In-depth expertise

by Andrii Krylov, Pavel Kyrylchenko

by Antonina Burlachenko, Maksym Tsivyna

by Loreena Bao, Andrew Fellows, Akio Okamura, Simone Zahn

by Monica Gonzalez, Jiyeong Lee, Sayori Mukherjee

by Thomas Helmer, Jana Kapitz

November 13, 2023

by Alexander Mukomelov, Perry Simpson

Webinars

by Antonina Burlachenko

by Yanick Gaudet, Pavel Kyrylchenko

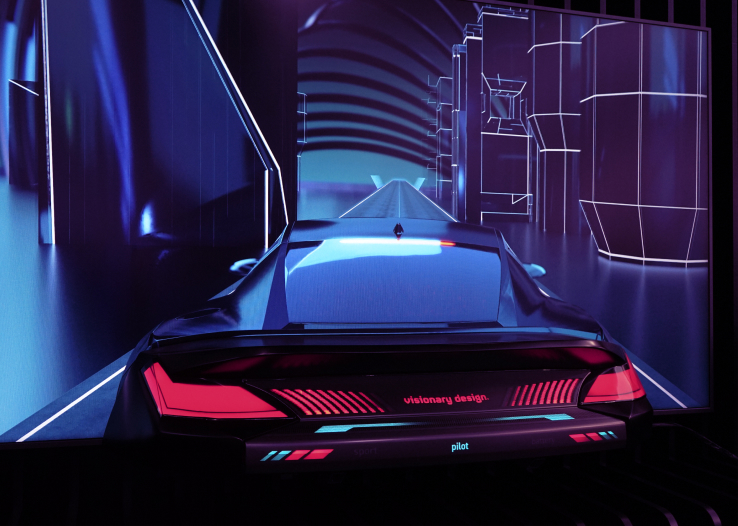

How Star sees the world

All Insights