New contracting, partnerships and business models are again redefining the healthcare business landscape in 2025. Behind them are a mix of ongoing pressures, including escalating costs for technologies, staffing shortages, increased demand from patients for choice, government demands for demonstrable outcomes and the growing expectation that health systems be resilient in the face of global disruptions.

As decentralization continues and patients become more empowered (thanks to digital tools, data access and changing expectations), new business models in healthcare are developing fast.

What's fueling new business models in healthcare?

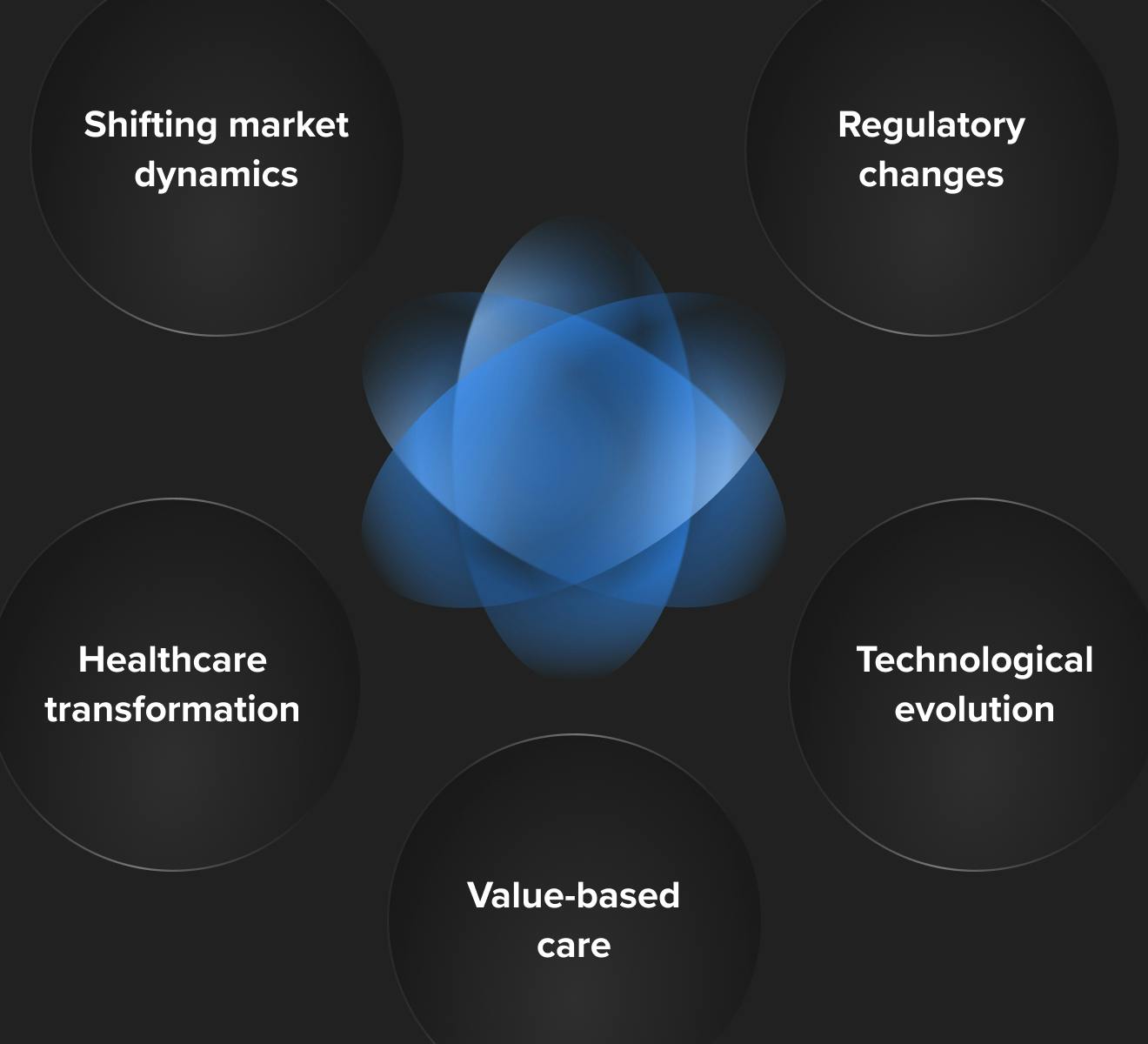

Multiple factors are driving new healthcare business models. Whether you work in pharmaceutical development, medical devices, digital therapeutics or in payer/provider organizations, you can no longer ignore overlapping currents shaping business models in healthcare:

- Shifting market dynamics: rising cost pressure from healthcare consumers and payers and the consolidation of healthcare systems into accountable care organizations networks both enables coordinated care and drives down prices as a result of increased bargaining power

- Regulatory changes: new telehealth and digital medical device reimbursement pathways, increased interoperability requirements, AI governance, changes to medicare and other billing codes are creating new incentives for technological development and sector partnerships

- Healthcare transformation: moving care away from hospitals and into the home along with shifting toward preventative and virtual care has disrupted in-person delivery

- Technological evolution: medtech, DTx, SaMD, digital healthcare, remote monitoring devices, IoMT and AI are changing care delivery and workflows across the board

- Value-based care: the move away from fee-for-service has created new payment and reimbursement models for public and private plans. Now, providers shoulder more responsibility for quality outcomes, especially with rising pressure from accountable care organizations and governments

Delving further, there’s three core streams shaping these models. First is the rising power of generative AI in healthcare, which now underpins diagnostics, operations, administrative work and even care-delivery logistics (though on the other hand also raises questions about AI governance, bias and data privacy).

Second is the rising cost pressure. Drug prices, labour, supply chains, energy and technology maintenance all are pushing margins tightly. And third is consumer/patient expectation: people expect care that is seamless, accessible, digitally enabled and more personalised.

These broader forces are reinforced by several specific themes outlined above. Non-acute care delivery is growing in importance by shifting services out of hospitals to clinics, virtual platforms and at-home settings.

Value-based payment and risk-sharing models are becoming more widespread as both public and private payers and providers seek to align incentives around outcome rather than volume.

Then there’s interoperability and data exchange, which are no longer optional. Regulation (in many countries) is pushing for open data standards and fast transfers. Preventive care, wellness and whole-person health (including mental health, social determinants) are being integrated more deeply into clinical models.

And finally, the workforce challenge. Burnout and staff shortages are forcing tech adoption, automation and rethinking how care is staffed and delivered.

The win-win effect of payment innovation

Redesigning how healthcare is paid for can benefit all parties — providers, payers, technology & device makers and patients.

When risk is shared more equitably, providers are incentivised to prevent disease, invest in remote monitoring, telehealth and upstream interventions. Payers can reduce downstream costs by avoiding unnecessary hospitalisations, chronic disease exacerbations, and redundant testing. Technology firms and medtech players that can prove their solutions deliver measurable outcomes (through real-world data, predictive analytics and patient engagement) gain advantage.

For patients, better care, more convenience, fewer surprises in billing and more focus on wellness and prevention.

One vivid example in 2025 is digital health companies moving from pilot projects around AI or remote monitoring into enterprise-scale outcome-based contracts. Companies that used to sell devices or apps per unit are now more frequently entering subscription or outcome pricing arrangements.

Some MedTech firms are even taking on financial risk tied to their device or solution working — such that if outcomes fall short, they share the cost burden or refund payers.

New business models and partnerships across the healthcare industry

By 2025 many of the fresh examples of business models in healthcare involve cross-sector collaboration and creative revenue models. AI-powered virtual hospitals and virtual wards are proliferating, combining remote monitoring, digital consults, home diagnostics and, in some cases, mobile clinics. These blend device manufacturers, software providers, payers and governments.

For example some at-home diagnostics providers are partnering with lifestyle/wellness brands to offer joint memberships, where lab work, data tracking, coaching and medical oversight are bundled.

Pharma companies are increasingly acquiring or partnering with digital health and wellness platforms. In some cases using digital therapeutics as companion products or embedding them in payer contracts. Employers are taking health provision into their own hands more aggressively — some are offering holistic health memberships that cover mental health, chronic condition management, fitness, nutrition and virtual care.

And medtech firms work more often in “device-as-a-service” or “monitoring as a service” models rather than one-off sales, especially when devices are part of longer-term management for chronic illnesses.

In many countries, home healthcare platforms that combine AI-driven predictive analytics (e.g. to detect fall risk or to monitor vital signs) with human caregiver networks are scaling. An example in the UK is Cera, which has raised significant funding to expand its AI-led home healthcare model.

Emerging healthcare business models for 2025

Here are the new business models we're seeing in healthcare in 2025 and beyond that you need to be aware of.

1. Digital therapeutics

Digital therapeutics (DTx) refers to software-driven interventions, delivered via mobile apps or web-based platforms, that treat or manage disease — either standalone or in conjunction with medication or devices. Business models include:

- DTC (direct-to-consumer) via subscription, freemium, ad-supported models or monetizing anonymized data

- B2B (employers/insurers) offering DTx as workforce health benefits

- Pharma partnerships co-developed programs enhancing drug adherence or efficacy

- Payer reimbursement is nascent but growing, with Germany’s DiGA framework being an early example (~€300 per course)

2. Value-based healthcare

As aforementioned, this model shifts reimbursement toward outcomes rather than service volume, often via bundled payments, where providers are paid a set fee for an entire care episode. This bridges fee-for-service and capitation models, aligning incentives across providers and payers.

3. Concierge medicine and direct primary care (DPC)

- Concierge (retainer) models: Patients pay a monthly or annual fee for enhanced access and personalized care. Variants include fee-for-care (FFC), fee-for-extra care (FFEC) and hybrid plans (blended with insurance billing)

- Direct primary care: Patients directly pay providers (often via dues or subscriptions), bypassing insurance in the process. It’s often paired with high-deductible plans to cover catastrophic events

4. AI-enabled care and operational efficiency

- AI-driven administrative solutions: AI is rapidly changing healthcare. For example, NLP tools automate documentation, improving accuracy and freeing clinician time. AI also accelerates interoperability mapping via HL7/FHIR translation, saving up to 75% of mapping labor

- AI across the patient journey: From scheduling to reminders and follow-ups, AI operates across the entire healthcare patient journey — personalizing care, improving throughput and maintaining adherence — all while ensuring compliance and scalability. Forecasted generative AI compound growth is ~10% through 2027, with up to 85% of cost savings tied to broader AI adoption

5. Remote monitoring and home-based care

- AI-powered sensor platforms: For elderly or chronic care, passive sensors and wearable tech can trigger alerts to caregivers with minimal user interaction. In one pilot in Europe, such a system reduced hospital transfers by 80% and achieved 97% patient satisfaction

- Remote health solutions: Digital health has evolved far beyond video calls. Notable categories include triage tools, digital biomarkers, virtual caregivers, remote monitoring and digital pharmacies — all forming parts of a seamless patient journey from prevention to post-care coordination

6. Healthcare data platforms

Fragmented systems hinder progress. But a modern healthcare data platform unifies patient records across stakeholders and offers real-time insights, advanced analytics,and a longitudinal patient view. All of which is built on micro-services, secure access and patient-centric architecture.

How to adopt new healthcare business models

Companies are accelerating their strategic capability development to thrive in modern healthcare models. Today's environment presents a wealth of opportunities to deliver data-driven solutions tailored to the needs of stakeholders. Remaining competitive in today’s healthcare market means embracing innovative business models refined for today’s challenges.

Begin your journey with these key considerations:

- Define your business case and partnership model upfront: Establish a clear foundation before launching any digital or tech initiative. This shores up alignment and reducing future friction

- Choose complementary partners strategically: Whether you're a pharma firm aiming to accelerate innovation or a medtech provider seeking digital transformation, align with software providers, payers or healthcare systems that complement your value proposition

- Expand your offerings with value-added services: Beyond core therapeutic solutions, consider bundling RPM (remote patient monitoring), companion apps, adherence support or digital behavior change tools that reinforce outcomes

- Ensure robust infrastructure: Technology and data are now pivotal differentiators. It’s imperative to build on secure, compliant systems with embedded interoperability to enable seamless care and analytics

2025 is truly an exciting time in healthcare. Partnerships like these are tackling the enormous challenges we face each day. With careful attention to these considerations and openness to new business models, healthcare companies can grow new business that fuels leadership, value and truly delivers change — and revenue.