single-handedly devastate any operation. Within the major FinTech markets, from Europe to the US, there is a noticeable effect from regulatory measures on FinTech products. The main difference? The UK and the EU are pushing laws for more market liberalization and financial inclusion while the US is less forward in creating concrete legislation supporting FinTech firms. Keeping your specific location in mind, the most important part of any compliance process is to take care of it as early as possible.

The main takeaway: Prioritize regulatory compliance to streamline your FinTech product development process and especially for avoiding expensive fines. Disruptive technologies like cryptocurrencies, online loans and person-to-person (P2P) payment options all have room for new competition, but innovative ideas need legal compliance. For launching a FinTech product in multiple countries, this can become even more complex, tedious and puzzling. Whether you decide to hire experts or use regulatory technology, make sure to take this essential first step when considering any new FinTech products.

Identifying your FinTech market

FinTech has become a very broad sector with over a dozen subsegments to choose from, and only more disruptive ideas keep showing up. This is why, from the very beginning, you have to make sure you enter the right FinTech market. And the best way to ensure this happens is by making a choice based on thorough market research.

As you dig deeper into your research, keep in mind that some of the main subsets are highly profitable but also extremely competitive. For example, while the Buy Now Pay Later and digital lending category is now booming worldwide, make sure that your market research identifies whether entering this sector is a good idea and, if so, how best to accomplish it. The Design Thinking approach in FinTech offers a solid roadmap for these early steps. From organizing your team and market research to delivering a FinTech Builder MVP and product launch, this creative and user-centric methodology can single-handedly transform any enterprise.

But, with so many subsegments to choose from, it’s also important to be ever-aware of the major categories within modern FinTech. These include:

- Payments: This covers person-to-person (P2P) payments, in-store retail payments, and credit and debit card transactions.

- Banking: Digital-first banks and “neobanks” provide digital alternatives to banking services and have already been adopted by 20% of Americans. These flexible finance options bring lower costs, greater user experience and faster financial services to their customers.

- InsurTech: This is another competitive subsegment which is redefining customer experience with tech-forward products that include risk-free underwriting and instantaneous activation, purchasing and claims processing.

- Wealth management: Within traditional wealth management, there are new disruptors in the category such as robo-advisers or a hybrid of digital and human services.

- Lending: Companies in this category are breaking through traditional barriers to loans and credit with newly accessible e-commerce and point-of-sale options like Buy Now Pay Later (BNPL) services.

- Blockchain: This technology has decentralized financial data through a shared, digital ledger and a peer-to-peer network with randomized groups.

And the list goes on. Mobile banking, security technologies, customer service and acquisition, cryptocurrencies and more — there are many to choose from. Which brings us to the big question: what specific problem is your FinTech product aiming to solve in your specific FinTech subsegment?

Main takeaway: For identifying your FinTech niche and effective market research overall, it’s vital that you get to know your target market really well. This should include both primary sources, where you collect data directly from your target audience, as well as secondary sources, which include data and research that already exists.

Design vision and technology stacks are key to building FinTech products

With the fast-changing nature of FinTech offerings, choosing the best app design and tech stack both play a major role in the success of any digital finance product. Let’s look at design first. For anyone designing new FinTech products, we need to be focused on three big goals:

- Make the financial product feel legitimate. As we all know well, personal finances are…well, personal, and extremely sensitive for most. Which means, to gain user adoption, it’s critical to create a product that fits the part by enabling heightened security and privacy. Some key features to consider are biometric security, two-factor authentication, and blockchain technology.

- Appeal to all age groups. While creating a FinTech product that attracts millennials and a younger demographic is a good start, you also want to consider inclusivity for all generations. A Plaid report found that baby boomers currently represent the fastest-growing segment, with FinTech use among those aged 56 and older doubling year-on-year to 79 percent. This means that product adoption is an important consideration for any age group. In certain contexts, creating dedicated products for different generations is the best solution for mass appeal.

- Remove user barriers. For any user experience, eliminating barriers to user entry must be a priority. Remember: the goal is to make people want to use the product, not scare them away. To do this, create a minimum viable product (MVP) to gather initial user feedback, or even look at the product from a consumer perspective. Our quick recommendations – don’t overload the users with too many choices and keep the process transparent with a percentage bar letting them know how far they’ve come and what they still have left.

These design and UX features also feed into choosing the right FinTech technology stack—and you should spend plenty of time on researching and investigating to find the best set of tools for this. For this, there are many pieces to consider, such as:

- Outline your project scope: What are your project’s objectives, features, deliverables, development expenses, and deadlines? Who’s your target audience, and how do you want them to utilize your product?

- Project budget: Before jumping into product development, how much are you able or willing to spend on the process, from start to finish?

- Product architecture: Will your product use a microservice architecture or serverless architecture to meet all stakeholder needs?

- Programming languages: Are you starting from the beginning with your FinTech service, which programming language is the best for your needs – JavaScript, Python, PHP, C++, or others?

- Database functionality: Which database — Apache Cassandra, PostgreSQL, etc. — offers the best for an all-in-one access point for end-users to find payment details?

- Development speed: What’s your timeline for launching your MVP or fully launching your product to market?

- Threat detection and fraud prevention: What technologies have you looked into that can help preemptively avoid malicious attacks online? Some of these include artificial intelligence (AI) solutions, end-to-end encryption, cloud security algorithms and more.

- DevOps integration: Have you considered DevOps, or Development and IT operations, throughout your product development process? This is a powerful set of practices that can reduce project costs and cut down on the development life cycle while also delivering software that meets the highest standard.

Main takeaway: FinTech startups and financial firms alike can have many big, disruptive ideas that can change the industry. But not all of them hold up under competitive pressure and market scrutiny, and this is often the result of gaps in design, strategy and engineering. This is why it’s even more important to prepare in advance from the outset.

Lessons about building financial ecosystem trust from Mastercard

Familiarity breeds trust laying the foundation for a stronger relationship to develop. The more it grows, the narrower trust gaps become until they’re virtually non-existent.

As a widely recognized brand in Finance, Mastercard has a built-in name recognition that provides a strong foundation. But Mastercard’s Western Europe Head of Fintechs Amrita Srivastava described how they don’t take that for granted.

On the other hand, Mastercard established trust as a “key pillar,” ensuring that “all stakeholders can come together to build something inclusive, innovative, and trustworthy.”

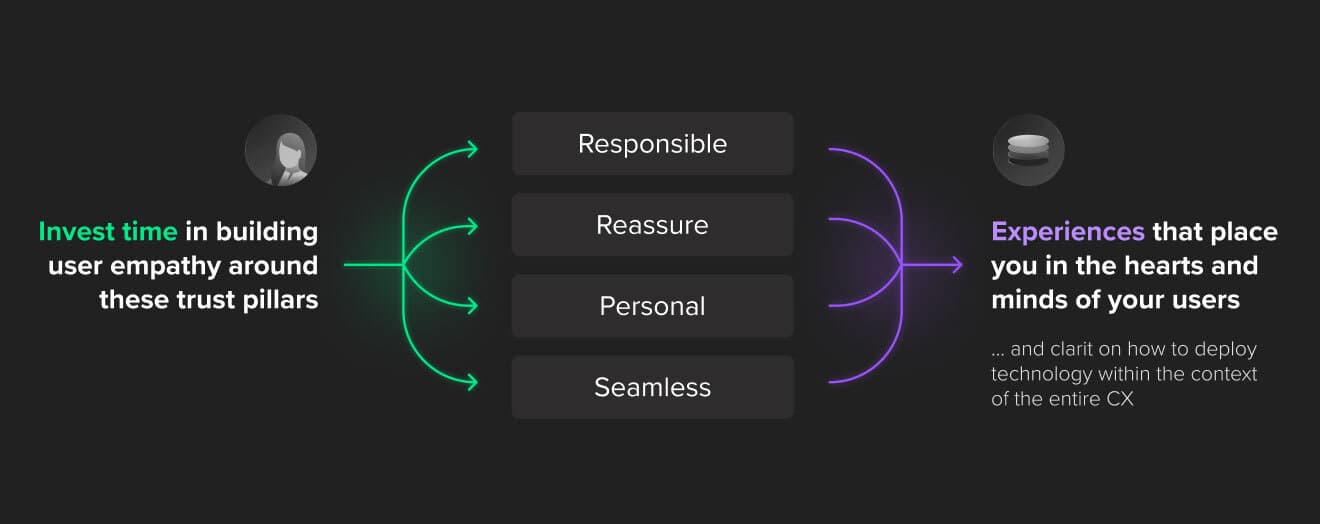

This is an essential lesson for everybody throughout financial services. Whether you’re a fresh startup or a widely recognized international brand, you have to value and maintain trust with your audience. But establishing trust is obviously much more critical for startups since they have to make that first-time connection with an audience, compete with a plethora of tech-savvy competitors and ultimately capture global demand. Meeting these needs relies heavily on design, as FinTech experts from Star, Paidy and Onfido explain in an episode of Shine Podcast. Learn about the challenges these industry leaders faced in building trust and the innovative solutions they used in “Why design is key to building trust in FinTech.”

Main takeaway: Guaranteeing user data ownership is one of the most important components of this. Amrita described Mastercard’s driving ethos as “when it comes to data, the user is the one who owns it, should be the one to control it, and should benefit from us and what we offer as the ecosystem provider…this is central to our innovation agenda.” This is the type of approach everybody in the digital finance sector should seek to emulate.

FinTech products must demonstrate clear value to the customer

While the vast majority of digital finance and FinTech providers are creating value for their users, they can further benefit by explaining to users what the value is by improving UX, ensuring security and providing benefits. Consumer education is absolutely pivotal for long FinTech engagement, much of which, again, can be accomplished through FinTech design.

At FTT Virtual Open Finance 2020, Star’s FinTech Managing Director Jawad Bhatti further illustrated this through a cross-sector example of an energy provider that wanted to increase customer digital engagement.

They did this through creating an intuitive and easy-to-use web portal, Opower, that synthesized customer data and “provided them personalized and useful insights to save energy, better understand their bill and, above all, reduce the bill shock, which was the driving force of distrust between consumers and energy providers.”

Let’s face it; nobody likes to see a sudden and unexplainably huge bill. By helping customers understand these charges and what they can do to reduce and prevent them, the utility provider significantly improved their relationship with their customer.

Main takeaway: Through this approach, it gives users a value for their data meaning (as a provider) you’re giving something to them before asking for more information. The result is a symbiotic relationship. Users then feel more comfortable sharing more of it so providers can further refine and grow their products.

Turn FinTech ideas into stress-tested, scalable MVPs

One thing is for certain: there are endless considerations, from project inception to delivery, for any FinTech player looking to innovate and succeed in the ecosystem. In order to do this, it’s important to collaborate with specialists who will investigate and stress-test your ideas, then help you build a robust plan for bringing them to market. And this requires building a user-centric MVP so that you have an informed onward strategy for testing, iterating and scaling your product.

That’s exactly what we deliver at Star. We build end-to-end, agile and design-driven FinTech and digital finance products that elevate the customer experience, improve trust and are powered by the latest technologies.

Learn more about how we can build your digital finance products that can win your users’ trust, whether they’re consumers, internal teams, or entire ecosystems. Connect with our FinTech and digital finance experts now.